The Federal Reserve may be putting its hoped-for soft landing of the economy at risk by tacitly accepting a run-up in long-term interest rates to the highest levels since 2007.

The surge — 10-year Treasury yields rose more than half a percentage point the past month to surpass 4.7% — heightens the danger in the near-term of a financial blowup akin to the regional bank breakdown in March. Longer run, it threatens to undercut the economy by markedly raising borrowing costs for consumers and companies.

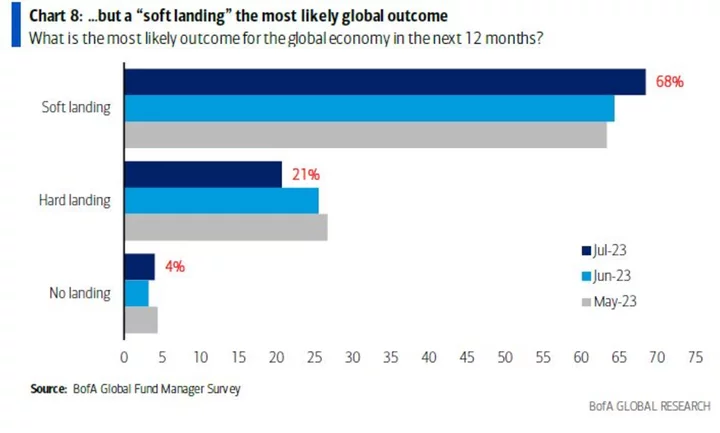

“Ultimately, the feedback effect starts to fuel fears that you’re going to have a hard landing,” said R.J. Gallo, a senior portfolio manager for Federated Hermes, with about $669 billion in assets under management.

What may have a particularly strong impact is the rise in so-called real rates, which remove the impact of inflation. Yields on 10-year inflation-linked Treasuries have soared in recent weeks to levels rarely seen over the past two decades.

Fed leadership has so far not shown much, if any, inclination to resist the rise in long-term rates. While New York Fed President John Williams suggested last week the US central bank may be finished raising rates, he also said policymakers would keep them high “for some time” to bring inflation down to their 2% goal.

“Fed officials have had a chance at various appearances — and they’ve not really taken that opportunity to push back against this,” former Vice Chair Richard Clarida said on Bloomberg Television on Wednesday.

The rise in yields “actually does some of the Fed’s job for it” by slowing economic growth and helping to contain inflation, added Clarida, who is now a global economic adviser for Pacific Investment Management Co.

The danger is the leg up in long-term rates does more damage than the Fed expects. The collapse of Silicon Valley Bank in March came in the wake of a rise in bond yields that was partly driven by tough talk on Fed policy by Chair Jerome Powell.

Other Headwinds

“There’s a potential near-term disruptive effect to worry about,” said Bruce Kasman, chief economist for JPMorgan Chase & Co.

The rise in rates is also occurring at a time when the economy is already facing a number of headwinds — from a resumption of student loan payments to a strike by autoworkers. Indeed, Bloomberg Economics chief US economist Anna Wong says the US economy is probably on the verge of tipping into a recession.

Market participants have identified a variety of triggers for the surge in yields — which moderated slightly Wednesday. Among them: investor concern about burgeoning US budget deficits, slackening demand for Treasury securities from foreign investors including China and expectations that Japan will exit its ultra-loose monetary policy in coming quarters.

Some economists and investors have also cited what they see as a muddled message from the central bank regarding its stance on real interest rates.

Real Rates

“We’ve gotten conflicting signals from the Fed,” MacroPolicy Perspectives LLC founder and former central bank economist Julia Coronado said. In an environment where bond yields were already rising, that “basically just gave the market permission to keep marching higher.”

What’s puzzling investors is how exactly policymakers define real rates. Fed officials have sometimes cited gauges that are based on past inflation and sometimes those tied to prospective inflation rates.

The difference can be critical in determining the future path of Fed policy. Williams in August suggested that the Fed would cut rates next year in tandem with an expected fall in inflation. The aim, he explained, would be to prevent real rates from rising and policy from becoming more restrictive.

But Cleveland Fed President Loretta Mester suggested on Tuesday that’s not inevitably so.

“Real rates should be based on expected inflation, not necessarily current inflation,” she told reporters.

In that case, a slowdown in inflation wouldn’t automatically call for a reduction in Fed rates, unless also accompanied by an easing in expectations. The Fed’s preferred gauge of core inflation, which strips out food and energy costs, was 3.9% in August. By comparison, a benchmark for expected inflation derived from bond market pricing indicates about a 2.5% pace over the longer term.

Neutral Rate

Powell has also muddied the waters about the so-called real neutral rate of interest — the equilibrium rate that neither spurs nor retards economic growth. Speaking to reporters on Sept. 20, Powell mused that the neutral rate might have risen, at least temporarily, given how resilient the economy has been in the face of the Fed’s aggressive credit tightening campaign.

His comments came against a backdrop of investors already thinking so-called R-star is permanently higher coming out the pandemic, and some Fed policymakers themselves bumping up their own estimates of the equilibrium rate.

The result: Powell “put a little bit of fuel on the fire” in the bond market, said Adam Abbas, co-head of fixed income for Harris Associates, with more than $100 billion in assets under management.

Whatever the reason for the rise in long-term rates, it’s something that policymakers will need to keep their eye on in case in gets out of control.

“If the moves get extreme or persistent, it could get the Fed engaged,” Clarida said.

--With assistance from Michael Mackenzie and Jonnelle Marte.