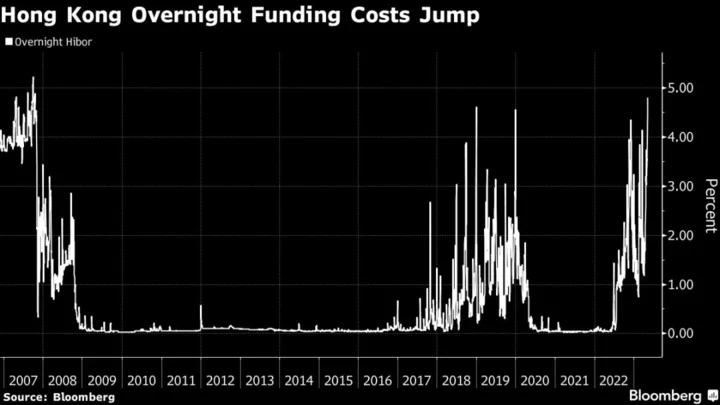

The cost to borrow overnight in Hong Kong jumped to a sixteen-year high as liquidity continued to tighten in the city after repeated currency intervention from authorities.

The overnight Hong Kong interbank offered rate, known as Hibor, climbed 37 basis points to 4.81%, the highest since 2007, on Thursday. The Hong Kong Monetary Authority has been draining liquidity from the banking system to boost the local dollar, reduce a gauge of interbank liquidity to its lowest since 2008.

The currency had come under pressure when the gap between Hibor and its US counterpart widened to attractive levels for hedge funds to borrow the city’s dollar cheaply and buy the higher-yielding greenback. The HKMA has spent $6.5 billion since February to defend the local dollar’s 7.75-7.85 peg with its US counterpart.

Rising demand for the local currency as some firms prepare for dividend payouts during summer is also playing a role in boosting Hibor.

The move “may be a hurdle for USD/HKD to rise back to 7.85 for now,” said Stephen Chiu, chief Asia FX & rates strategist at Bloomberg Intelligence in Hong Kong. “That said, USD/HKD buyers could return if the Federal Reserve refrains from cutting rates and Hibors fail to rise beyond their US counterparts.”

The city’s currency was little changed at 7.8309 per dollar on Thursday.

Other Hibors

One-month Hibor gained for a 16th consecutive day, a move which has helped the Hong Kong dollar pull away from the weak end of its allowed trading band. That will be welcomed by the city’s authorities but the low level of the aggregate balance means Hong Kong watchers expect Hibor rates to remain volatile.

Hong Kong Dollar Pulls Back From Peg Limit as Local Rates Jump

Still, some pointed to signs in slightly-longer dated maturities as a sign that funding pressures are expected to ease further out. Three-month Hibor has edged below its one-month counterpart.

“Despite the climb in Hibor overnight, there are some signs of relief in the HKD liquidity squeeze,” said Eddie Cheung, senior emerging market strategist at Credit Agricole in Hong Kong. “While the smaller aggregate balance makes the Hong Kong dollar market more vulnerable to these squeezes, we think that resilient HKD demand in the months ahead will also help to ease outflow pressures.”

(Updates with additional comment)