Hedge-fund manager George Jarkesy said he didn’t recall more than 800 times during questioning at the SEC about deceiving investors. A judge at the agency said he was so evasive his testimony was all but worthless.

A decade later, Jarkesy may have the last laugh.

The US Supreme Court is now using his case to consider stripping the Securities and Exchange Commission of a key weapon in its arsenal – the ability to go before its in-house judges to seek multimillion-dollar penalties. The court hears arguments Wednesday with a ruling likely by June.

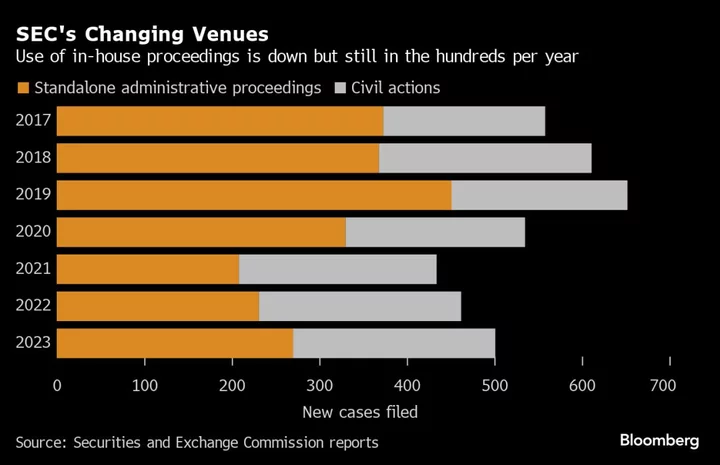

Jarkesy, a former Wall Street broker and television commentator, is the new face of a long-running effort to undercut what critics say is an unfair advantage the SEC holds when it tangles with alleged wrongdoers. The SEC uses its in-house system for hundreds of cases a year – even after scaling back in response to a 2018 loss at the Supreme Court.

Backed by Elon Musk and Mark Cuban, Jarkesy contends that defendants in SEC cases have a constitutional right to make their case to a federal jury. A win for Jarkesy would reduce the SEC’s leverage to extract expensive settlements.

“The effect for defendants would be significant,” said Nicolas Morgan, a lawyer with Paul Hastings and former SEC litigator who filed a friend-of-the-court brief for Musk, Cuban and three other business leaders who have clashed with the commission. “Potentially, you would see fewer defendants settle if they know they’re going to be able to plead their case to a jury.”

Depending on the court’s reasoning, the case could also affect the Federal Trade Commission, which uses in-house judges as well.

Jarkesy in 2007 set up the first of two Houston-based funds that eventually raised $24 million from 120 investors. He became a conservative commentator on Fox Business News and CNBC, talking about the financial markets and government regulation.

His radio show was distributed in at least eight markets, giving him a forum to opine on politics as well as business. In one segment, he said the US Civil War was driven by northern states’ overtaxation and their need for money from the South.

‘Evasive Manner’

It all came crashing down in 2013, when the SEC accused him of misleading investors about who served as the funds’ prime broker and auditor and about their investment strategies and holdings.

Jarkesy testified during a 12-day hearing at the SEC’s New York office in 2014. Administrative Law Judge Carol Fox Foelak was left unimpressed, saying he “generally testified in an evasive manner that did not provide any assurances of the reliability of his testimony.”

He lost again when he appealed to the SEC’s commissioners, who imposed almost $1 million in penalties on Jarkesy and his firm. The 5th US Circuit Court of Appeals threw out the award, saying he was entitled to a jury trial, and the Biden administration turned to the Supreme Court.

Jarkesy and his allies say the process is fraught with injustice. Defendants have fewer rights to obtain evidence in administrative hearings than federal court, and SEC lawyers can rely on third-party “hearsay” testimony. Appeals go to the same SEC commissioners who approved the complaint in the first place.

Making matters worse is the fact that the SEC decides which cases go in-house, says Susan Hurd, a securities defense lawyer at Alston & Bird in Atlanta.

“It feels fundamentally unfair — put aside all the niceties of constitutional law — for the SEC to decide whether you get an Article III judge or you don’t,” said Hurd, referring to the part of the Constitution that established the federal judiciary.

The commission in June dropped 42 other cases amid revelations that enforcement staff members improperly had access to restricted records from the SEC general counsel’s office. Jarkesy this month filed a Freedom of Information of Act request seeking information about the handling of his case.

Jarkesy declined to be interviewed. A spokesperson said he “sees this journey as his patriotic journey” and believes the appeals court decision “clears his name and proves the unfairness and unconstitutional nature of SEC in-house tribunals.”

Protecting Investors

Congress has steadily expanded the types of cases eligible for administrative hearings, most recently in 2010. The SEC began to ramp up its use of the administrative process after losing a series of jury trials in insider-trading cases, including a 2013 verdict favoring Cuban, the Dallas Mavericks owner.

The SEC shifted course again after the Supreme Court ruled in 2018 that the commission’s judges were appointed unconstitutionally. The SEC now uses the system primarily to handled uncontested matters, including settlements.

Defenders say the in-house tribunals provide needed flexibility and let regulators better protect investors from fraud and other abuses.

It reflects “Congress’s determination that pre-existing common-law mechanisms were inadequate to safeguard markets and protect the investing public,” Solicitor General Elizabeth Prelogar told the justices on behalf of the SEC.

In addition to ruling that Jarkesy had a jury-trial right, the 5th Circuit said Congress unconstitutionally gave the SEC unfettered discretion to decide which cases go to court. The panel also said job protections afforded to SEC judges leave them too insulated from presidential control.

The case is SEC v. Jarkesy, 22-859.

--With assistance from Austin Weinstein.