While all the world is fretting over a potential default in the US, a country at the center of Europe’s debt crisis a decade ago is staging a remarkable rebound.

Greece’s election results this week have spurred so much optimism among investors that they are now willing to grab the nation’s bonds for much lower yields than they get in Italy and not far off US Treasuries in nominal terms.

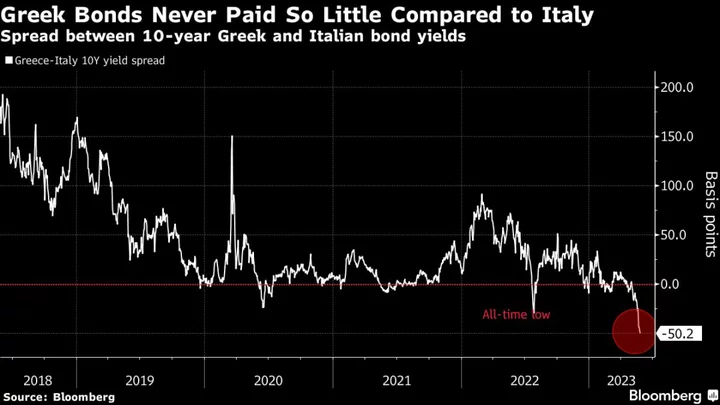

The junk-rated bonds have posted the only rally in the developed world this week, taking the benchmark 10-year yield down to 3.9%. That’s half-a-percentage point lower than the rate paid by investment-grade rated Italian bonds, a gap never seen before. Its two-year yields are now similar to France.

The performance is telling of investor expectations that Greece will win a return to investment-grade status, 13 years after an unprecedented crisis that cut off funding to the nation. While the US risks breaking its debt ceiling and European peers try to stave off a recession, Greece’s economy is roaring back.

“Greece has been one of our strongest convictions,” said Flavio Carpenzano, investment director for fixed income at Capital Group, which manages more than $2.6 trillion. “Our view has been to overweight Greece and underweight Italy as we have expected an upgrade to investment grade for Greece and still see this happening.”

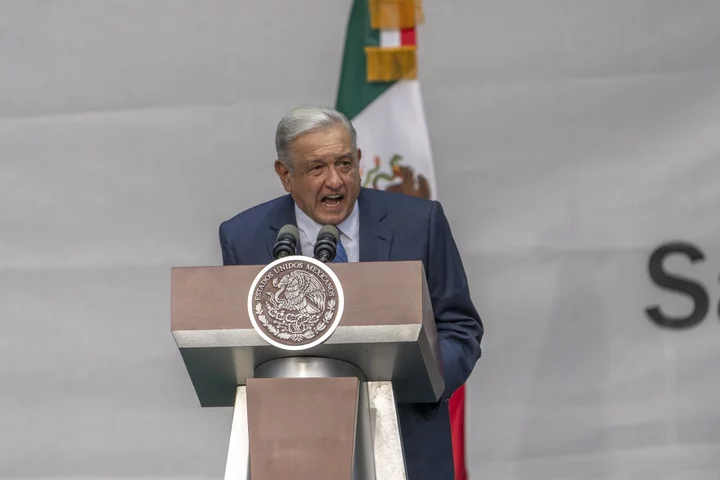

Greek Prime Minister Kyriakos Mitsotakis easily beat his opposition in Sunday’s national election, getting a step closer to another four-year term that would mean investment-friendly policies will continue.

Morgan Stanley IM Says Greek Stocks Hottest Emerging-Market Bet

That’s taken yields around 45 basis points below even the UK in nominal terms, after gilt yields surged this week on hotter-than-expected inflation data. Adjusted for currency, the benchmark UK gilt pays about 3% in euro terms, while US Treasuries pay about 2.9%, still lower than Greece’s.

Many analysts say Greek bonds will now remain supported until an upgrade happens and the country joins investment-grade benchmark bond indexes that are tracked by mutual and exchange-traded funds all over the world.

“Policy continuity, strong growth and primary surpluses are all very supportive for the rating,” said Aman Bansal, a fixed income strategist at Citigroup Inc. in London. “After that flow is over, some investors who positioned for that dynamic may take profit.”

The next event to watch is a review on June 9 by Fitch Ratings, which currently has the nation at BB+, one notch below investment grade, with a stable outlook. After that comes a second election on June 25, which is likely to confirm a victory for Mitsotakis.

S&P Global Ratings, which rates Greece at BB+ with a positive outlook, has its next assessment scheduled for Oct. 20.

The outcome of the vote “is viewed as cementing Greece’s improving appeal with its economy close to fully reversing the losses incurred since the euro-zone debt crisis, while its ratings converge on investment grade,” Richard McGuire, a rates strategist at Rabobank, wrote in a note this week.

--With assistance from Sujata Rao.

(Adds comment, currency-adjusted yield comparison.)