Italy was kept at three steps above junk by Scope Ratings, extending Premier Giorgia Meloni’s victory lap after a month when her loosened fiscal stance withstood scrutiny by investors and credit assessors.

The company stuck with its BBB+ score, and that grade isn’t in imminent danger of being lowered in due course, according to a statement issued on Friday.

Italy benefits from “supportive European monetary and fiscal policy frameworks,” the size of its economy and “a favorable public debt structure with an average cost of funding of around 3.1% over 2022-2026 and an average debt maturity of around seven years, which mitigates the impact of rising financing costs,” Scope said.

Additionally, “the country’s recent political stability” with a “wide parliamentary majority” supports the credit assessment, analyst Alvise Lennkh-Yunus said.

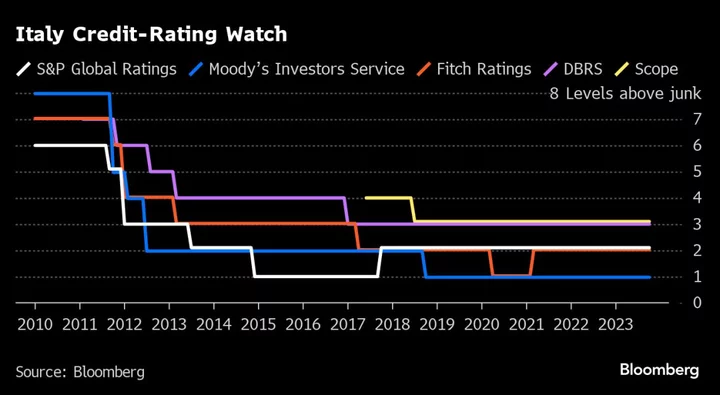

The company’s remarks offer a rosier view than those of bigger rivals S&P Ratings and Fitch Ratings, which assess Italy to be two steps above junk and each affirmed those grades in recent weeks.

The lack of any shift is another win for Meloni’s coalition after it unveiled a budget loosening Italy’s fiscal stance in order to meet election promises to voters. An even bigger victory was the decision by Moody’s Investors Service last month to remove its threat of a cut to junk, eradicating a danger that had haunted the prime minister’s first year in office.

Similarly, the European Commission didn’t censure Italy when it released a report on European Union members’ fiscal plans, and pressure from investors has lessened too.

Fiscal Plans

After Meloni’s budget in September, the spread between bonds of Italy and Germany — a key measure of risk in the region — widened to 210 basis points for the first time since January, but that gauge was far lower at 174 on Friday.

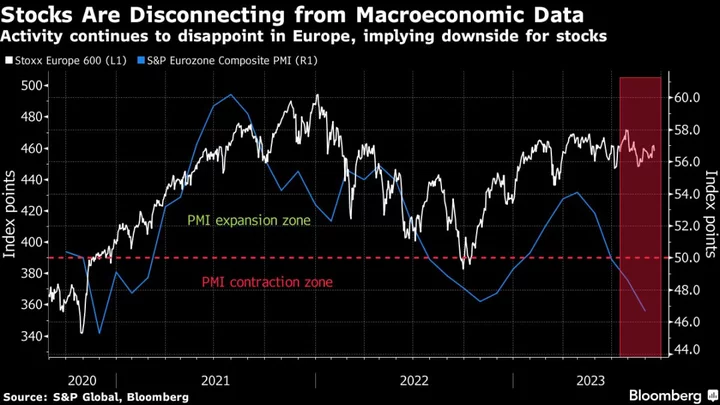

With the spate of assessments now out the way, Meloni has some leeway to concentrate on trying to steer the country out of economic stagnation amid high interest rates and low growth.

Italy’s economy grew just 0.1% percent in the third quarter according to the latest data from its national statistics institute. The reading was an improvement on a previous forecast of zero growth. The country’s economy is seen expanding 0.7% overall this year.

The government is still trying to keep its election promises, including tax cuts and aid to lower income families. That’s making it difficult to bring the deficit as a percentage of gross domestic product below the EU’s 3% limit until 2026 — a year later than originally planned.

Those “weak public finances” were highlighted by Scope, which said that “elevated annual funding needs, including bills, of around 25% of GDP,” are “expected to persist into the medium term.”

Some help might come from EU Recovery Fund cash, with the government set to receive the latest €16.5 billion ($17.9 billion) installment by the end of the year. That will bring the total funds doled out to Italy to help kick-start its economy to around €102 billion, or more than half the total allotment.