Japanese auto companies look set to be a major beneficiary from the Detroit strike with their US competitors likely to get bogged down in labor negotiations that hurt sales.

Many Japanese carmakers receive a large percentage of their overall revenue from US markets, so the labor action there may give a tailwind to firms such as Toyota Motor Corp., Honda Motor Co. and Nissan Motor Co. The strike seems to be getting broad support from the US public, even after the Big Three rejected demands for raises of as much as 40% over four years.

“Japanese auto firms are in a good place to benefit” from any protracted strikes in the US that cause supply disruptions, said Oliver Lee, a portfolio manager at Eastspring Investments Singapore Ltd. “Taking into account stronger pricing and the current cost outlook, Japanese auto manufacturers continue to look attractive to us.”

The Detroit walkout of course helps carmakers elsewhere, including those from South Korea and Germany, but the scope for outperformance of Japanese firms is greater because they have a third of US market share. This provides a much-needed boost to the sector, which had lagged on worries about firms’ slow response to developing electric vehicles, and gives an added tonic to the market amid concerns the advantages of a weaker yen are waning.

Analysts at Nomura Securities Co. said the action, which started Sept. 15, may last about 40 days, based on a strike at General Motors Co. in 2019. That would dent output by some 300,000–500,000 vehicles, it said. On top of short-term disruptions, US wage costs look set to surge, increasing the competitive edge to non-US carmakers.

Read: What’s at Stake as US Autoworkers’ Strike Drags On: QuickTake

“Investors should be aware that wages for automotive workers in the US will rise by much more than in other regions,” Nomura analysts including Masataka Kunugimoto and Anindya Das wrote in Sept. 22 report, noting they’re retaining a buy rating on Toyota and Nissan. Nomura expects wage increases of 26% at the Big Three over the next four years.

Costs for Japan’s exporters have already become comparatively cheaper due to the fall in the yen of 12% so far this year and almost 30% over the past three years. “The Japanese look quite competitive, especially with a weak yen at the moment,” Eastspring’s Lee said, adding that although worker pay is increasing in Japan, wage pressure in the US is likely to be more substantial.

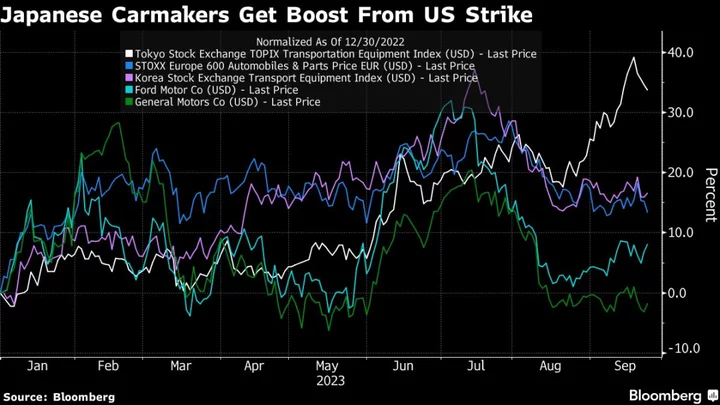

The cheaper currency, in fact, has been the main driver for Japanese auto shares in 2023 after a few years of sluggish performance as they fall behind in the EV race. The Topix transportation equipment index has gained 36% in dollar terms, versus 16% for an equivalent South Korean measure and 15% for a European gauge.

Still, with their valuations already now well above their peers in Europe and South Korea, some analysts say more needs to be done in the shift to electrification to make the rally durable. The Topix transportation index is traded at 11 times forward earnings, double peers in Korea and Europe.

For Japanese carmakers, the prospect of a sustained strike in the US “may give them a good chance to buy time a little bit,” said Shinichi Ichikawa, a senior fellow at Pictet Asset Management Japan Ltd. “The question is whether they can make the best use of this opportunity.”

--With assistance from Youkyung Lee.