The escalation of hostilities between Israel and Hamas could further strain global oil and gas supplies, already disrupted by Russia's invasion of Ukraine, experts have warned.

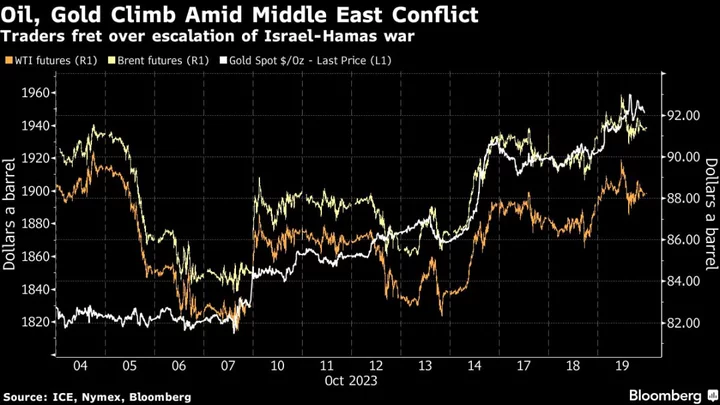

Increases in oil prices in response to the conflict, triggered by the bloody attack by Hamas in Israel on October 7, have so far been relatively mild.

Brent, the European benchmark, has gained around 10 percent, while its American equivalent has gained around 9 percent.

Prices are around $90 per barrel, still far from their historical highs.

"Israel is not an oil producer and no major international oil infrastructure runs close to the Gaza Strip or southern Israel," Edoardo Campanella, analyst at UniCredit, told AFP.

However, investors are conscious of the "Middle East tinder box's inherent risk to global oil supply. Hence they have been diving into contracts compounding matters," explained Stephen Innes, analyst at SPI AM.

The prospect of Iran, a supporter of Hamas and sworn enemy of Israel, being drawn into the conflict presents one of the main risks for the energy market.

The OPEC member has seen its production and exports damaged by years of international sanctions, but has nevertheless increased its production over the last year and is suspected of smuggling barrels onto the market.

This has helped contain global prices despite rising demand and tight supply, leading the Biden administration in the US to "turn a blind eye," according to Helge André Martinsen, analyst at DNB.

Even if Tehran stays out of the conflict, "the West might decide to tighten sanctions on Iran or simply to enforce existing sanctions more effectively," said Campanella.

Iran could respond by blocking the Strait of Hormuz, the most important oil transit zone in the world, with a daily flow of more than 17 million barrels -- 30 percent of all oil traded by sea --, according to Seb Research.

Only Saudi Arabia and the United Arab Emirates have pipelines to bypass the Strait of Hormuz when shipping crude oil outside of the Gulf, explained Campanella.

- Gas threat -

The worst-case scenario, unlikely but not impossible according to analysts, would be stronger sanctions leading Iran to retaliate by attacking oil installations in Saudi Arabia, one of the world's main producers and exporters.

Attacks on its infrastructure in September 2019, claimed by Yemeni Houthi rebels supported by Tehran, caused Saudi to temporarily halve production, leading the price of Brent to jump by almost 20 percent in one day.

Experts recall previous oil shocks, such as the OPEC embargo against Israel's allies in the midst of the Yom Kippur War 50 years ago, and then in the wake of the Iranian revolution in 1979.

The shocks led to crude prices jumping within a few months, bringing developed economies to their knees.

But they are less exposed this time around given the rise of the US as a producer and an OPEC that claims to be less political.

On the gas side, the effects are more immediate.

The price of TTF, the European benchmark for natural gas, was up by a third in mid-October compared to before the October 7 attack.

The war "seriously threatens the regional natural gas market and could impact Europe's LNG (liquefied natural gas) supply as winter approaches," warned Innes.

"While European gas inventories are almost full, they are not sufficiently high to get through the winter in case all imports stop," said Giovanni Staunovo, of UBS.

US giant Chevron has suspended activities at its Tamar platform, off the Israeli coast, on instructions from the country's authorities.

This gas field represents "around 1.5 percent of global LNG supply", said Innes, mainly supplying the domestic market, then Egypt and Jordan.

If Leviathan, Israel's largest gas field, were to close, the consequences would be much more worrying, say analysts, who recall prices surging to a historic high of 345 euros per MWh at the start of the war in Ukraine.

emb/ved/jwp/giv