Israel’s shekel swung to the world’s biggest loss from the biggest gain on Monday as investors weighed whether rising political tension in the country will do long-term damage to the appeal of a currency still supported by real returns.

The shekel weakened for a third day, dropping 0.7% to 3.6566 per the dollar, after a wild day when it initially strengthened more than 1% before dropping as much as 1.5%. Israel’s dollar bonds rose, with the yield on notes due in 2028 falling to 4.87%.

Read More: Israel Passes Divisive Law Limiting Judges’ Power

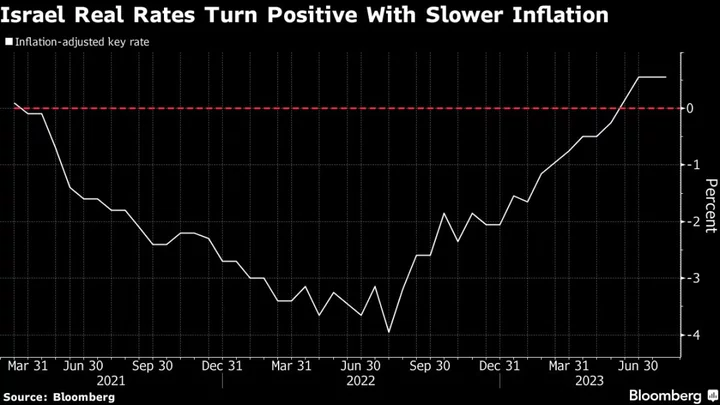

“When the dust settles we still expect the shekel stronger,” said Geoffrey Yu, a currency and macro strategist at BNY Mellon in London. “Real yields are favorable and that is providing support while the carry trade is unwinding and the shekel as a funding currency should benefit.”

The carry trade is a popular emerging-market transaction in which investors borrow money in a low interest-rate country to invest it in higher-yielding currencies.

Despite criticism from opposition parties and huge demonstrations across the country, Israel’s parliament on Monday approved a bill reducing the power of judges to overrule government decisions.

“The shekel’s risk premium is substantial” said Deustche Bank analysts, who have a recommendation to go long the currency. “Further FX weakness could also be met by Bank of Israel intervention,” they said, referring to the central bank.

Jerome Leibovici, FX and rates strategist at BNP Paribas, said positioning data suggests that offshore investors have been short the shekel. Over the longer term, he said he expects the currency to appreciate as its risk premium declines, something that could revive its correlation with US technology stocks, rather than domestic political developments.

(Updated with market figures in second paragraph.)