One of Nvidia Corp.’s long-term investors is trimming bets on the stock, saying the frenzy around artificial intelligence has pushed valuations too far.

Edmond de Rothschild Asset Management’s overweight on Nvidia, a position held since at least the end of 2020, is now “far smaller,” according to global chief investment officer Benjamin Melman. The money manager took some profits in the recent rally that briefly sent the company’s market cap above $1 trillion last week.

“Would we add to AI tech? We’re less and less sure on that as valuations are too lofty,” Melman said in an interview. His firm has 79 billion francs ($87.1 billion) in assets under management. “If the gains continue, we’ll be even more cautious.”

An Nvidia spokesperson declined to comment.

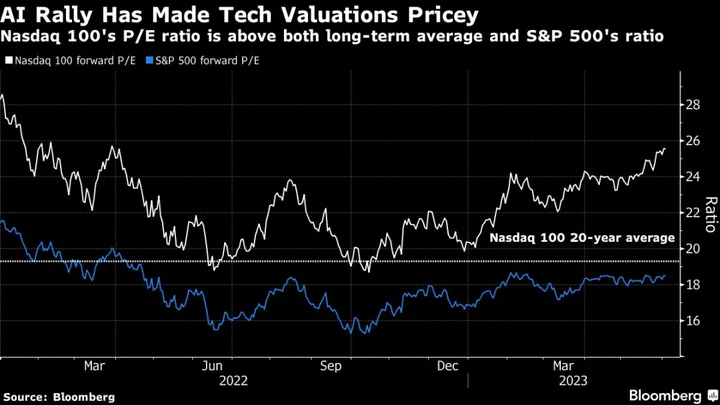

The buzz around AI propelled the Nasdaq 100 to its best May returns since 2005, and tech stocks are beating other industry groups in the S&P 500 by the most on record. The sector has also gotten a a boost from bets the Federal Reserve will stop hiking rates.

The pace of the rally has prompted some caution among strategists. BofA’s Michael Hartnett said AI is in a “baby bubble,” after tech funds attracted record inflows in the week through May 31. And Citigroup Inc.’s Chris Montagu has said positioning risks are biased toward profit taking in the Nasdaq 100.

Melman is still optimistic about the theme more broadly, seeing opportunities in companies that provide the data to power AI. He declined to mention specific stocks, but said they were spread across sectors such as banks, insurance and radiology.

--With assistance from Lynn Doan.

(Updates to note Nvidia declined to comment.)