Two Federal Reserve officials who led the push for higher interest rates to curb inflation last year signaled they could be comfortable holding rates steady for now, reinforcing expectations that the central bank’s current hiking cycle is done.

Governor Christopher Waller, one of the most hawkish Fed officials, said policy is well positioned to return inflation to the Fed’s 2% goal, suggesting policymakers may not need to raise rates again. Governor Michelle Bowman said she remains willing to support rate hikes if inflation progress stalls, but stopped short of endorsing an increase next month.

While the remarks don’t fundamentally change expectations for the Fed’s December meeting, Waller’s comments in particular suggest support is widening among officials for an extended policy pause amid signs that economic activity, inflation and the labor market are cooling.

“I am increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%,” Waller said Tuesday at the American Enterprise Institute in Washington.

“I am encouraged by what we have learned in the past few weeks — something appears to be giving, and it’s the pace of the economy,” he said, referencing remarks he made last month, when growth and inflation data were picking up rather than slowing down. Waller said data since then has moved in the right direction. He also pointed to fourth-quarter forecasts that predict a further cool down.

Read More: Fed’s Waller Signals Support for Keeping Interest Rates Steady

Both Waller and Bowman noted that there are still many uncertainties about how policy will unfold. Bowman, speaking at an event in Salt Lake City, Utah, said she continues to believe more policy tightening will be needed, though her support for higher rates was more conditional than it had been in previous remarks.

“I remain willing to support raising the federal funds rate at a future meeting should the incoming data indicate that progress on inflation has stalled or is insufficient to bring inflation down to 2% in a timely way,” she said.

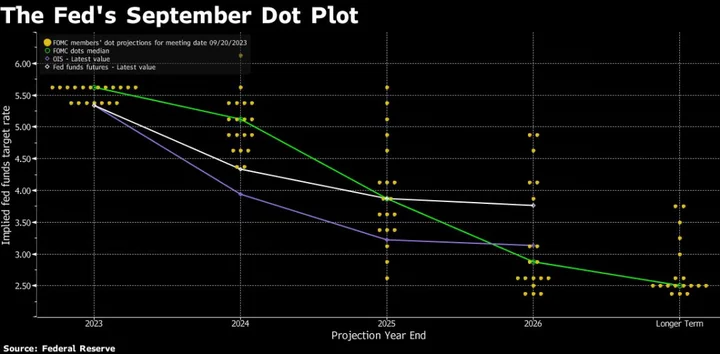

Policymakers voted unanimously to keep interest rates unchanged in a range of 5.25% to 5.5% for a second straight meeting earlier this month. Recent economic reports have bolstered Fed watchers’ bets that the central bank is done raising rates and has pushed forward expectations for the first rate cut.

Bowman had previously indicated support for raising rates further. She’s become one of the most vocal policymakers warning of the risk that inflation could fail to fully return to the Fed’s 2% goal, while others have coalesced around the idea that prices are cooling, even if slowly.

“We should keep in mind the historical lessons and risks associated with prematurely declaring victory in the fight against inflation, including the risk that inflation may settle at a level above our 2% target without further policy tightening,” Bowman said.

The softer comments from the Federal Open Market Committee’s more hawkish members sets the stage for another pause in December, while signaling that they remain attuned to how the economy evolves and whether inflation continues to ease.

The Fed has one more meeting this year, Dec. 12-13. The last time policymakers released economic and rate path projections, at their September meeting, the majority of officials predicted one more rate increase would be necessary this year. That hasn’t materialized yet, and looks increasingly unlikely.

Other voters on the committee, including Minneapolis President Neel Kashkari and Dallas Fed President Lorie Logan, have pointed this month to the high level of uncertainty, vowing to let data guide their decision making.

Chicago Fed President Austan Goolsbee, speaking Tuesday, said the inflation slowdown this year has been the biggest such drop in 71 years. New York Fed President John Williams, in a Bank for International Settlements publication released Tuesday, called the decline encouraging.

Several officials said last month that a run-up in long-term Treasury yields may reduce the need for further rate hikes. Though yields have come down since the Fed’s last policy meeting, Waller said Tuesday that financial conditions are still tighter overall, and yields are higher than they were in the first half of the year.

“But the recent loosening of financial conditions is a reminder that many factors can affect these conditions and that policymakers must be careful about relying on such tightening to do our job,” he said.

Both Bowman and Waller said much of the disinflation progress so far has come from an easing of supply-chain disruptions stemming from the pandemic. Going forward, further easing in price pressures would need to be driven by restrictive monetary policy, Waller said.

Bowman, who celebrates her five-year anniversary on the Fed board this week, said interest rates might need to be higher in the long-term to account for shifts in the post-pandemic economy, compared to the period of low interest rates that followed the financial crisis.

(Updates with comment from New York Fed’s Williams in fourteenth paragraph.)