(Bloomberg Markets) -- One afternoon in May, an oil tanker called the Pablo made its way through the South China Sea. Owned by an obscure company in the Marshall Islands, it was 26 years old, ancient by industry standards, and according to global databases, it carried no insurance—telltale signs that it was part of what’s become known as the “dark fleet.”

Ever since Russia invaded Ukraine, President Vladimir Putin’s regime has relied on hundreds of decrepit, hard-to-trace ships like this one to evade US and European Union restrictions designed to keep it from profiting from the world’s oil markets.

The journey of the Pablo, which had previously carried Iranian crude, might have passed unremarked, except for one thing: An explosion tore through its upper deck that day, leaving the ship little more than a smoldering hulk. Three crew members are still missing. The Pablo had just returned from China, according to ship-tracking data, and, fortunately for most of the crew, its oil tanks were empty.

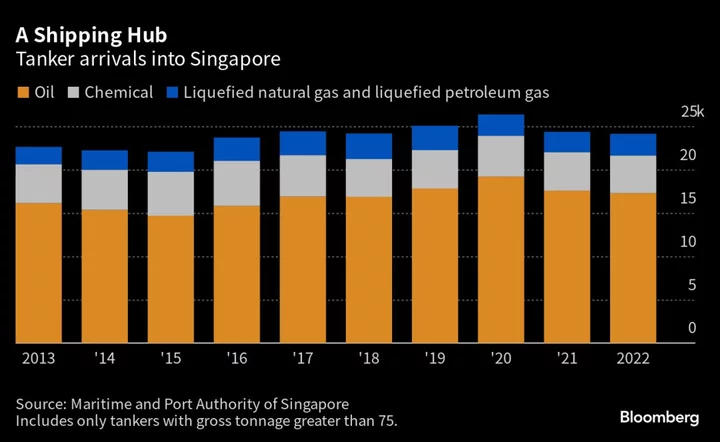

As is so often the case, the Pablo appeared headed through the crowded sea lanes near Singapore. Each day, hundreds of cargo and container ships line up at the country’s deep-water port, one of the busiest in the world. The Southeast Asian city-state, whose population of 5.9 million is smaller than New York City’s, handles hundreds of millions of barrels of crude oil and fuel shipments each year.

The Pablo and the rest of the dark fleet represent the delicate position of Singapore. The country has long thrived because it prioritizes open commerce—a “free port” dating to its founding as a British colony—and can work with opposing superpowers. Ever since winning independence in 1965, Singapore has managed to negotiate any conflicts, like a captain steering a ship through the narrow strait that runs by the island, connecting China to India, the Middle East and the West.

But what happens when China, its largest trading partner, wants more Russian oil while the US, its biggest foreign investor, wants to restrict revenue going to Moscow? It seems like an irreconcilable conflict, but not for Singapore, which has found a way—so far—to remain in the good graces of both. How? By imposing its own sanctions on Russia’s banks and military goods while letting the local oil industry figure out how to comply with Western restrictions.

Singapore is sometimes described as trying to hew to a “middle” approach in politics and business. It’s the only way a country with few natural resources and a small local consumer market could have risen from poverty to having one of the highest living standards in the world.

“The whole point of Singapore being in the middle is to find and use that middle space,” says Chong Ja Ian, a political science professor at the National University of Singapore. “You want to show you go with the rules, but you also keep it largely symbolic, with a lot of wriggle room.”

That balancing act manifests itself in Singapore’s sights and sounds: English and Mandarin are two of the island’s four official languages, the American and Chinese embassies sit next to each other near the main shopping district, and US and Chinese banks fill skyscrapers downtown.

Its defense strategy is the same. American warships regularly dock at Singapore’s Changi Naval Base, US naval officers work out of a facility on the island’s northern tip, and the city-state is a big buyer of US weaponry, including its stealthy F-35 jets. Singaporean troops even train in the US. Still, China’s navy also has access to Singapore’s ports, and the two countries conduct joint training drills as well.

Satisfying all sides in energy may be especially tricky because of the vast scale and diversity of countries involved in Singapore’s trading operations. The city-state handles far more than physical oil; it’s considered a critical energy hub because so many deals and trades are made on the island. Oil doesn’t even have to pass through Singapore: Traders based there can negotiate to buy Colombian crude for a Chinese refinery on a ship that never travels through Southeast Asian waters.

Some of the world’s biggest commodities traders, such as Glencore Plc and Trafigura Group Pte Ltd., have operations in Singapore. (Trafigura has one of its headquarters there.) So do dozens of other trading outfits, including two major Chinese companies: China Petroleum & Chemical Corp., known as Sinopec, and PetroChina Co., which are conduits for meeting Beijing’s energy demands.

Because of geopolitical sensitivities, few in the petroleum industry or Singapore’s government will talk publicly about how the country can balance US and Chinese priorities. But interviews with more than a dozen traders, company officials and oil experts show the private sector’s various strategies for letting the suspect oil flow—and trade—freely.

Amid the gleaming office towers of the Suntec City business district, home to China’s commodities trading industry in Singapore, the mood in company offices was somber. Cafes and restaurants favored by Chinese crude traders fell silent.

Singapore had lured them to the island more than a decade before under its Global Trader Programme, which offered a corporate tax rate of as little as 5% on trading income for several years. The traders would help secure crude for China’s private refiners, once rickety startups nicknamed “teapots” but now multibillion-dollar enterprises with big ambitions. By situating in Singapore, they could also rack up US dollar profits outside of China.

