RESTON, Va.--(BUSINESS WIRE)--May 23, 2023--

The global COVID-19 pandemic has accelerated the trend of working remotely, which also inspired people worldwide to search for new destinations to work and travel. Being citizens of a wide range of countries, worker travelers become customers of financial institutions at their current locations. This means banks, FinTech businesses, crypto brokers, and insurance companies have to be able to meet the needs of the booming digital nomad community while also maintaining robust fraud prevention measures.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230523005127/en/

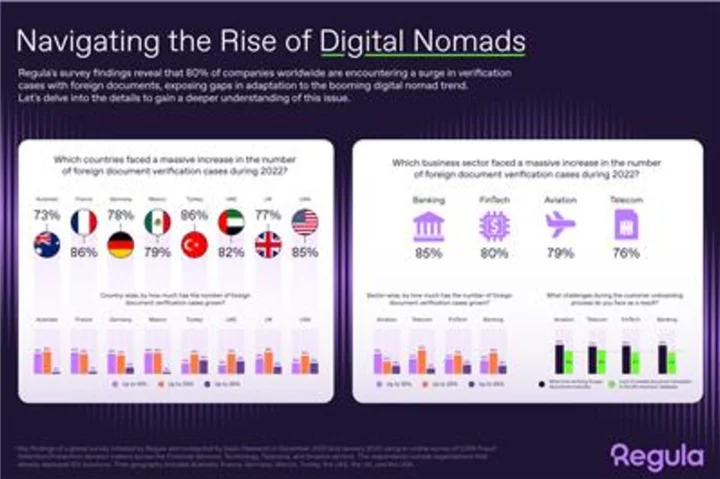

Navigating the Rise of Digital Nomads. Regula's survey findings reveal: 80% of companies worldwide encounter surge in verification cases with foreign documents, exposing gaps in adaptation to the booming digital nomad trend. (Graphic: Business Wire)

The survey* conducted by Regula shed light on the readiness of Banking and FinTech businesses to address new challenges. It appears that Financial Services companies are grappling with a surge in foreign document verification cases, with 80% of them reporting an increase, particularly in countries like France (86%), Turkey (86%), and the USA (85%)—the country most visited by digital nomads as of March 2023. Alarmingly, almost half of these organizations (44%) are facing a staggering 25% rise in volume over the last year. Furthermore, 62% of these businesses have been forced to verify foreign documents manually, which is a time-consuming process.

With 38% and 31% of respondents from FinTech and Banking, respectively, citing accuracy as the most important consideration in choosing identity verification solutions, the increased number of manual checks should be a red flag for the industry.

Business representatives also note the problem of incomplete databases of document templates. As a reference, 48% of companies say they face challenges during the customer onboarding process because they don’t have all the needed document templates at hand.

“The expansion of the global migration and digital nomad community in particular has highlighted the need for businesses to work with extended databases with a wide range of document templates, including rare specimens. Failure to do so may increase the risk of fraud since the lack of templates may lead to less accurate and thorough document verification checks. That is why we consistently update our database, which has now reached over 12,000 document templates from 247 countries and territories, to boost the capabilities of Regula Document Reader SDK. Since Regula experts have extensive knowledge of what security elements should look like, based on present documents, all possible IDs can be easily verified, and even the most sophisticated fraud can be promptly detected with our products,” says Henry Patishman, Executive Vice President of Identity Verification Solutions at Regula.

With the current growth of digital nomads, implementing the right identity verification solution can have a significant impact on productivity and efficiency. To respond to new challenges, financial institutions should take into account the following criteria while choosing the most suitable tool(s):

- The size and diversity of the document template database provided by the solution: A tool which features a database with detailed information on all present documents issued in different countries, their security parameters, and verification methods, can perform fast and comprehensive ID checks.

- The availability of liveness checks in the document verification flow: The solution must encompass both document verification and biometric verification to provide strong protection against fraud, verifying both the document and the liveness of the individual. While document liveness confirms the presence of dynamic security elements (such as holograms) in the submitted document, and ensures that the passport or ID presented remotely is real, biometric liveness detects if a live person is applying, not a spoof or a fake.

- Face comparison and matching of a selfie to the photo in an ID document: To mitigate identity fraud online, the solution should compare an image of the user’s identity document and the portrait from the identity document, e.g., from the chip or MRZ.

Read the full report, which analyzes the state of identity verification in 2023, here.

*The research was initiated by Regula and conducted by Sapio Research in December 2022 and January 2023 using an online survey of 1,069 Fraud Detection/Prevention decision makers across the Financial Services (including Banking and FinTech), Technology, Telecoms, and Aviation sectors. The respondent geography included Australia, France, Germany, Mexico, Turkey, the UAE, the UK, and the USA.

About Regula

With our 30+ years of experience in forensic research and the largest library of document templates in the world, we create breakthrough technologies in document and biometric verification. Our hardware and software solutions allow over 1,000 organizations and 80 border control authorities globally to provide top-notch client service without compromising safety, security or speed.

Regula was named a Representative Vendor in the Gartner® Market Guide for Identity Proofing and Affirmation in 2022. Learn more at regulaforensics.com.

View source version on businesswire.com:https://www.businesswire.com/news/home/20230523005127/en/

CONTACT: Kristina

ks@regulaforensics.com

KEYWORD: UNITED STATES NORTH AMERICA VIRGINIA

INDUSTRY KEYWORD: TECHNOLOGY HUMAN RESOURCES FINANCE SECURITY MARKETING COMMUNICATIONS PROFESSIONAL SERVICES SOFTWARE INTERNET DATA MANAGEMENT

SOURCE: Regula

Copyright Business Wire 2023.

PUB: 05/23/2023 03:00 AM/DISC: 05/23/2023 03:01 AM

http://www.businesswire.com/news/home/20230523005127/en