JD.com Inc.’s chief executive officer is departing after about a year at the post, a surprise move that coincides with the Chinese internet retailer’s slowest pace of growth on record.

Xu Lei is departing China’s No. 2 online commerce firm after more than a decade of climbing the ranks, handing the reins to Chief Financial Officer Sandy Xu starting June. While the outgoing CEO only officially took up his role around April 2022, he headed up JD’s core retail division for years and was once regarded as heir apparent to billionaire founder and Chairman Richard Liu.

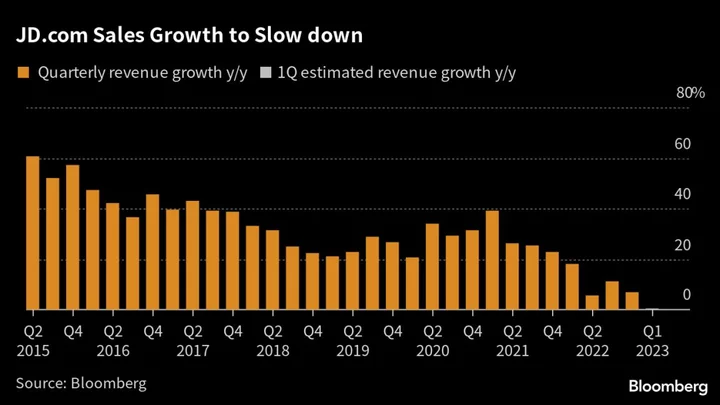

The shift was announced after JD on Thursday reported revenue grew just 1.4% to of 242.96 billion yuan ($35 billion). That beat projections by a slight margin but was the company’s lowest-ever pace of expansion. JD’s shares climbed more than 3% in pre-market trading in New York.

The incoming CEO, a two-decade auditing veteran who spent time with PriceWaterhouseCoopers, now takes up the task of reviving growth at one of China’s largest and highest-profile public companies. JD’s results, the first from a major Chinese tech company for the March quarter, suggest the internet sector is making some headway in efforts to eke out top-line growth but still struggling to regain momentum after years of punishing Covid restrictions.

JD’s revenue rise was a far cry from the double-digit percentage expansions of previous years, before Beijing’s clampdown on internet spheres from online commerce to ride-hailing chilled a once free-wheeling tech sector.

The 48-year-old outgoing CEO Xu, known for devising JD’s signature annual “6.18” sales bonanza, said in a statement he was quitting to devote more time to family. His successor becomes one of the few women chiefs of a major technology company, and emphasized in the same statement that Xu will remain involved with the company.

Xu leaves behind a legacy that includes introducing a rival to Alibaba’s Nov. 11 Singles’ Day sales bonanza, pushing back against internal opposition to roll out the weeks-long equivalent event around the company’s June 18 anniversary. He also stepped up during the company’s low points — including an investigation into Liu over an alleged rape charge in 2018 — by trimming the workforce and cutting units that weren’t contributing to growth.

Read more: JD.com Shares Soar on Plan to List Two Units in Hong Kong

What Bloomberg Intelligence says:

The unexpected retirement of JD.com’s 48-year-old CEO as it reported its first quarterly retail sales drop since 2019 suggests the e-commerce company faces heightened market-share challenges in China this year. This raises uncertainty about JD.com’s retail margin gains, which widened year-over-year in 1Q vs. the prior quarter to beat market expectations of lower profitability, through December.

- Catherine Lim and Trini Tan, analysts

Click here for the research.

JD’s earnings give investors a sense of what to expect when Tencent Holdings Ltd., Baidu Inc. and Alibaba Group Holding Ltd. report results next week.

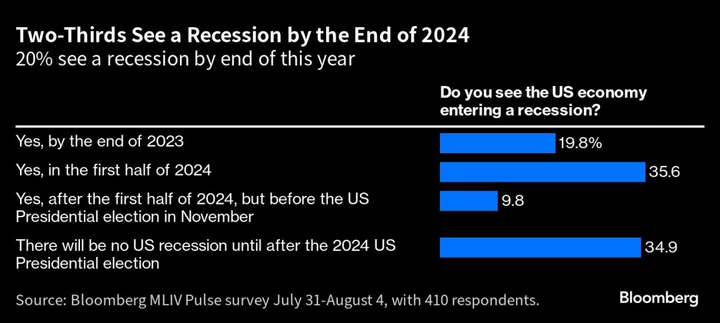

Investors had bet that consumer spending and the tech sector would rebound as Beijing lifted years of sweeping restrictions that hobbled the world’s No. 2 economy. It expanded 4.5% in the first quarter of 2023, the fastest pace in a year, with economists expecting growth this quarter to be even stronger. But economists have pointed to slowing trade and other signs that that nascent recovery may be losing steam.

JD is now spending on incentives to ward off intensifying competition from PDD Holdings Inc. as well as social media platforms such as ByteDance Ltd. It launched a 10 billion yuan discount campaign to capture new Chinese users in March even as it pulled away from Southeast Asian e-commerce, closing its Indonesian and Thailand e-commerce sites to try and shave costs elsewhere.

JD had avoided the worst of the years-long crackdown that hit biggest rival Alibaba, which in March made the historic decision to split itself into six business units that could seek independent fundraising and listings.

JD.com itself has spun off several units including JD Health International Inc., and is in the process of listing its property and industrials businesses in Hong Kong. It would remain the majority owner of both companies, which haven’t disclosed fundraising plans.

--With assistance from Molly Schuetz.

(Updates with shares and analyst’s comment from the third paragraph)