Hydrogen is a losing bet for investors interested in making money in the foreseeable future, according to Barry Norris, the founder and chief investment officer of UK hedge fund Argonaut Capital Partners.

“It’s a complete waste of time, unfortunately,” London-based Norris said in an interview.

The Argonaut CIO said he’s “skeptical that the business models of a lot of these companies will work.” That’s why he’s built “a few shorts in hydrogen,” he said, referring to bets that share prices will fall. He declined to specify which companies his short positions target.

It’s the latest salvo in a controversial corner of green technology that, depending on who’s asked, is either a crucial piece in the puzzle to reduce greenhouse gas emissions or an over-priced, over-hyped distraction. For now, even card-carrying hydrogen evangelists are having to take a few steps back, as they await detailed guidance on how to take advantage of subsidies locked in the US Inflation Reduction Act.

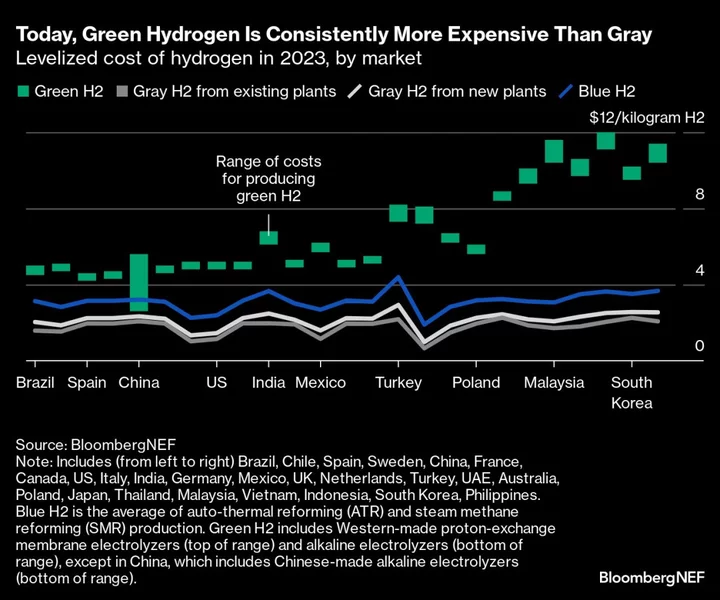

Hydrogen, the basic chemical element that fuels the sun, has the potential to generate energy with hardly any CO2 emissions. But unlike solar power or wind, hydrogen first needs to be extracted. That can be done in a number of ways, some of which are cleaner than others. For now, the most common (and cheapest) forms of production rely on fossil fuels.

The cleanest form is known as green hydrogen, whereby an electrolyzer powered by renewable energy is used to split water into hydrogen and oxygen. But that process is costly, which is why a lot of investors are skeptical. Other challenges include storing it in a way that makes its use viable for things like moving vehicles.

“There’s a massive capital cost in hydrogen, which is building the electrolyzer,” Norris said. “In order to pay back on that capital cost, capacity utilization has to be very high. So you have to have a stable, consistent source of power that is producing hydrogen in the electrolyzer.”

Since the IRA was signed into US law just over a year ago, there’s been a 58% increase in low-carbon hydrogen project announcements, according to analysts at BloombergNEF.

Read More: Green Hydrogen Project Capacity Doubles 1 year Post IRA: BNEF

But the only form of hydrogen generation that’s “remotely competitive in terms of cost is that which is produced either by fossil fuels, hydro or nuclear energy,” according to Norris. “If you have hydrogen produced by weather-dependent power, your capacity utilization is going to be structurally much lower than that produced by base load power.”

Ian Simm, the chief executive of Impax Asset Management, is also cautious around hydrogen’s short-term prospects. The Biden administration’s climate bill is a “potential game changer” for hydrogen, but there’s still “significant uncertainty” around how the subsidies will work in practice, he said.

The US and other governments have announced over $280 billion in subsidies to the low-carbon hydrogen sector, a quadrupling since 2021, according to BNEF. Meanwhile, manufacturers of electrolyzers are starting to acknowledge that their “optimism has run too far and are slowing down expansion,” according to BNEF analyst Xiaoting Wang. Nevertheless, electrolyzer shipments continue to soar, Wang said.

Impax, which oversees about £40 billion ($50 billion) in client assets making it among the world’s biggest low-carbon fund managers, is betting that hydrogen stocks are still overpriced, even after having sold off. The Solactive Global Hydrogen Index, whose members include Plug Power Inc., NEL ASA and Ballard Power Systems Inc., is down more than 20% this year. From its peak in November 2021, the index has lost about 70%.

Read More: Nel, Engie Lead on Hydrogen Project Share Globally: BNEF

“There have been times recently when valuations of green hydrogen-related stocks have been pricing in an efficient, speedy policy transition to support green hydrogen,” Simm said. “That’s probably been over-optimistic.”

However, further down the road the picture starts to look very different, Simm said.

“We’re very bullish about hydrogen with a 10-to-15 year horizon because it’s one of the key ways that we will be decarbonizing industrial heat,” he said. “But in the short term, it’s really hard to see a rapid expansion of demand to a scale that we would invest in.”

The “key obstacle” is “limited visibility of scalable and clear business models,” Simm said. That’s because most listed hydrogen companies focus on electrolyzers, which are bogged down by “concerns about commoditization,” he said. The IRA “led to a brief run in hydrogen names but this has now reversed,” said Simm. Now, most hydrogen stocks are “materially below pre-IRA levels.”

Argonaut’s Norris says he can’t imagine hydrogen that’s powered by renewables being a financially viable alternative.

“If you’ve got this big capex to build the electrolyzers and they’re operating on wind and solar, you will find that capacity utilization is equivalent to wind and solar capacity utilization, which is at best 30%-to-40%,” he said. “It will never be cost competitive if they’re powered by wind and solar. And what’s the point if they’re not powered by wind and solar?”

But the financial viability of hydrogen over time is far from settled. Adithya Bhashyam, an analyst at BNEF, says that when it’s available, “you can combine wind and solar and reach a higher utilization which makes the hydrogen cheaper. Grid electricity does not necessarily make hydrogen production economic because high utilization also means more exposure to higher power prices. Long-term we think connecting to wind or solar will be cheaper as the capex of the electrolyzer comes down and utilization doesn’t matter as much anymore.”

--With assistance from Ishika Mookerjee.

(Adds comment from BNEF in final paragraph.)