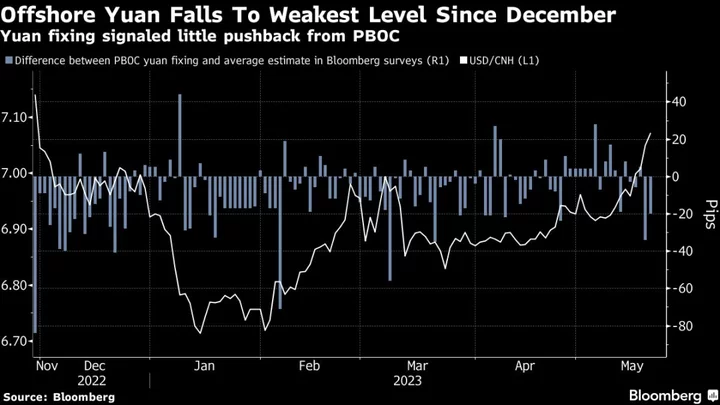

A gauge of bank funding costs in Hong Kong jumped to the highest in 16 years, as year-end demand for cash exacerbates an already-tight liquidity environment.

The one-month Hong Kong interbank offered rate, or Hibor, rose 15 basis points to 5.53%, the highest since October 2007. Demand for the local currency is on the rise as lenders stockpile cash for regulatory purposes, sucking capital from the interbank system.

While the supply of cash often tightens toward the end of a year, swings in Hong Kong funding costs in the last month of 2023 may be more than usual. That’s because the pool of liquidity in the city has shrunk to the lowest in more than a decade, at least according to one gauge.

“Front-end Hong Kong dollar rates have further headroom due to seasonal funding need,” said Cindy Keung, an economist at OCBC Bank (Hong Kong) Ltd. “Bias for the US dollar-Hong Kong dollar pair remains to the downside on rates differentials.”

The so-called aggregate balance has been bouncing around the lowest since 2008 this year, as Hong Kong’s de facto central bank drained local dollars from the financial system to prevent currency depreciation.

Hong Kong Dollar’s Rally Seen Extending on Liquidity Squeeze

The increase in Hibor is lending support to the Hong Kong dollar, as the higher rates make assets denominated in the city’s currency more appealing relative to those in the US. The local currency rose to the strongest level since December last week.

As a small and open economy, Hong Kong is especially vulnerable to money flowing in and out. The city uses the linked exchange-rate system to manage monetary policy and prevent local borrowing costs from diverging too much from US rates.

Pegged to the U.S. dollar since 1983, the Hong Kong dollar is allowed to trade in a band of 7.75 to 7.85 against the greenback. The de-facto central bank was forced to defend the peg on multiple occasions in the past two years, shrinking the city’s aggregate balance by about 90% since its 2021 high.

The currency traded around the 7.7873 level on Monday.

“The year-end seasonality will be the driver for higher Hong Kong dollar rates and the narrowing rate spread with the US will keep the spot rate of the city’s currency supportive below 7.8,” said Ken Cheung, chief Asian FX strategist at Mizuho Bank Ltd.

(Updates with background and second chart.)