James Taylor Will Hold Concert for Biden in Fundraising Push

Six-time Grammy Award winner James Taylor is hosting a concert for President Joe Biden on Dec. 5 in

2023-11-29 03:17

Court tosses $223.8 million verdict against J&J in talc cancer case

By Brendan Pierson (Reuters) -A New Jersey appeals court on Tuesday threw out a $223.8 million verdict against Johnson &

2023-10-04 00:59

Australia Mulls Adding Superannuation Payments to Parental Leave

Australia’s government has revived plans to add superannuation to paid parental leave payments and increase housing affordability through

2023-07-22 14:55

SUPIMA Design Competition Names Carla Pierini Its 2023 Winner

NEW YORK--(BUSINESS WIRE)--Sep 8, 2023--

2023-09-09 01:29

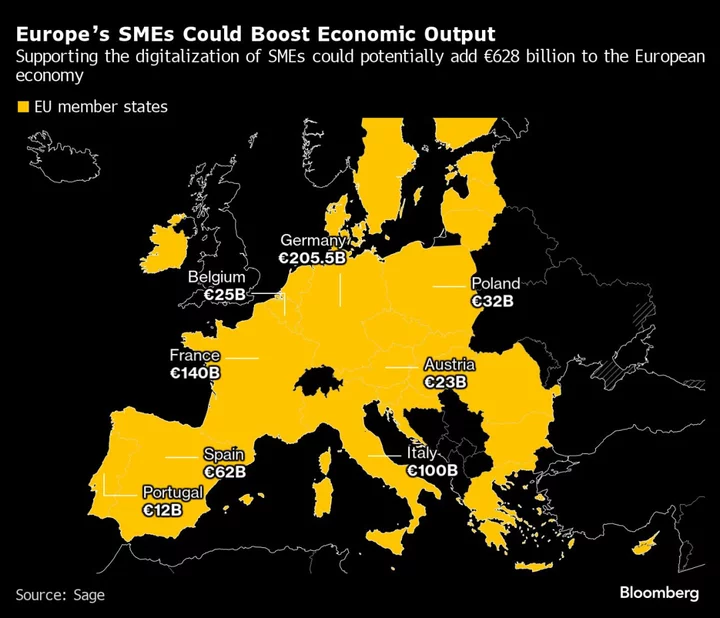

Untapped Tech Adoption Could Boost EU Economy by €628 Billion

The European Union could reap €628 billion ($681 billion) a year by bringing digitally lagging businesses up to

2023-11-17 13:27

Volkswagen puts off east European gigafactory amid sluggish EV demand

PRAGUE (Reuters) -German car group Volkswagen will not make a decision on a fourth battery factory site for now, with

2023-11-01 22:21

Teck Resources misses quarterly profit estimates

Canadian miner Teck Resources missed market estimates for third-quarter profit on Tuesday, hurt by lower steelmaking coal sales

2023-10-24 13:51

Japan regulator exploring ways to bolster leveraged buyout financing

By Makiko Yamazaki and Ritsuko Shimizu TOKYO Japan's financial regulator is exploring ways to bolster financing for leveraged

2023-06-07 16:24

Column-Leveraged funds' record short Treasuries bets surge again: McGeever

By Jamie McGeever ORLANDO, Florida Leveraged funds trading U.S. Treasuries futures have increased their record net short position

2023-10-23 10:46

Vince McMahon subpoenaed in sexual misconduct investigation

Federal law enforcement agents executed a search warrant and subpoenaed World Wrestling Entertainment executive chairman Vince McMahon last month as part of an investigation into claims of sexual misconduct, the company announced this week.

2023-08-03 20:59

Top ESG Funds in Asia Boost Returns In Once Unloved Market

Asia’s top ESG funds are reaping the rewards of investing in Japan, a market largely ignored even by

2023-05-31 15:57

Equities in retreat as Powell warns rate hikes still on table

Asian stocks sank Friday and the dollar held gains after Federal Reserve boss Jerome Powell warned he "will not hesitate" to hike interest rates further in his...

2023-11-10 10:50

You Might Like...

Drug used in diabetes treatment Mounjaro helped dieters shed 60 pounds, study finds

Dubai International Chamber’s New Horizons Initiative Successfully Connects UAE and Uzbek Renewable Energy Companies

Macy’s Falls After Cutting Outlook as Demand Trends Worsen

Apple expected to unveil next generation of iPhones as company tries to reverse a recent sales slump

UAW will try to organize workers at all US nonunion factories after winning new contracts in Detroit

Elizabeth Holmes Objects to $250-a-Month Victim Payments After Prison

US retail sales bounce with online spending boost

RBA's Lowe says it remains to be seen if more tightening needed