Japan’s consumer inflation outpaced expectations in data published hours ahead of the central bank’s policy decision, casting some doubt over the Bank of Japan’s price outlook.

Consumer prices excluding fresh food rose 3.1% from a year ago in August, unchanged from the previous month, the internal affairs ministry reported Friday. Energy dragged more on prices while hotel fees boosted them, with gains in processed food costs continuing to be the biggest factor behind inflation. Analysts had expected the reading to slow to 3.0%.

Prices excluding energy and fresh food, another key measure watched by the BOJ, also grew at the same pace as in July, increasing 4.3% from the previous year.

The unchanged pace of price gains calls into question the BOJ’s view that inflation will peak later this year and fall back below its 2% target in the following years. The central bank has relied on its price projections to explain why it needs to keep its ongoing ultra-easy policy settings.

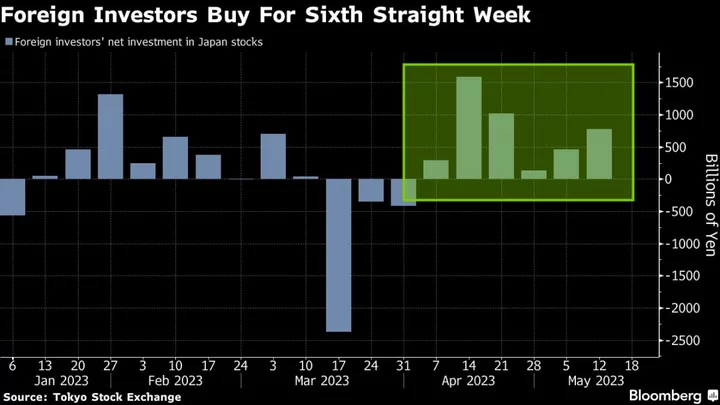

Speculation over eventual policy normalization continues to simmer as inflation has been stickier and stronger than the BOJ had expected. The bank surprised BOJ watchers by effectively raising the upper ceiling of a long-term bond yield in July. Governor Kazuo Ueda’s recent remarks in a local newspaper have added to the speculation over normalization.

Still, BOJ watchers expect no change in policy settings later today. The central bank is closely monitoring data for clues on whether inflation is finally getting on a sustainable path accompanied by healthy wage growth.

“Food prices were a big factor as they continue to rise for longer than we had expected,” said economist Yuichi Kodama at Meiji Yasuda Research Institute. “But looking ahead, price hikes are likely to continue at a slower pace. As long as the outlook points to a slowdown in price hikes, the BOJ can stick to its stance that it needs to maintain its current easing.”

What Bloomberg Economics Says...

“Japan’s firmer-than-expected August CPI data suggest inflation is getting stickier, as demand-pull pressures take hold while cost-push factors revive with an increase in gasoline prices. These upward forces countered a downward tug from lower utilities costs and statistical base effects.”

— Taro Kimura, economist

For the full report, click here.

Current inflation, first driven by higher import costs of materials, energy and food, has prompted companies to pass on cost pressure to consumers and raise wages for workers. But the transition isn’t complete, as wage growth continues to trail inflation, weighing on consumers’ spending power.

Now a rebound in oil prices and a drop in the yen are throwing a wrench into the inflation dynamics because both developments make imports more expensive and hit consumers. More than 6,600 food items are expected to see price hikes in September and October, according to a report by Teikoku Databank. The yen also continues to be weaker than the level a year ago that prompted authorities to intervene in markets to prop up the currency.

“The BOJ can say uncertainties are high for its price outlook but there is no doubt that the underlying trend is strong at this point,” said Taro Saito, head of economic research at NLI Research Institute. “I don’t think the BOJ will tighten policy today but they might do something small or nuanced to ease pressures on the yen to weaken.”

To ease the pain of inflation, the government has extended gasoline subsidies to the year end, and is putting together a fresh round of economic measures to support the economy. Recent indicators suggest Japan’s economic growth is slowing down from the second quarter as companies and consumers cut back on spending.

Prime Minister Fumio Kishida said Thursday during a visit to New York that he will unveil the outline of new economic measures next week as he aims to help households cope with “rapid” inflation and boost momentum for wage growth. He warned that Japan’s economic situation remains unstable. In a sign of growing frustration, Kishida also told reporters that Japan will take action against any excessive yen moves. It’s unusual for Japan’s prime minister to engage in verbal intervention on currencies.

--With assistance from Toru Fujioka.

(Updates with more details from report, economist comments)