Federal Reserve Governor Christopher Waller said it’s not clear that recent banking strains will lead to significantly tighter lending conditions in the US, adding that officials should not allow worries about a few lenders to interfere with their inflation fight.

“Let me state unequivocally: The Fed’s job is to use monetary policy to achieve its dual mandate, and right now that means raising rates to fight inflation,” Waller said Friday. “I do not support altering the stance of monetary policy over worries of ineffectual management at a few banks,” rebutting the argument by some critics that the Fed should take into consideration the losses on banks’ balance sheets spurred in part by higher rates.

Waller commented in remarks at an event in Oslo organized by the Norges Bank and the International Monetary Fund.

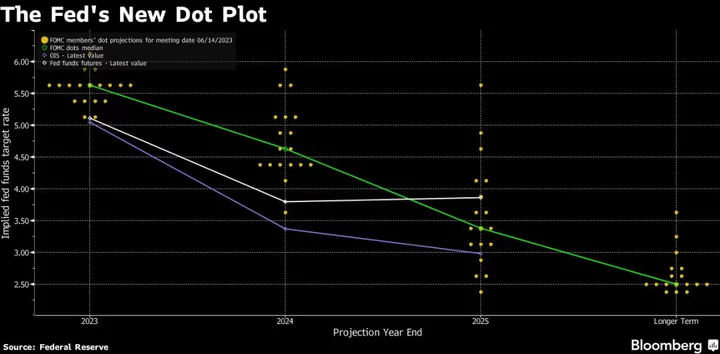

Fed officials paused their interest-rate hikes this week after 10 straight increases to allow more time to evaluate how the economy is being affected by higher rates and recent banking strains. Policymakers also signaled borrowing costs will need to go higher than previously expected to tame persistently high inflation.

Data out this week showed headline inflation slowed but core prices excluding food and energy continued to rise at a pace that’s concerning for Fed officials including Waller.

“Core inflation is just not moving and that’s going to require probably some more tightening to try to get that going down,” he said.

Wednesday’s decision left the benchmark federal funds rate in a target range of 5% to 5.25%. Fresh projections from policymakers showed they see interest rates rising to 5.6% this year, according to median forecasts, up from 5.1% in March.

Waller, who is known as one of the more hawkish Fed officials, said on May 24 that he wanted to learn more about how the bank failures from earlier this year may contribute to a pullback in lending that could slow growth.

“It’s not like 2007-08, where banks were sitting with some really bad, toxic assets that were never going to get better,” Waller said in response to a question Friday. “People got scared, they ran, we stepped in, created liquidity facilities, replaced some of that deposit funding.”

He continued: “Right now, everything seems to be calm in the banking system.”

Targeted Tools

Waller said the central bank has separate, targeted tools to address financial stability. He also said the tighter credit conditions seen so far are not out of step with a trend visible before the failures of several regional US banks.

“While lending conditions imposed by banks have tightened since March, the changes so far are in line with what banks have been doing since the Fed began raising interest rates more than a year ago,” Waller said in his remarks. “That is, it is still not clear that recent strains in the banking sector materially intensified the tightening of lending conditions.”

(Updates with more comment from Waller in sixth paragraph.)