CHINT Invites Worldwide Partners for the Global Energy Nexus at 10th CHINT International Marketing Forum

SHANGHAI--(BUSINESS WIRE)--Oct 11, 2023--

2023-10-12 11:18

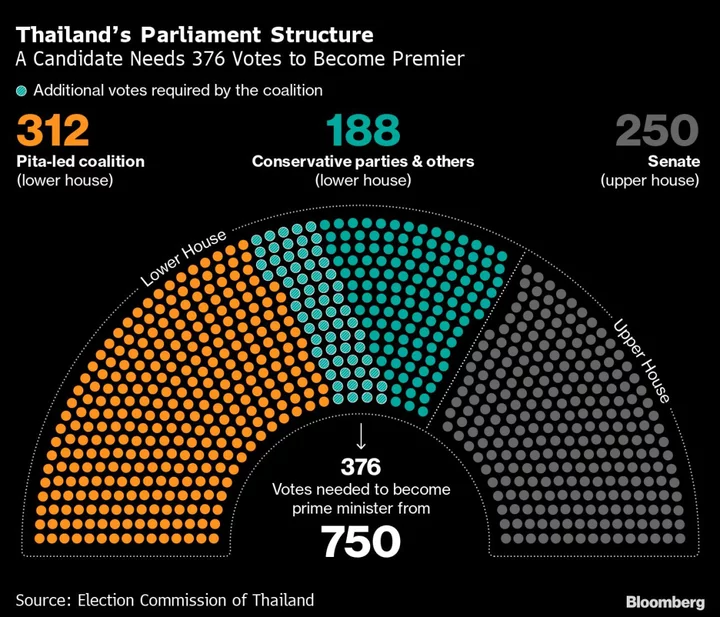

Thai Election Agency to Probe PM Frontrunner Pita: Bangkok Post

Thailand’s Election Commission will investigate if prime minister frontrunner Pita Limjaroenrat violated an election rule on candidacy after

2023-06-10 17:52

AstraZeneca advances UK clean heat and energy efficiencies with £100m commitment

CAMBRIDGE, United Kingdom--(BUSINESS WIRE)--Sep 14, 2023--

2023-09-14 14:20

Collapse of Ukraine grain deal to have medium-term impact

The collapse of the Black Sea export corridor, which allowed the export of more than 32 million tonnes of Ukrainian grain over the past year, should have little immediate impact but over the medium term...

2023-07-18 05:19

UN anti-drug agency warns there is no let-up in methamphetamine trade from Asia's Golden Triangle

The United Nations anti-drug agency is warning that the huge trade in illegal drugs such as methamphetamine from Southeast Asia's ‘Golden Triangle’ shows no signs of slowing down

2023-06-02 12:53

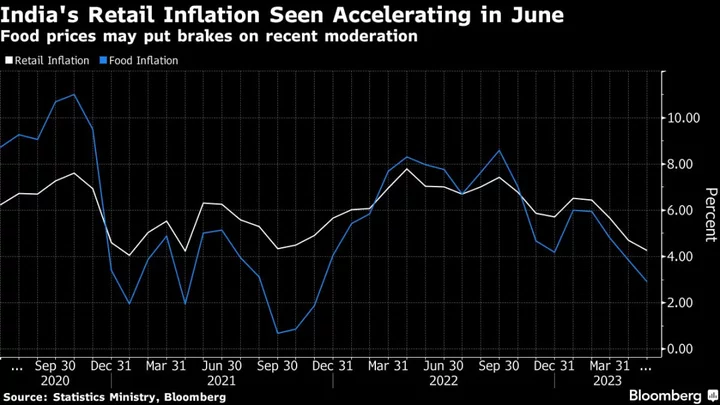

Surging Food Prices Seen Pushing Up India’s Inflation in June

Spiraling prices of tomato, onion and pulses are emerging as new risks for India’s retail inflation, reaffirming expectations

2023-07-12 06:27

Company that allegedly sent billions of robocalls sued by 49 attorneys general

On Tuesday, a bipartisan coalition of attorneys general from 48 states and the District of Columbia sued Avid Telecom, alleging that the company is responsible for billions of illegal spam calls posing as government agencies and large corporations.

