Voting fraud claims spread ahead of Spain's pivotal election

Claims of vote rigging and election fraud are spreading in Spain ahead of that nation's pivotal election on Sunday

2023-07-19 18:24

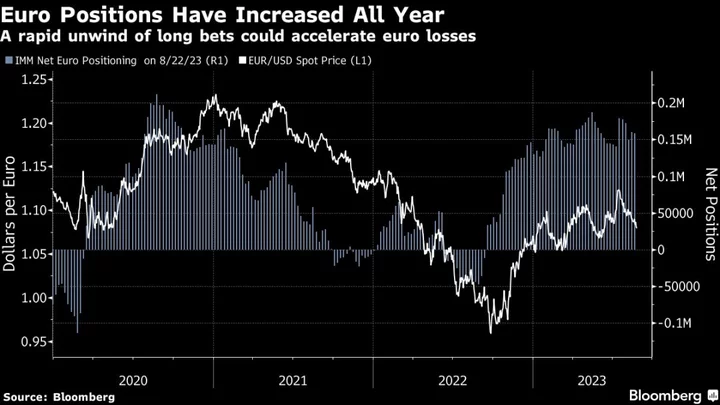

Traders Are Bailing on the Euro as Talk of Stagflation Heats Up

Traders are abandoning the euro at pace as speculation grows the European Central Bank will struggle to tighten

2023-08-31 16:52

Debt ceiling agreement gets thumbs up from biz groups, jeers from some on political right

The reviews are starting to come in as details emerge about the debt ceiling agreement reached by President Joe Biden and House Speaker Kevin McCarthy

2023-05-29 03:20

Veryon Expands Its Portfolio of Industry-Leading Solutions With Acquisition of Rusada

SAN FRANCISCO--(BUSINESS WIRE)--Oct 3, 2023--

2023-10-03 21:52

Artilysin® - A Groundbreaking "Green Pharma” Solution

TRIESENBERG, Liechtenstein--(BUSINESS WIRE)--Jun 23, 2023--

2023-06-23 15:28

Taiwan chip giant TSMC says Arizona plant making 'fast progress'

Taiwan chip giant TSMC's planned factory in the United States was making "fast progress", the company's chairman said Wednesday, despite it facing a delayed start due to worker...

2023-09-06 18:47

Tesla China extends delivery time for Model Y Long Range to 6-8 weeks

BEIJING Tesla China has extended delivery time for its Model Y Long Range to between six and eight

2023-09-04 13:29

Alibaba CEO and Chairman Zhang to step down to focus on cloud business

By Brenda Goh and Casey Hall SHANGHAI (Reuters) -Alibaba Group on Tuesday said its CEO and chairman Daniel Zhang will

2023-06-20 16:25

The State of Port Houston Is Awesome

HOUSTON--(BUSINESS WIRE)--Sep 11, 2023--

2023-09-12 07:15

Recalling a wild ride with a robotaxi named Peaches as regulators mull San Francisco expansion plan

An Associated Press reporter recalls the first time he took a ride in a car without sitting in the driver’s seat

2023-08-06 00:26

Weak yen gives Japan's automakers temporary relief from China pain

By Daniel Leussink TOKYO Japanese automakers are getting much-needed cover from an old standby, as the weaker yen

2023-08-14 07:21

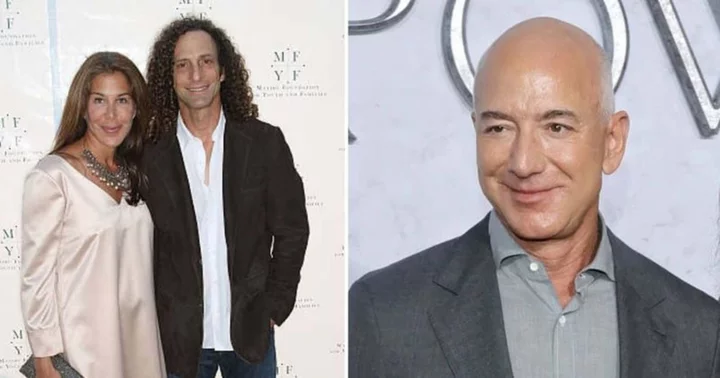

Lyndie Benson: Kenny G's ex-wife demands the sale of Malibu mansion rented by Jeff Bezos for $600K a month

Lyndie Benson also wants Kenny G to hand over any rental earnings generated by the Jeff Bezos deal

2023-06-23 06:15

You Might Like...

Oracle Expands Database to Ampere Chips, Dealing a Blow to Intel

Intel spends $33 billion in Germany in landmark expansion

Russia Readies Digital Ruble Pilot as War Squeezes Economy

George Santos' campaign paid $85,000 to the embattled New York Republican this year, filing shows

Higher food prices and more hunger: Collapse of Black Sea grain deal poses a massive threat

Russia Pledges to Reduce Oil Exports in August After Saudi Extends Voluntary Cut

Qantas secures new planes from Airbus and Boeing in multi-billion dollar order

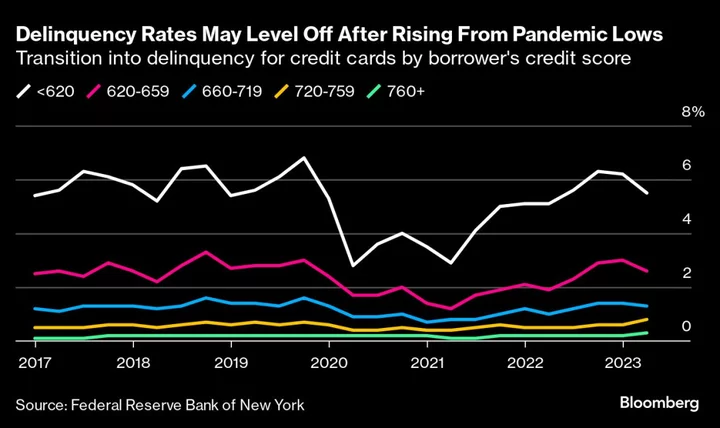

Fed to Weigh How Much Fuel Consumers Have Left After Rate Hikes