LONDON--(BUSINESS WIRE)--Nov 27, 2023--

The FICO UK Credit Card Market Report for September 2023 reveals a more stable picture of credit card spending and balances, with changes remaining relatively small month-on-month.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20231127340795/en/

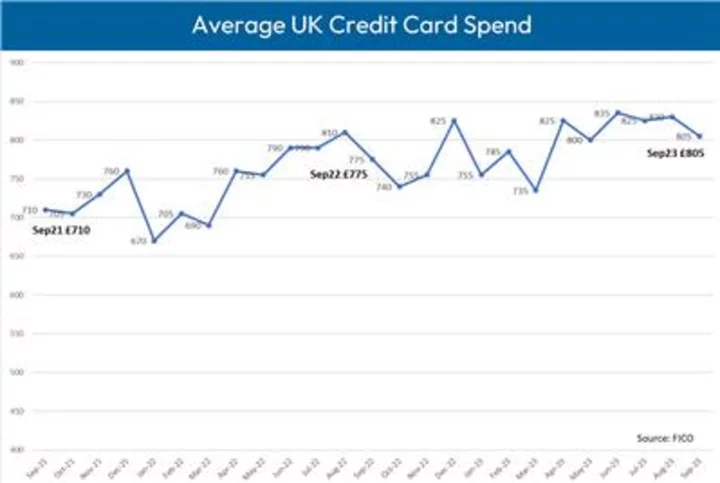

FICO reports that average UK credit card spend fell slightly during September, ending at £805, down 2.9% on August 2023 but up 4.1% on the previous year (Graphic: FICO)

Highlights

- Average UK credit card spend fell slightly during September, ending at £805, down 2.9% on August 2023 but up 4.1% on the previous year

- The average credit card balance remained relatively stable compared to August, at £1,735, but continued the longer-term upward trend with a year-on-year increase of 8.6%

- After peaking at 42% in May 2022, the percentage of payments to balance has been on a downward trend and currently stands at 38% — this follows up-and-down movements since a two-year low in April 2023

- Year on year, the percentage of customers missing one, two and three payments has continued to rise, with those missing two payments 9.3% higher than in 2022 and those missing three payments 17.8%

- Cash use has also continued the upward trend since March 2023 — in September there was a 1.6% month-on-month increase and a 4.3% increase year-on-year

FICO Comment

Following a yo-yo summer of consumer spending and credit card management, September 2023 saw the average spend on credit cards fall slightly, albeit it remains higher than the previous year. With the festive season approaching and advertisers ramping up their spending push, it’s likely spending will rise in November and December, although the question will be how much, given the other well-documented financial pressures consumers are facing.

Driven by the increase in spending, there has been a slight monthly increase in average credit card balances. There has also been an increase in the number of customers missing payments, illustrating that the ongoing economic volatility continues to impact consumer spending. Inflationary pressures and a weak economic outlook mean average balances are likely to continue an upward trend, remaining higher than last year for some months to come.

The month-on-month picture for missed credit card payments is still volatile. There was a decrease in missed payments in August, but September brought a 13.5% increase in accounts missing one payment. The number of accounts missing two payments remained relatively stable in September, continuing a new flat trend we have seen since July 2023, following steady increases from May 2022.

For those customers missing two payments, the average balance has marginally decreased by 0.6% month-on-month at £2,605, but this has been trending upwards over the last few months.

The continuing economic turbulence, high cost of goods and energy bills as well as the approaching festive season are set to sustain pressure on consumer finances. The steady increase in customers using their credit cards to withdraw cash that we have witnessed since March this year continued in September, with a month-on-month increase of 1.6% and an annual increase of 4.3%. This trend is another signal of financial struggle and should act as an important warning sign to lenders.

Key Trend Indicators – UK Cards September 2023

Metric | Amount | Month-on-Month | Year-on-Year |

Average UK Credit Card Spend | £805 | -2.9% | +4.1% |

Average Card Balance | £1,735 | +0.2% | +8.6% |

Percentage of Payments to Balance | 38.01% | -1.8% | -6.9% |

Accounts with One Missed Payment | 1.67% | +13.5% | +9.3% |

Accounts with Two Missed Payments | 0.31% | -0.4% | +10.7% |

Accounts with Three Missed Payments | 0.20% | +1.6% | +17.8% |

Average Credit Limit | £5,600 | +0.1% | 2% |

Average Overlimit Spend | £90 | 0% | -4.3% |

Cash Sales / Total Sales | 0.98% | +2.7% | -5.8% |

Source: FICO |

These card performance figures are part of the data shared with subscribers of the FICO® Benchmark Reporting Service. The data sample comes from client reports generated by the FICO ® TRIAD ® Customer Manager solution in use by some 80% of UK card issuers. For more information on these trends, contact FICO.

About FICO

FICO (NYSE: FICO) powers decisions that help people and businesses around the world prosper. Founded in 1956, the company is a pioneer in the use of predictive analytics and data science to improve operational decisions. FICO holds more than 215 US and foreign patents on technologies that increase profitability, customer satisfaction and growth for businesses in financial services, insurance, telecommunications, health care, retail and many other industries. Using FICO solutions, businesses in more than 100 countries do everything from protecting 2.6 billion payment cards from fraud, to improving financial inclusion, to increasing supply chain resiliency. The FICO® Score, used by 90% of top US lenders, is the standard measure of consumer credit risk in the US and other countries, improving risk management, credit access and transparency. Learn more at www.fico.com.

FICO and TRIAD are registered trademarks of Fair Isaac Corporation in the U.S. and other countries.

View source version on businesswire.com:https://www.businesswire.com/news/home/20231127340795/en/

CONTACT: For further comment on the FICO UK Credit Card activity contact:

FICO UK PR Team

Wendy Harrison/Parm Heer

ficoteam@harrisonsadler.com

0208 977 9132

KEYWORD: EUROPE IRELAND UNITED KINGDOM

INDUSTRY KEYWORD: BANKING PERSONAL FINANCE PROFESSIONAL SERVICES FINANCE

SOURCE: FICO

Copyright Business Wire 2023.

PUB: 11/27/2023 04:00 AM/DISC: 11/27/2023 04:00 AM

http://www.businesswire.com/news/home/20231127340795/en