South Korea trimmed its growth outlook for 2023, citing uncertainties over momentum in China and the US, the world’s two largest economies.

The finance ministry now sees gross domestic product expanding 1.4% this year, down from a 1.6% forecast in December, according to its mid-year outlook Tuesday. The economy is projected to rebound next year with growth of 2.4%, the statement indicated.

Government analysts also lowered their inflation outlook. They forecast the pace of consumer price gains will ease to 3.3% by the end of 2023, from an earlier estimate of 3.5%, before softening further into next year.

Inflation is likely to stay around the mid- to upper-2% level in the second half of the year, and may even temporarily drop below mid-2% in July, Finance Minister Choo Kyung-ho said during a briefing in Seoul.

“Korea’s inflation rate is showing clear signs of easing,” Choo said.

Separate data Tuesday showed inflation cooled in June for a fifth straight month to 2.7%, advancing at the slowest pace since September 2021, according to the statistics office. The Bank of Korea warned, though, that inflation is set to heat up again this year.

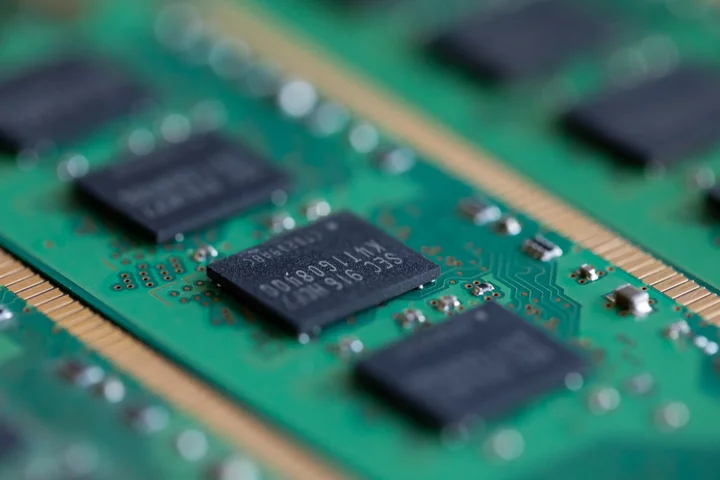

The ministry’s lower growth projections come after a sluggish first half when export demand dropped amid a weaker-than-expected recovery in China’s economy and a global slowdown. Government analysts see South Korea rebounding in 2024, led by an improvement in world demand for chips and a sustained pace of private consumption.

The growth projections are largely in line with the BOK’s view, but the finance ministry is more optimistic that inflation will cool, as global commodity prices fall and inflationary pressure eases in the service sector.

While South Korea posted its first trade surplus in 16 months in June, data showed chip exports extended a decline along with shipments to China, Korea’s biggest trading partner.

To support economic momentum, the government said it will prepare measures to back local exporters, with a goal for them to secure $35 billion in overseas orders this year. The ministry also said it will refrain from raising utility fees this year as part of efforts to ease the cost-of-living crunch for consumers.

The ministry reiterated its plan to reduce bond issuance by about 30 trillion won ($23 billion) in the second half, and plans to issue up to $2.7 billion in foreign exchange stabilization bonds.

Additional forecasts from the statement:

- Private consumption is set for a gradual recovery this year, rising 2.5%, aided by an increase in outdoor activities, robust jobs growth and improvement in consumer sentiment

- Facilities investment is seen falling 1.2% this year due to the chip industry slowdown, before rebounding in 2024

- Construction investment forecast to rise 0.6% this year, before slowing to 0.2% in 2024

- The labor market will remain tight, with expansion of face-to-face service jobs, and in health and welfare industries

- Exports growth seen dropping 6.6% this year and advancing 8.8% in 2024, led by improvement in chips demand

--With assistance from Jaehyun Eom.

(Updates with finance minister comments in fourth paragraph.)