Hedge-fund veteran George Noble’s foray into the exchange-traded fund industry is ending after less than a year.

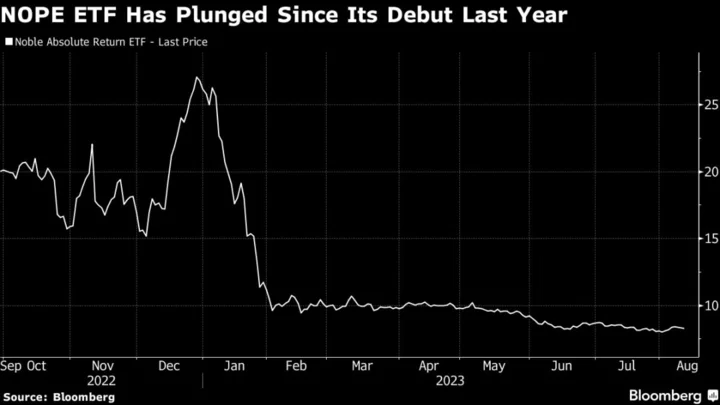

The Noble Absolute Return ETF (ticker NOPE), which took long and short equity positions and which has dropped 59% since its September debut, is set to liquidate, according to a Wednesday announcement. Its plunge has happened even as the S&P 500 rose 23% over that stretch and the Nasdaq 100 jumped some 36%.

NOPE held positions against a number of tech stocks that have posted staggering advances in 2023. The tech sector overall has made an impressive comeback following 2022’s drubbing, partly fueled by hype over prospects for artificial intelligence, as well as optimism that the Federal Reserve is likely done raising interest rates.

The largest bearish position in the ETF is a short bet against the Invesco QQQ Trust Series 1 fund (QQQ), which tracks the tech-heavy Nasdaq 100, data compiled by Bloomberg show. It also holds wagers against electric-vehicle-maker Tesla Inc. and Nvidia Corp., the chipmaker whose shares have surged about 190% this year. Other short positions include Coinbase Global Inc. and Apple Inc., which have also rallied.

“NOPE was like the anti-ARKK — a negation of high growth stocks that never found the long-term bear market it thought would happen,” Bloomberg Intelligence senior ETF analyst Eric Balchunas said. “In the end, for hot-sauce-type ETFs, you need good performance to make it and NOPE never delivered.”

NOPE will stop trading on Aug. 24. A representative declined to comment beyond the release.

At its debut, the fund made a splash in the ETF industry because of George Noble’s long career in finance. He launched NOPE with the goal of offering access to strategies that are typically not available to average investors, he told Bloomberg News earlier this year.

“It’s another example of how difficult the ETF industry can be — especially for more high-cost, complex strategies that may not speak to the adviser crowd,” Todd Sohn, ETF strategist at Strategas, said of NOPE. It “also speaks to how difficult this environment has been for some managers. Tech had a terrible stretch last year, and an amazing stretch this year. So the timing aspect of being long or short can torch a fund.”