Lazard Ltd. Chief Executive Officer Ken Jacobs plans to step down from the top job as the investment bank retrenches amid a slump in dealmaking and a plunge in the company’s stock price.

Jacobs, 64, will remain with the firm and be succeeded as CEO by Peter Orszag, a person familiar with the matter said. The transition hasn’t been finalized and could still change, the person said, asking not to be identified discussing private information. Richard Parsons, the bank’s lead director, said in a statement that Lazard has had a succession plan in place for a while and that the plan “is on track,” while a spokesperson for the firm declined to comment further.

Jacobs took Lazard’s top job in late 2009 after the death of famed dealmaker Bruce Wasserstein and became one of Wall Street’s longest tenured leaders. While annual revenue has nearly doubled under his watch, the firm’s shares have lagged behind many peers and its market value is now lower than it was when Jacobs took over.

Lazard posted a surprise loss for the first quarter and in April announced plans to reduce its workforce by 10% this year, predicting a slowdown in the mergers & acquisitions advisory business will last through 2023. Investment-banking fees across the five biggest Wall Street banks plummeted 49% last year, according to Bloomberg Intelligence.

“Candidly, things are not feeling as good as they were in December or January,” Jacobs said in an April interview. “It’s time to act. That’s basically it.”

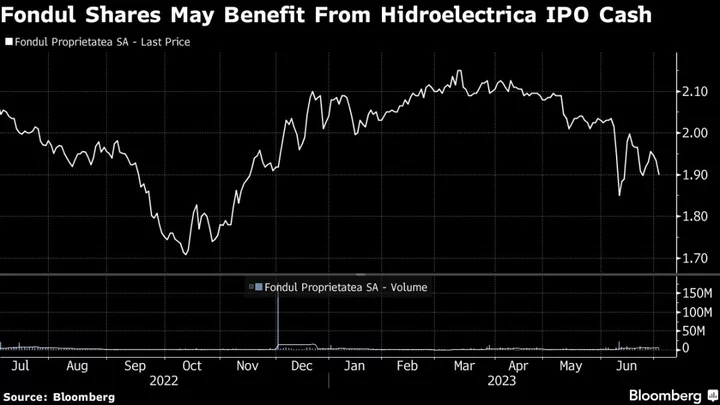

The investment bank’s shares have fallen 17% this year, after a plunge of about 21% in 2022. While many larger banks have leaned on lending businesses to weather the slump in deals, advisory firms have suffered. Lazard, Moelis & Co., and Perella Weinberg Partners have all dropped more than 37% over the past 18 months.

Jacobs preached a message of stability when he took the helm and worked over the past decade to build the firm’s pipeline of homegrown talent as boutiques looked to be less reliant on poaching expensive senior bankers from rivals. Still, the firm has struggled with the balance of paying top dealmakers versus boosting profit margins, often failing to hit its goal of reducing the share of revenue it handed out in compensation.

The firm gets just over half its revenue from its financial advisory business, with the rest coming from asset management. It ranked ninth in advising on mergers and acquisitions over the past five years, down from seventh in the previous five years as rival Evercore Inc. passed it. The firm has seen a number of notable exits over the past few years, including Matthieu Pigasse, the deputy CEO for the advisory unit who joined Centerview Partners, while it added top bankers like Citigroup Inc. veteran Ray McGuire.

Orszag, 54, is Lazard’s CEO of financial advisory, a role he took on four years ago. He joined Lazard in 2016 from Citigroup after stints in government. He was at the Office of Management and Budget from 2009 to 2010 and director of the Congressional Budget Office from 2007 to 2008, and is a former Bloomberg Opinion columnist.

The move by Jacobs was earlier reported by the Wall Street Journal.

Lazard’s first-quarter financial-advisory revenue slumped 29% from a year earlier to $274 million, falling short of the $296 million estimate in a survey of analysts by Bloomberg News. Asset-management revenue of $265 million was down 15%.

The firm is planning to close offices in Latin America as part of its cost-cutting, people familiar with the matter said earlier this month. Countries affected are Argentina, Chile, Colombia, Peru and Panama, the people said.

--With assistance from David Scheer.