Kenya’s central bank left the benchmark interest rate unchanged at its final meeting presided over by Governor Patrick Njoroge as it expects inflation to ease further.

The monetary policy committee held the rate at 9.5%, Njoroge, who is due to step down next month after eight years at the bank’s helm, said Monday in an emailed statement. Five of six economists surveyed by Bloomberg anticipated the decision, while one expected a 25 basis-point hike. President William Ruto has nominated Kamau Thugge to fill the governor’s post when it falls vacant on June 17 and lawmakers are due to vet him on Tuesday.

Read more: Kenyan President Nominates Thugge as Central Bank Governor

The yield on Kenya’s 10-year eurobond fell 7 basis points to 11.75% by 5:39 p.m. in Nairobi in light trading because of public holidays in the US and UK.

The MPC has raised rates four times in the last year to rein in inflation that has been above the 7.5% upper limit of the central bank’s target band since June, including a 75-basis point hike at its March meeting.

The pause will allow the last hike to transmit in the economy, the governor said. That and government measures to allow duty-free imports of specific food items, particularly sugar, are expected to moderate prices and ease domestic inflationary pressures, he said.

Inflation, which softened to a 10-month low in April, is expected to revert to within the central bank’s 2.5% to 7.5% target range this quarter, in part because of improved harvests and an easing in commodity prices, National Treasury Cabinet Secretary Njuguna Ndung’u said last week.

May inflation data due to be released on Wednesday is likely to show annual price growth remained steady at 7.9% compared with last month, according to the median estimate of five economists surveyed by Bloomberg. The shilling has depreciated almost 5% against the dollar since the MPC’s March meeting, which has pushed up the cost of imports and kept price pressure elevated.

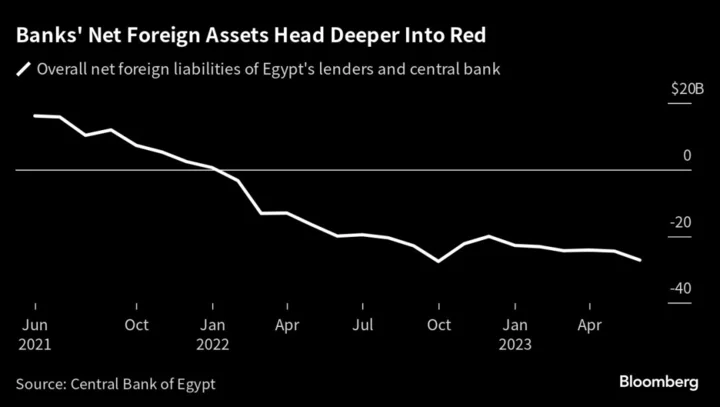

Central banks in Egypt, Angola and Ghana have also kept rates unchanged this month, while borrowing costs have been raised in Zambia, Nigeria and South Africa.

Key Insights:

- Leading indicators point to a strong economic performance in the first quarter.

- The economy is expected to continue to strengthen in 2023, supported by the services sector and expected recovery in agriculture.

- Foreign-exchange reserves stood at $6.495 billion. That’s equivalent to 3.61 months of import cover.

- The disbursement of recently approved World Bank Development Policy Operation funding and other external inflows will help improve liquidity in the economy.

- Growth in private-sector credit increased to 13.2% in April, from 11.7% in February.

- The government’s decision to remove fuel subsidies and plans to introduce several new tax measures to finance the budget may add to price pressures in coming months.

- Respondents in surveys conducted by the central bank expressed concerns about the proposed increase in taxation, rise in electricity and fuel prices, and the weakening of the shilling.

--With assistance from Simbarashe Gumbo, Robert Brand and David Malingha.

(Updates with market reaction in third paragraph.)