Italy is seeking to turn Banca Monte Paschi di Siena SpA into the country’s third largest bank by merging it with one of its peers.

The government is evaluating how to make the world’s oldest lender a cornerstone of a new banking hub to challenge the duopoly of Intesa Sanpaolo SpA and UniCredit SpA, according to people familiar with the administration’s plans.

The administration’s favorite option would be a merger between Paschi and peers of a similar size like Banco BPM SpA or BPER Banca SpA, said the people who asked not to be named on a confidential issue. There are so far no formal talks with those lenders which have denied any interest in Paschi.

Ahead of such a deal, the government is planning the sale of a minority Paschi stake of as much as 15% on the market, according to the people. Financial advisers could be hired by the end of the year to manage the disposal, they added. Newspaper Il Messaggero reported Wednesday that Equita could be picked as an adviser.

The European Commission, the EU’s executive arm, has told Italy to exit Paschi this year or next. The people argued that selling a minority stake would buy the government time and demonstrate that it is committed to complying with this demand.

The finance ministry declined to comment. A spokeswoman for Banco BPM reiterated that the lender is not interested in M&A deals as it pursues a standalone strategy. A representative for BPER Banca declined to comment.

The plan has been conceived as a landmark deal for Prime Minister Giorgia Meloni’s right-wing government in the corporate sector. But forging such a merger won’t be an easy task, given that Rome doesn’t own stakes in Banco BPM or BPER Banca and has no formal power to force them into a takeover.

Previous cases of government-backed takeover talks between domestic lenders show they can be difficult to pull off, with Commerzbank — whose largest shareholder is the German government — and Deutsche Bank failing to reach agreement in early 2019. By contrast, the government-engineered takeover of Credit Suisse by UBS in Switzerland earlier this year only worked because it came with very favorable terms for UBS.

Deputy Premier Matteo Salvini of the League party, a junior ally in Meloni’s coalition, has lobbied for months for the creation of a new hub which would retain the world’s oldest brand, they added.

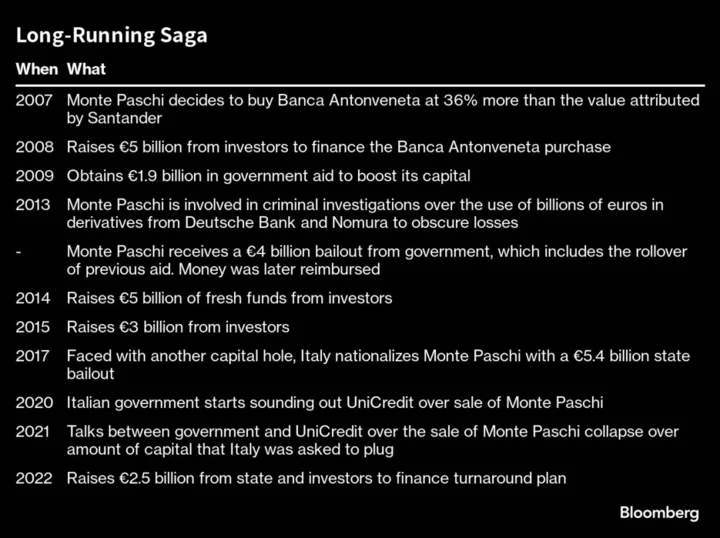

Rome has long struggled to sell the controlling stake in Siena-based Paschi. Two years ago, the previous government tried but failed to combine Paschi with UniCredit as no agreement was reached on financial terms. But progress made under Chief Executive Officer Luigi Lovaglio, who implemented a turnaround after years of painful restructuring, has made the bank more appealing to investors.

BPER Banca’s top shareholder has recently requested authorization to increase its stake in Banca Popolare di Sondrio SpA, fueling speculation about a possible deal between those two banks.

Paschi, which traces its roots to the 15th century, is now the country’s fifth-largest bank, with more than 3.3 million clients and €120 billion ($127 billion) in total assets. It reported net income of €383 million in the second quarter, more than 10 times higher than a year earlier.

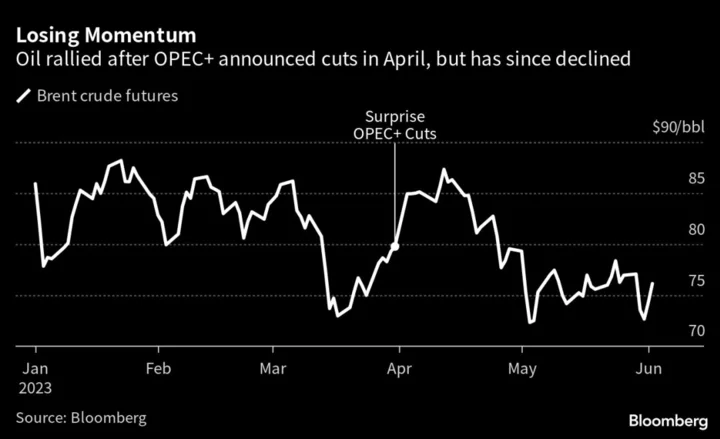

Major consolidation in European banking stalled after the financial crisis despite the widely held view that greater scale would make struggling lenders more competitive. With rising interest rates lifting profit from lending, prospects for deal-making in the industry have recently improved.

--With assistance from Alessandra Migliaccio, Steven Arons and Tommaso Ebhardt.