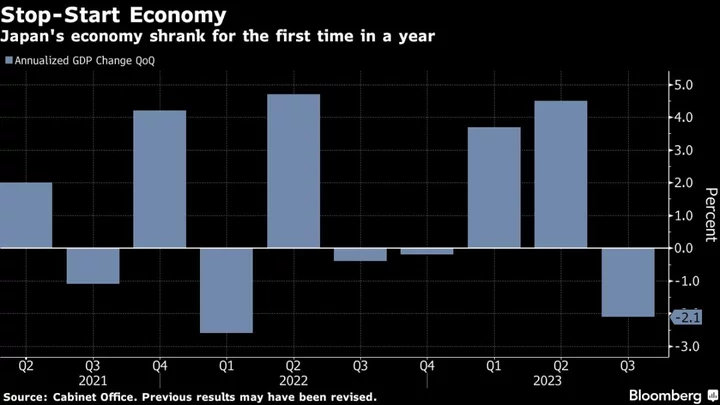

Japan’s economy shrank over the summer, pointing to the fragility of the country’s recovery in the face of uncertainties including currency weakness, prolonged inflation and a cloudy outlook overseas.

Gross domestic product contracted at an annualized pace of 2.1% in the third quarter, largely on the back of falling business spending and higher imports that dragged on the economy, the Cabinet Office reported Wednesday. The contraction was deeper than economists’ estimate of a 0.4% shrinkage.

Wednesday’s data suggest that Japan’s economic recovery remains patchy, lagging behind its global peers. The lackluster economy may give the Bank of Japan a reason to delay any policy shift away from its massive monetary easing stance.

BOJ Governor Kazuo Ueda has maintained that the bank will stand pat until there are clearer signs that a virtuous cycle of wages, prices and growth is strengthening. Still, Ueda also recently hinted that Japan is making progress toward its 2% stable inflation target, a prerequisite for policy normalization, fueling speculation over a possible early shift.

The contraction was partly driven by imports, which rebounded from a sharp drop in the spring, with net exports subtracting 0.1 percentage points from the overall GDP figure.

What Bloomberg Economics Says...

“We expect GDP to shrink again in 4Q, when slowing demand from China and the US will probably hit exports. The contraction will probably be mild, but the outlook is weak enough that the Bank of Japan isn’t likely to pivot away from extreme stimulus anytime soon.”

— Taro Kimura, economist

For the full report, click here.

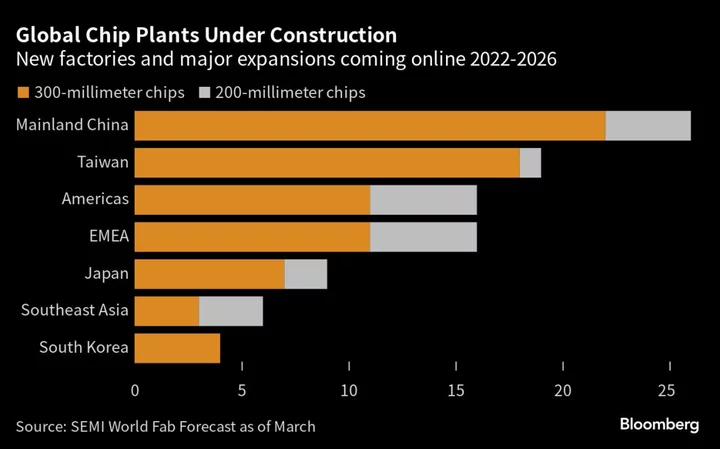

Businesses’ capital spending also decreased 0.6% after a 1% drop in the previous quarter, indicating that companies continued to cut back on investments amid price hikes, despite the increasing need for digitalization to tackle labor shortages.

The weak yen has also kept inflation sticky, continuing to weigh on consumer spending. Private consumption failed to grow as expected from the previous quarter. Analysts had forecast a 0.3% increase.

Higher prices, coupled with sluggish pay growth, may risk a further cooling of consumer confidence going ahead.

(Updates with more details from release)