Chevron Corp. fell the most in more than a year after posting disappointing profits amid losses from overseas refining and rising costs at a massive oil-field project in Central Asia.

Chevron, which missed third-quarter expectations by 66 cents per share, plunged as much as 6.2%, putting it on track for its worst decline since September 2022. The company was among the worst performers in the S&P 500 Index.

Its rival, Exxon Mobil Corp., also reported lower-than-expected third-quarter results Friday, citing weak performance in its chemical businesses. Shares of the Texas-based company fell as much as 2.5%.

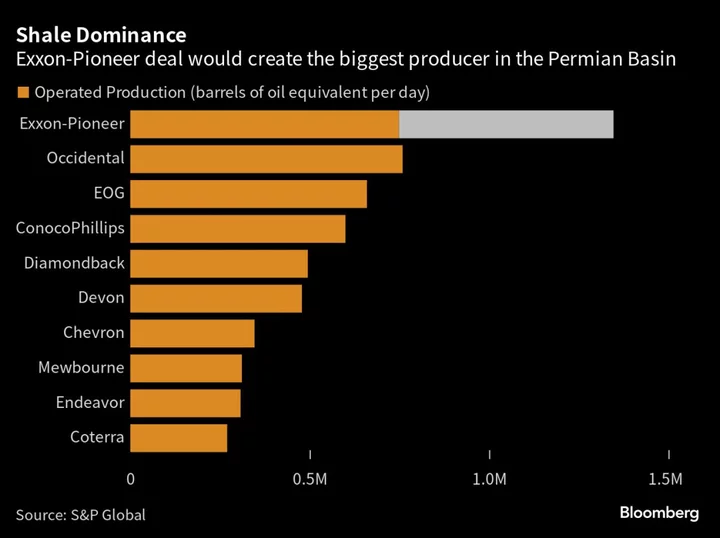

The results come as both companies pursue historic deals that are expected to vastly expand their oil-production potentials. Exxon’s $60 billion agreement to acquire shale giant Pioneer Natural Resources Co. and Chevron’s $53 billion offer for Hess Corp. highlight their determination to stay ahead of European supermajors and American independents by locking up control of vast resources than can underpin crude output for decades to come.

Chevron Chief Executive Officer Mike Wirth talked about growth prospects from Guyana earlier this week when announcing the Hess deal. But it was problems on a major project on the other side of the world that dominated the California-based company’s earnings on Friday.

Costs at Chevron’s $45 billion Tengiz project will rise by about 4% due to a slower-than-expected start-up that had been years in the making. The company will need to pay an extra $1 billion for its share of the capital spending, meaning that the operation’s free cash flow will drop 20% from 2025. Output will be lower than expected in 2023 and 2024.

The new outlook comes on top of a 25% rise in the operation’s cost estimate back in 2019.

Tengiz, on Kazakhstan’s western steppe, is a critical part of Chevron’s pledge to grow global production by 3% a year over the medium term and the delays upset both analysts and investors.

About half the project’s value “has been taken our of your stock this morning,” Doug Leggate, an analyst at Bank of America, told Wirth during a conference to discuss the results. Paul Cheng of Scotiabank called it “disappointing.”

Wirth acknowledged that “there has been a reaction apparently in the market this morning,” and attempted to reassure investors that there would be no more cost overruns or delays.

“We sent in an independent team to give us a kind of a cold eyes assessment on cost and schedule,” he said on the call. The new plan reflects “a more conservative forecast” on completing the remaining work.

The project has suffered from engineering problems at the outset, and mobilizing tens of thousands of workers was delayed by the pandemic. The biggest challenge, however, was its sheer complexity. Chevron had to re-do the electrics on the entire field and replace infrastructure that dated back to the Soviet era, Wirth said.

For shareholders, Tengiz is a bitter reminder of Gorgon and Wheatstone, two giant LNG developments in western Australia that cost almost $90 billion combined, way over initial targets, and dominated Chevron’s capital spending for a decade.

Despite the miss, Exxon lifted quarterly investor payouts to 95 cents a share, payable on Dec. 11, a penny higher than the Bloomberg Dividend Forecast. Meanwhile, third-quarter free cash flow more than doubled from the prior period to $11.7 billion, far in excess of the $9.36 billion average estimate.

“We view the dividend as a commitment,” Exxon Chief Executive Officer Darren Woods said during a conference call with analysts. “And as we saw through the pandemic, even when things get tough, we work hard to make sure that we’re continuing to deliver on that commitment to our shareholders.”

Exxon is banking on investments in fossil-fuel projects that date back to the pandemic, combined with cost-reduction efforts, Chief Financial Officer Kathy Mikells said during an interview.

The landmark Pioneer deal will vault Exxon to the pinnacle of Permian Basin output, giving it unmatched ability to flex production depending on oil demand during the energy transition. Chevron’s agreement to buy Hess, meanwhile, will secure the company a 30% stake in Exxon’s fast-growing Guyana operation.

Investors’ feedback on the Pioneer deal has been “overwhelmingly positive,” Mikells said. “They completely understand the strategic fit and the strong synergies that we expect to be able to achieve from the transaction.”

By one oil-industry metric, known as cost-per-flowing-barrel, Chevron is paying a much higher price for Hess. Chief Executive Officer Mike Wirth has sought to ease investor concern about the high price for Hess by pledging to fatten dividends and buybacks. The combination will assuage concerns in some corners that Chevron is too reliant on just two regions — the Permian Basin and Kazakhstan — to meet future production targets.

At Tengiz, Wirth said the goal line is in sight.

“We’re close to the finish line on this thing and, and we’ve got a full-court press on it,” he said during the call. “The lessons from that will be applied in every other project that we do.”

--With assistance from David Wethe.