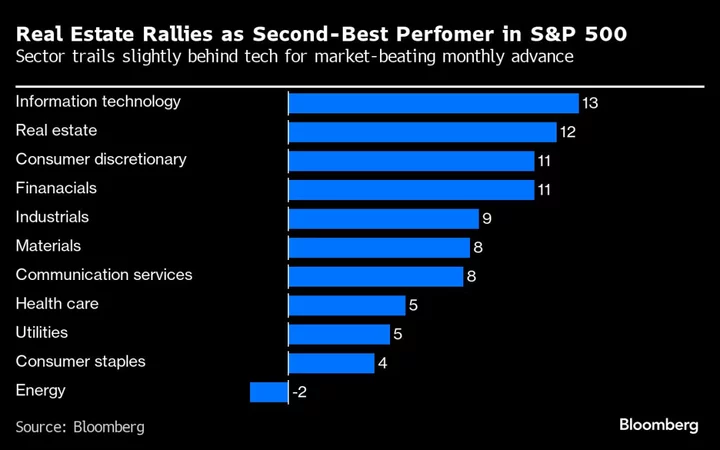

China’s struggling real estate industry is expected to see an L-shaped recovery in the coming years, placing a drag on the world’s second-largest economy, according to a research note by Goldman Sachs Group Inc.

The US investment bank said policy makers appear determined not to use the property sector as a short-term stimulus tool and instead want to reduce the economy’s reliance on the industry, according to a research note on Sunday.

The country is expected to see a multi-year slowdown due to “falling demographic demand, a shift in policy focus to support strategically important sectors, and weaker housing affordability,” Goldman analysts led by Wang Lisheng said.

Read More: China Mulls New Property Support Package to Boost Economy (2)

China’s property sector has avoided a collapse following three years of Covid restrictions, but signs of renewed weakness have emerged in the residential market. The rebound in home sales slowed in May to just 6.7% from more than 29% in the previous two months.

Citigroup Inc. also downgraded earnings estimates and price targets on some Chinese property stocks, citing challenging market and liquidity conditions.

China is working on a new basket of measures to support the property market after existing policies failed to sustain a recovery in the sector, people familiar said in early June.

Goldman analysts said they expect credit easing for new homebuyers and upgraders, additional mortgage rate reduction and down-payment ratios, and further relaxation in home purchase restrictions.

However, they don’t see the government trying to “engineer an up-cycle,” and don’t expect “a repeat of the 2015-18 cash-backed shantytown renovation program.”

It suggests “a likely end-game for the property sector policy,” which is to reduce the country’s economic and fiscal reliance on the sector, step up public housing and gradually expanding property taxes to more pilot cities over the long-term, it added.