Strategists at Goldman Sachs Group Inc. have revised their forecasts to reflect a weaker shekel on renewed concerns that Prime Minister Benjamin Netanyahu’s judicial plan will increase pressure on the currency and the central bank won’t intervene to support it.

Comments by central bank Deputy Governor Andrew Abir last week that interest rates need to be the main tightening tool have downplayed the “potential for FX interventions,” the strategists said in a report on Friday. The shekel slumped 2.3% last week after parliament passed a new national budget, which granted more funding to the nation’s ultra-Orthodox in order to secure the bloc’s loyalty to his right-wing coalition.

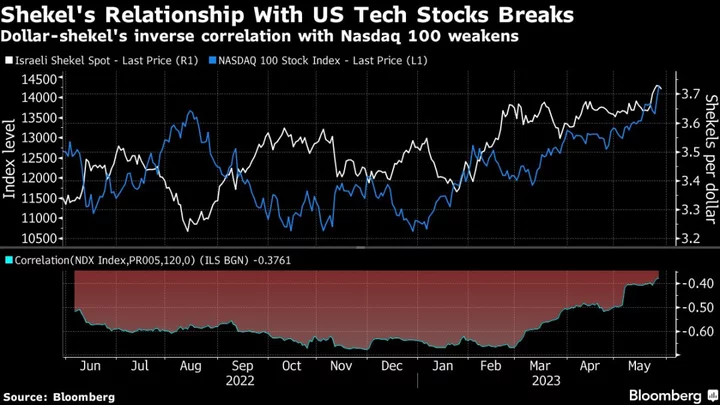

Goldman revised its forecasts of the shekel to 3.70 and 3.60 against the dollar in the next three and 12 months, respectively, compared with 3.50 and 3.40 previously. While that’s still stronger than the current level, the strategists said they expect volatility around their estimates to “remain elevated.” The shekel rose 0.3% to 3.7178 as of 2:50 p.m. in Jerusalem on Monday.

“With limited policy support, we think domestic political developments will remain in the driver’s seat for the shekel,” Goldman’s strategists, including Kamakshya Trivedi, said in the report.

The shekel’s correlation with the performance of global technology stocks began to break down in January amid massive protests against Netanyahu’s plans to give politicians more control over the judiciary and its appointments. His decision in late March to delay the plan had provided some reprieve for the currency, until last week.

The shekel trades at a more than 10% discount to Goldman’s estimated fair value of around 3.3 per dollar, the strategists said.

In April, Moody’s Investors Service lowered the outlook on the nation’s A1 rating to stable from positive, citing a “deterioration of Israel’s governance.”

“If market participants and tech investors continue to grow more concerned about domestic political developments and their impact on institutional quality, then risk premium may build further in the currency,” the strategists at Goldman said.