2023-05-24 06:19

Citigroup discriminated against Armenian-Americans, federal regulator says; bank fined $25.9 million

Citigroup intentionally discriminated against Armenian Americans when they applied for credit cards, the Consumer Financial Protection Bureau said Wednesday

2023-11-08 22:53

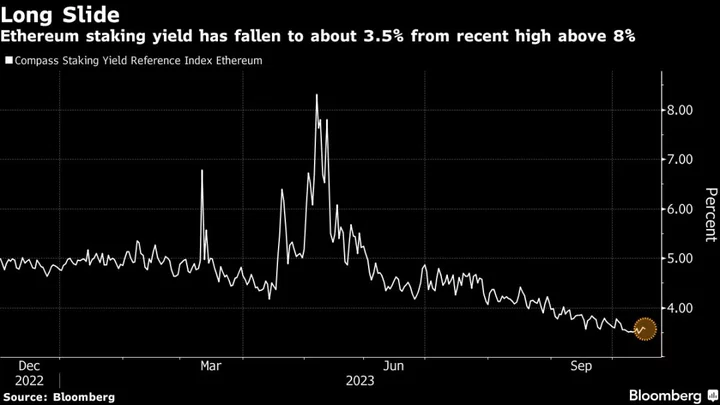

Bitcoin’s Rival Ether Falters in Shadow of Elevated Treasury Yields

A key pillar of demand for Ether, the second-largest digital token, is weakening against a backdrop of elevated

2023-10-20 14:21

Argentina ramps interest rate to 97% as inflation soars

Argentina's central bank hiked its base interest rate Monday by six points to 97 percent as the government prepares to announce a spate of measures to tackle soaring...

2023-05-16 08:24

HGreg takes home the 2023 Mercuriades Award, the most prestigious business competition in Quebec, Canada

MIAMI--(BUSINESS WIRE)--May 31, 2023--

2023-05-31 22:47

iPhone Maker Hon Hai’s Profit Beats in Sign of Resilient Demand

Key iPhone assembler Hon Hai Precision Industry Co. reported stronger-than-expected profit, suggesting demand for Apple Inc.’s signature devices

2023-11-14 14:55

You Might Like...

Exactech Publishes New Machine Learning Research That Evaluates Fairness and Accuracy of AI Predictions

Raimondo Seeks to Seize Moment With China Visit Focused on Business

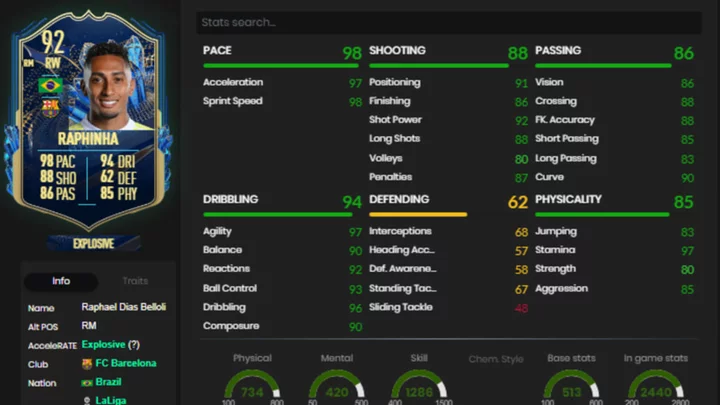

Raphinha FIFA 23: How to Complete the Team of the Season SBC

US government shutdown could add misery to air travel

Biden Hosts Uruguay’s Centrist President for Surprise Meeting

The largest health care strike in US history enters its second day

HydrogenPro Completed Electrolyser Delivery to World Leading Validation Center

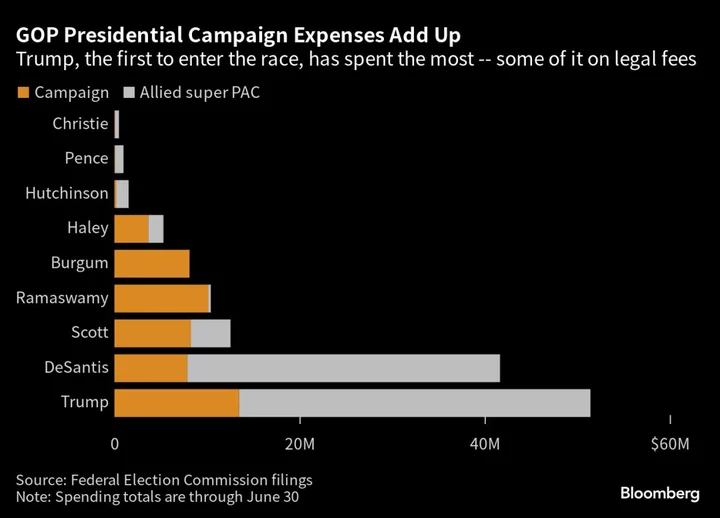

Nikki Haley and Mike Pence Rise in the Polls Without Spending Too Much