Israel should manage to avoid its first ever rating downgrade thanks to sound finances, unless the war with Hamas drags on for a long time, a top official in charge of the country’s debt said.

A downgrade to Israel’s sovereign credit rating is an extreme scenario, said a senior official at the Finance Ministry’s General Accountants’ Office. A more realistic possibility is that Israel will be put on credit watch, said the official, who asked not to be named due to the sensitivity of the information.

Through wars, conflicts and global economic crises, Israel has never been downgraded by any of the major ratings companies. But its ranking was already under pressure before the unprecedented Oct. 7 attacks by the Palestinian militant group, with credit assessors taking an increasingly dim view of the government’s controversial efforts to weaken the power of the judiciary.

For more on the Israel-Hamas war, click here

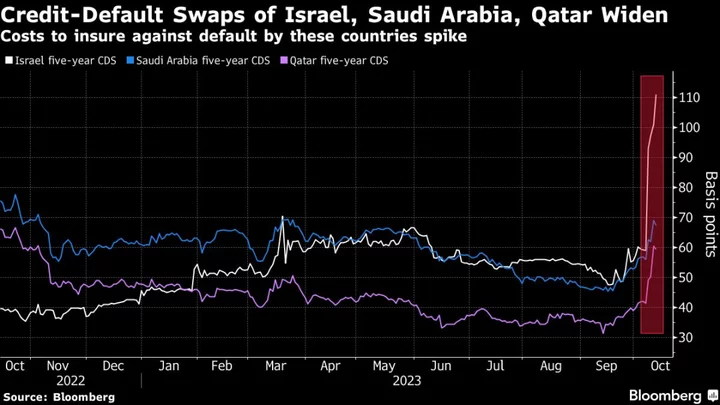

The cost to insure Israeli bonds against potential default has soared to the highest point in a decade last week. That makes it more expensive than the credit-default swaps of countries including Peru, rated three levels lower than Israel.

Moody’s Investors Service postponed a planned review of Israel’s rating on Friday. The resilience of Israeli debt issuers is at stake if a conflict stretches on, the ratings agency said in a research note last week.

The Gaza conflict will bring on an increase in government expenditures, a decrease in tax collection and a growth in government deficit, the official said. Still, Israel does not anticipate any impact on its financing capabilities because it has a strong fiscal cushion.

Israeli Central Bank Governor, Amir Yaron, also expressed confidence in the economy’s resilience.

“Every war has a considerable economic dimension that includes the impact to the financial markets, and with so many reserve soldiers at the front-lines and civilians in shelters, there is an effect on real economy, Yaron said in a video address to the G-30 forum in Marrakech. “However, with the appropriate budget adjustments, that I believe are manageable , there should be no major changes to Israel’s fundamental fiscal position,” he added.

Economic Cost

Israel has vowed to wipe out Hamas in response to the assault that killed 1,300 people in southern Israel. It’s preparing for a ground offensive against the group in the Gaza Strip, fueling speculation of a prolonged war. There are fears a second front could open in the north with Hezbollah, the Lebanon-based militia.

The economic cost of the conflict would probably run to at least 27 billion shekels ($6.8 billion), according to Bank Hapoalim in Tel Aviv.

Israel’s relatively low public debt, at 60% of gross domestic product, and a budget deficit of around 2% suggests that the government has room to increase spending, especially for defense. Prospective aid by the US could further support its additional spending needs, Deutsche Bank AG strategists said.

Policymakers have sought to limit the market fallout from the worst attack on Israel in decades, with the central bank pledging to sell as much as $30 billion from its reserves to support the currency, as well as to extend up to $15 billion through swap mechanisms. Those pledges seem to be stabilizing some corners of the local market, for now.