Just 5% of women's players at Wimbledon have a female coach. The tennis tour wants to change that

Only six of the 128 women entered in singles at Wimbledon work with a female coach

2023-07-13 18:19

Palo Alto Network’s Odd Summer Friday Report Has Wall Street Asking Why

Palo Alto Networks Inc. investors are cautious ahead of the cybersecurity firm’s fiscal fourth-quarter results, which will be

2023-08-19 01:51

Expro Wins Work on Well Abandonment Campaign Offshore UK

HOUSTON--(BUSINESS WIRE)--May 22, 2023--

2023-05-22 16:25

Google vows more transparency on ads as new EU rules kick in

By Foo Yun Chee BRUSSELS Google will provide more information on targeted advertisements and give researchers more access

2023-08-25 05:27

China's troubled property sector to face more debt defaults

By Xie Yu HONG KONG More debt defaults are likely to emerge in China's property sector as troubled

2023-10-20 18:22

Indonesian leader takes a test ride on Southeast Asia's first high-speed railway

Indonesian President Joko Widodo has taken a test ride on Southeast Asia’s first high-speed railway, a key project under China’s Belt and Road infrastructure initiative

2023-09-13 18:15

Big Oil Shows Support for Energy Transition But on Its Own Terms

The heads of Saudi Aramco and Exxon Mobil Corp. took to the stage at a major industry event

2023-09-19 08:25

Edmunds picks the five best cars for under $30,000

Pricing for the average new car continues to rise, with the latest reports pegging the average new vehicle transaction price around $48,000

2023-11-22 20:19

Court rules against Uber in major win for California workers

By Daniel Wiessner Uber Technologies Inc must face a California lawsuit claiming it should have covered UberEats drivers'

2023-07-18 06:45

Deutsche Bank Q2 profit falls 27% on investment banking slump

FRANKFURT (Reuters) -Deutsche Bank posted on Wednesday a 27% fall in second-quarter profit as investment banking revenues slumped, but the

2023-07-26 13:57

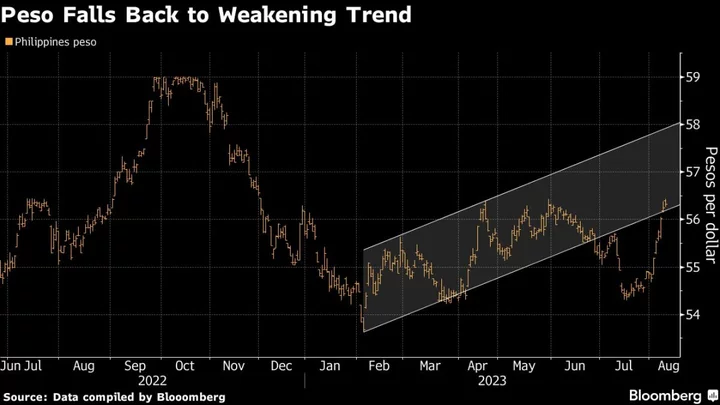

Embattled Peso Seeks Relief as Philippines to Weigh Rate Hike

A rebound in the dollar has hit the peso harder than most of its peers and the losses

2023-08-14 11:49

Intel calls off $5.4b Tower deal after failing to obtain regulatory approvals

Intel is terminating a $5.4 billion agreement to acquire Israeli chip manufacturer Tower Semiconductor after China failed to sign off on the deal amid deteriorating US-China relations

2023-08-16 19:28

You Might Like...

Cresco Labs Launches First-Ever Cannabis Advertisements on Spotify, the World’s Most Popular Audio Streaming Subscription Service

CDN Controls Ties Community Investment to Their Plan for Market Dominance

Zelenskiy Seeks More Europe Support as Funding Worries Mount

BIS' Carstens: too early to say how new war will impact global outlook

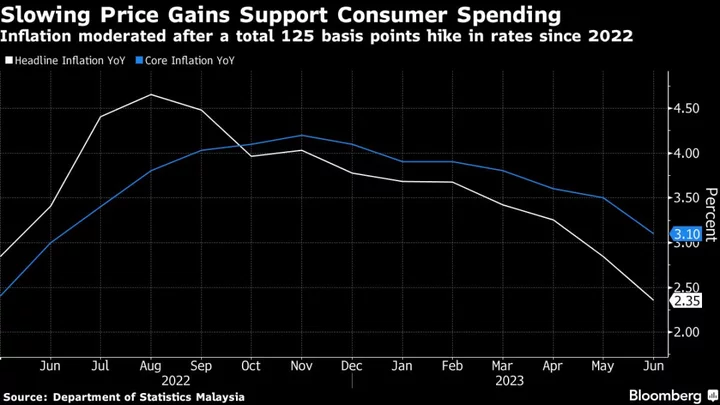

Malaysia’s Growth Misses Estimates Amid El Niño, Export Woes

Texas Sued by Houston Over Law Limiting Power of State’s Cities

Proposed Minnesota nickel mine begins environmental review, would supply Tesla if approved

Vodafone Reports Sales Growth Ahead of Estimates, Names New CFO