CHICAGO--(BUSINESS WIRE)--Aug 9, 2023--

Kin, the direct-to-consumer home insurance company built for every new normal, today announced select operating results through the second quarter ended June 30, 2023.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230809700044/en/

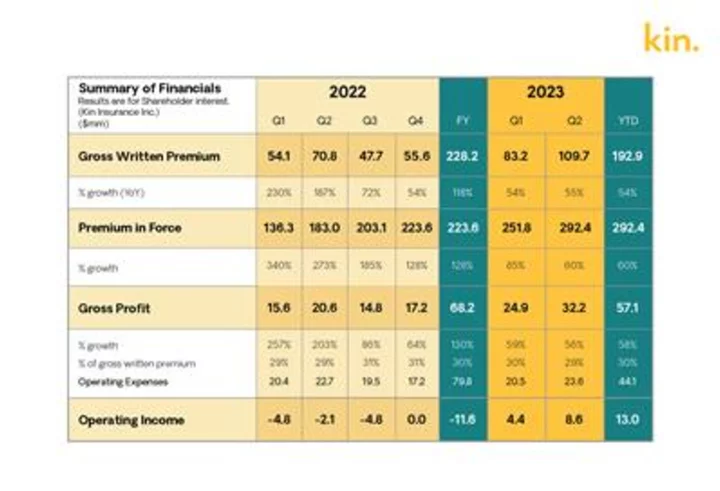

Q2 2023 Financial Summary for Kin. (Graphic: Business Wire)

Kin finished the second quarter of 2023 with $109.7 million in gross written premium, bringing the year-to-date total to $192.9 million. Kin’s positive operating income nearly doubled to $8.6 million in the second quarter of 2023, driven by disciplined expense management and an ever-increasing renewal base. Notably, Kin achieved a single-month record with $26.9 million in renewal premium in June.

Kin has also nearly quadrupled its geographic footprint by launching five states in recent months - Alabama, Arizona, Mississippi, South Carolina, and Virginia. Between those new markets and Louisiana, Kin has generated $12.5 million in new bound premium outside of Florida in the first half of 2023, which is a 400% increase over the prior-year period.

CEO Sean Harper attributed Kin’s fast, efficient, and profitable growth to two distinct advantages: “Our business model enables us to target customers we know will be a good match for our risk criteria, and cuts out about half of the legacy cost structure. Then our proprietary technology enables us to do much more accurate pricing and underwriting, which is why we’re beating our competitors on loss ratio.”

Kin continues to drive down its adjusted loss ratio, which reflects insurance claims paid plus adjustment expenses divided by total earned premiums. The adjusted loss ratio for the Kin Interinsurance Network, net of XOL recoveries, was 34.5% through the first half of 2023. Non-cat adjusted loss ratio was 24.2% in the second quarter of 2023, a slight increase from the all-time low of 20.1% in the first quarter of 2023, but still well below previous years.

Kin’s results in the second quarter of 2023 continue to demonstrate how it outperforms other insurers across several key metrics, including average new bound premium with surplus ($3,100), premium renewal rate (110%+), LTV/CAC ratio (18x), and payback period (0.8 years).

As Kin enters its next phase of growth, the company has added two seasoned executives to its management team: Vivek Vaid as chief technology officer, and Ashish Agarwal as chief marketing officer. Both Vaid and Agarwal are experienced in successfully scaling high-growth technology businesses.

About Kin

Kin is the only pure-play, direct-to-consumer digital insurer focused on the growing homeowners insurance market. Kin makes homeowners insurance more convenient and affordable by eliminating the need for external agents. Kin’s technology platform delivers a seamless user experience, customized options for coverage, and fast, high-quality claims service. Behind the scenes, Kin utilizes thousands of data points about each property to provide accurate pricing and produce better underwriting results. Kin is a fully licensed carrier that offers coverage through its reciprocal exchanges which are owned by its customers. To learn more, visit www.kin.com.

View source version on businesswire.com:https://www.businesswire.com/news/home/20230809700044/en/

CONTACT: Kim Markus

press@kin.com

KEYWORD: UNITED STATES NORTH AMERICA ILLINOIS

INDUSTRY KEYWORD: INSURANCE PROFESSIONAL SERVICES

SOURCE: Kin

Copyright Business Wire 2023.

PUB: 08/09/2023 10:00 AM/DISC: 08/09/2023 10:01 AM

http://www.businesswire.com/news/home/20230809700044/en