It was March 2022, the month after Russia invaded Ukraine, and Singapore had announced unilateral military and financial sanctions on Russia. The US was pleased, but some Singapore business leaders worried about being seen as taking sides. It was the first time in at least four decades that the country had imposed such measures, according to Bilahari Kausikan, who once served as one of Singapore’s most senior diplomats. (It last did so after Vietnam’s invasion of Cambodia in the late 1970s.)

The country’s explanation for the move was straightforward: “For a small state like Singapore, this is not a theoretical principle but a dangerous precedent,” the foreign ministry said. “This is why Singapore has strongly condemned Russia’s unprovoked attack on Ukraine.”

At the time, many international companies had stopped doing business with Russia, and the energy market was rattled. “Volatility was off the charts,” says John Driscoll, director of JTD Energy Services Pte Ltd. in Singapore. “Russia was being taken out of the equation—one of the top producers, a major crude exporter—so the initial response was that markets froze.”

The blow was severe. China’s energy needs were enormous, and like India, it saw the benefit of buying discounted Russian crude. Unsure if they could handle the Russian oil that Beijing wanted, Singapore-based traders for Chinese companies began to look to rival hubs Hong Kong and Dubai, which were placing fewer restrictions on business with Russia.

But within weeks, the US and EU began talks to create a price cap, a move meant to deprive Putin’s government of revenue from higher crude prices while still letting the oil flow in global markets. Oil sold above the $60-per-barrel cap would be blocked from access to critical Western-provided services such as shipping insurance, making it essentially untouchable in some parts of the world. Early on, however, it was clear that many nations, including China and India, wouldn’t join in that effort.

Companies would be left to themselves when it came to complying with the restriction, which took effect in December 2022. And they quickly found ways of benefiting from Russia’s reliance on the dark fleet, which grew enormously, as well as through practices that have long been a part of the oil shipping industry.

Singapore-based traders found they could move some transactions to jurisdictions that still welcomed Russian business, passing on deals to subsidiaries in Beijing, Hong Kong or Dubai. Some traders set up corporate intermediaries that helped shield the origin of the oil or the firms involved, all while operating in Singapore. About a dozen Singapore-based oil traders say it was common for such trades, including with Russia and Iran, to be discussed, negotiated and brokered from Singapore, with the financing, finalization of deals and paperwork carried out elsewhere.

In other corners of the oil industry, merchants would turn to age-old shipping and logistical workarounds to mitigate the risks of handling sensitive oil. At some storage tanks in Singapore, and elsewhere, traders would discharge Russian oil into large onshore facilities where it got mixed with petroleum from other countries. At that point, it’s difficult to determine the origin of any single barrel.

Another approach involves ship-to-ship transfers of oil just outside Singapore’s waters in the Malacca Strait. The process, which can be legal, helps create “clean documents” for sensitive or suspect cargoes, making them more palatable to many traders, including some in Singapore. Some traders say they were unwilling to have their Singapore-registered companies touch those barrels because of the chance of legal liability.

The reliance on the dark fleet also raises the risk of another Pablo-style incident, which could have been an environmental disaster with a far higher human toll. Malaysian officials said in September that salvage operations were set to begin on the Pablo, which was still stranded nearly 40 nautical miles off the country’s east coast. Still, there are always other traders willing to risk being associated with a tanker disaster, as well the legal exposure that citizens of the US and its allies could face for failing to honor the price cap.

On the high seas or in a foreign port, the US doesn’t have any jurisdiction over a ship carrying Russian oil sold in violation of the cap. The US has seized ships carrying Iranian oil, but that crude is under international sanctions. The Maritime and Port Authority of Singapore directed to the Ministry of Trade and Industry any questions about the country’s sanctions enforcement and the storage of Russian crude. The trade ministry referred to February and March statements: “Companies and financial institutions in Singapore have been informed of the ban imposed by the EU and other countries,” Minister of Trade and Industry Low Yen Ling said in February. “This is so that they are aware of such measures and can consider and manage any potential impact on their business activities, transactions and customer relationships accordingly.”

A month later, a statement suggested companies should check the US Treasury Department website for information about the price cap policy. That website says the government could take enforcement action against US individuals trading in oil sold in violation of the price cap, and it urges record-keeping to show compliance. Citizens of the many other Western countries imposing the cap could face similar peril. “It is up to each individual company to decide the level of risk they are willing to take,” says Prakaash Silvam, a partner and head of the shipping department at Singapore law firm Oon & Bazul.

Another risk remains. As the Pablo explosion illustrated, the dark ships hauling Russian crude to China pose a potentially grave safety threat. Although the fire’s cause isn’t known, the dilapidated vessels are operating well beyond their intended life spans and tend to have poor safety practices, such as turning off their tracking beacon when in suspect waters to avoid detection. At a news conference, its captain said crew members jumped into the ocean. In response, Singapore has stepped up detentions of oil and chemical tankers. It has held 35 ships for failing safety inspections so far this year, more than it did in the entire decade through 2019, according to figures from Tokyo MOU, a regional port control organization.

Those actions represent one of the few public responses to the dark fleet and the private sector’s handling of the restriction on Russian oil. Another one was more subtle. Soon after the US and EU talks on price caps got underway, and workarounds became commonplace, some familiar figures from the Suntec City trading crowd started to reappear in local restaurants. They dug into plates of steamed leek dumplings washed down with Tsingtao beer. The Chinese traders were back in business. —With Anuradha Raghu, Alfred Cang, and Clara Ferreira Marques

Cheong leads Bloomberg’s coverage of Asian oil trading from Singapore.