Two Federal Reserve officials said the central bank may have to raise interest rates further to tame price pressures that in some sectors aren’t showing much sign of easing.

Fed Governor Christopher Waller said Friday headline inflation has been “cut in half” since peaking last year, but prices excluding food and energy have barely budged over the last eight or nine months.

“That’s the disturbing thing to me,” Waller said during a question-and-answer session following a speech in Oslo, Norway. “We’re seeing policy rates having some effects on parts of the economy. The labor market is still strong, but core inflation is just not moving, and that’s going to require probably some more tightening to try to get that going down.”

At a separate event Friday, Richmond Fed President Thomas Barkin said inflation remained “too high” and was “stubbornly persistent.”

“I want to reiterate that 2% inflation is our target, and that I am still looking to be convinced of the plausible story that slowing demand returns inflation relatively quickly to that target,” Barkin said in prepared remarks for a speech in Ocean City, Maryland. “If coming data doesn’t support that story, I’m comfortable doing more.”

Read More: Fed’s Barkin Comfortable Doing More to Slow Resilient US Economy

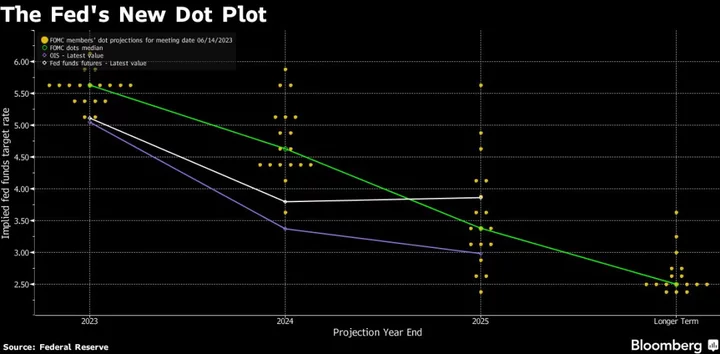

The Federal Open Market Committee paused its series of interest-rate hikes Wednesday, but policymakers projected rates would move higher than previously expected in response to surprisingly persistent price pressures and labor-market strength.

The consumer price index this week showed headline inflation slowed, but core prices excluding food and energy continued to rise at a pace that’s concerning for Fed officials. Employers continued adding jobs at a rapid clip in May, and job openings climbed in April, recent data showed.

Barkin warned that prematurely loosening policy would be a costly mistake.

“I recognize that creates the risk of a more significant slowdown, but the experience of the ’70s provides a clear lesson: If you back off inflation too soon, inflation comes back stronger, requiring the Fed to do even more, with even more damage,” he said. “That’s not a risk I want to take.”