The European Union is looking at an array of tools to ensure it punches at its global weight, as countries such as China and Russia show an increasing willingness to use trade and the control of critical supply lines to further political and military goals.

The European Commission, the EU’s executive arm, will unveil on June 20 its economic security strategy, which will outline business and security risks to the bloc, policy measures it has at its disposal to combat those risks, as well as options for new protective measures to ensure it can ward off attempts at economic coercion by its rivals.

The EU was slow to fully realize how dependent it was on Russia, and when the Kremlin invaded Ukraine a year ago, Europe suffered record inflation and stared down an economic catastrophe as it tried to find new supplies of oil and gas that it previously sourced cheaply from Russia. But member states are torn over how to act, with some reluctant to start a trade war with China, which is a major commercial partner with several EU countries.

“I’m not so positive on what we’ve been doing,” Alicia Garcia Herrero, chief economist for Asia Pacific at Natixis SA, said in an interview. “While Japan and the US have been more forceful, we need to centralize more competences to be more effective, and I don’t think the member states are in any mood to do that.”

Here are five tools the EU has implemented or is eying to ensure its economic security:

Anti-Coercion Instrument

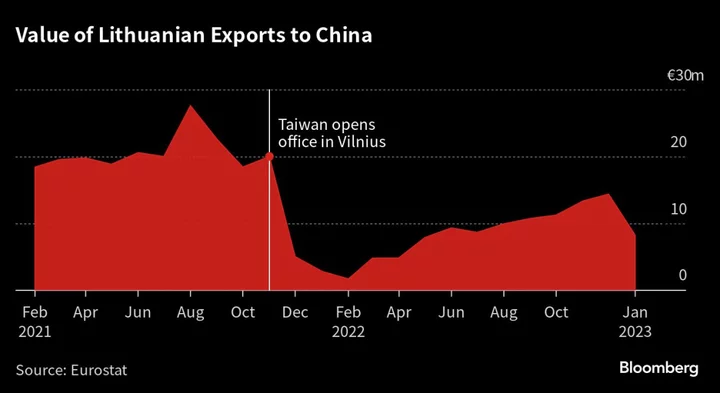

This year, European member states agreed to a new set of trade powers that will allow the bloc to strike back at third countries that use economic restrictions for political retribution. The EU’s new anti-coercion instrument beefs up EU trade defenses and enables the commission to impose tariffs or other punitive trade measures in response to incidents of politically motivated foreign trade restrictions. The tool gained prominence after China penalized Lithuania for opening a de-facto Taiwan mission in its capital, Vilnius. Lithuanian exports to China fell by 75% last year after China downgraded diplomatic ties and restricted Lithuanian trade.

The US has been pressuring the EU to harden its stance toward China as part of Washington’s plan for a global alliance to counter Beijing’s economic heft. And in recent months, European Commission President Ursula von der Leyen has struck a more assertive stance, arguing that the bloc needs to “de-risk” from China without a full-blown “decoupling.”

But this shift in the EU’s executive arm has worried some corporations and particularly countries that have deep trade ties with China. German automakers Volkswagen AG, Mercedes-Benz AG and Bayerische Motoren Werke AG have built dozens of factories in China and all three manufacturers now sell more vehicles in China than any other market.

Outbound Investment Screening

The commission is mulling new curbs on outbound investments for strategic rivals like China in sensitive sectors like semiconductors that could enable Beijing to build a world-class chip industry. This year, ASML Holding NV, a Dutch producer of advanced semiconductor manufacturing equipment, accused a former China-based employee of helping steal confidential technological information.

Biden administration officials have urged Europe to align their efforts to prevent China from acquiring sensitive capabilities with national security implications. Earlier this year, the Dutch announced export restrictions of semiconductor technology to China to prevent the shipment of lithography machines.

Inbound Investment Screening

Next month, the EU’s foreign subsidies regulation will enter into force and provide the commission with new powers to prevent subsidized foreign competitors from distorting competition in the internal market. The tool imposes reporting and notification obligations for all businesses involved in large public tenders or merger and acquisition deals in the EU. The commission is also reviewing its two-year-old foreign investment screening rules, which govern the ability of foreign companies to make investments in the 27-member trading bloc.

EU’s Port Strategy

Later this year, the European Parliament will consider new limits on foreign companies that want to invest in European critical infrastructure. Chinese companies already have stakes in ports of at least 10 member states, which potentially provides Beijing with access to sensitive information on the flow of European goods. The measure comes as Germany reconsiders its contentious decision to allow Chinese state-owned conglomerate Cosco Shipping Holdings Co. to buy a 24.9% stake in one of Hamburg’s port terminals.

Trade Agreement Push

European policymakers are leveraging the economic sway of its $8.6 trillion consumer sector to negotiate trade deals that expand the EU’s influence in key foreign markets. The EU is in the process of concluding trade deals with Chile and Australia, which will facilitate EU access to lithium, a critical material for electric vehicle batteries. The commission is also negotiating a deal with the Mercosur trade bloc, which includes some of the largest and resource-rich nations in Latin America: Argentina, Brazil, Uruguay and Paraguay. Finally, the EU is rolling out its Gateway initiative — a €300 billion ($328 billion) investment strategy that aims to compete with China’s Belt and Road program for economic influence in Latin America, Central Asia and Africa.

“We have seen a very deliberate hardening of China’s overall strategic posture for some time and it has now been matched by a ratcheting up of increasingly assertive actions,” von der Leyen said in a policy speech earlier this year. “Just as China has been ramping up its military posture, it has also ramped up its policies of disinformation and economic and trade coercion.”