European stocks fell on Monday as weak economic data from China hit risk sentiment, while investors turned to corporate earnings for clues on the impact of slowing global growth.

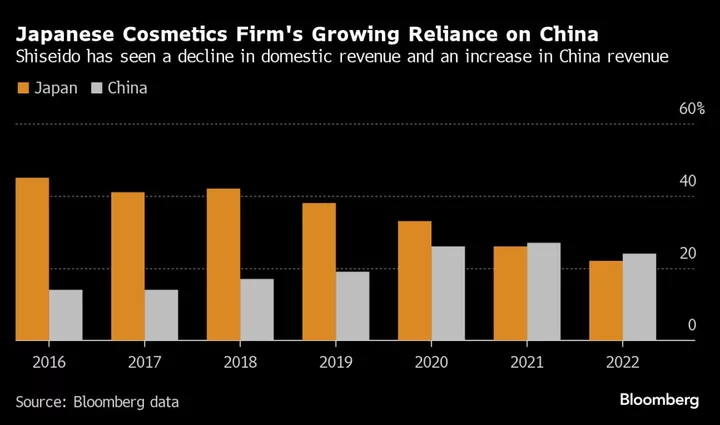

The Stoxx 600 was down 0.6% as of 11:03 a.m. in London, after closing out its best week since March on Friday. Luxury goods makers LVMH and Hermes International dropped as data showed China’s economic growth trailed expectations in the second quarter, with signs of a slowdown in consumer spending and ongoing pain in the property market prompting calls for Beijing to do more to support the recovery.

Still, market strategists said they expect investors to remain cautious on bets of stimulus.

“If Chinese policy makers were willing to engage in the sort of broad and aggressive fiscal stimulus that characterized the decade post crisis, they would have done so by now,” said James Athey, investment director at Abrdn.

“Europe is by far the biggest loser from this latest approach to economic management in China,” Athey said. “Heavy machinery, vehicle exports, luxury goods — the relationship is shifting in a way which isn’t good for Europe across a number of facets.”

Consumer products and mining sectors fell the most today, while health care outperformed.

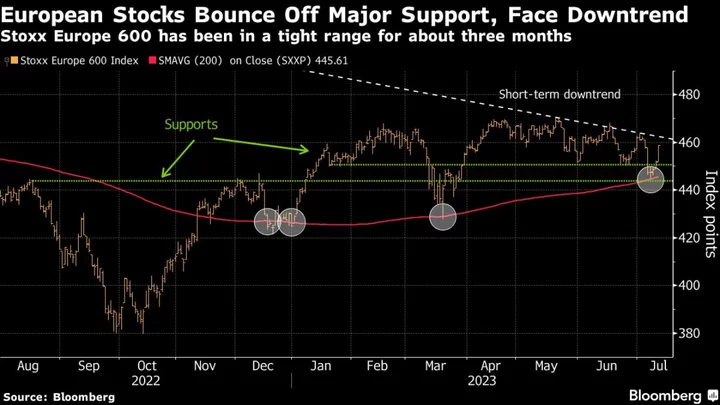

After a strong rally in the first half, Europe’s benchmark index has retreated in July as investors weigh the outlook for economic growth against expectations of hawkish-for-longer central banks. Sentiment was boosted last week as US inflation cooled more than expected.

Focus now is on the second-quarter earnings season, with analysts expecting the biggest year-on-year decline in European profits since 2020. JPMorgan Chase & Co. strategists said they expect another leg of underperformance for euro-area equities against their US peers.

Read More: A $10 Trillion Stock Market Rally Faces Crucial Test in Earnings

SECTORS IN FOCUS:

- European sectors exposed to China, such as luxury and miners, as data showed the nation’s economy grew more slowly than expected in the second quarter with worrying signs in consumer spending and ongoing pain in the property market.

For more on equity markets:

- It’s Getting Harder to Take Sides in This Market: Taking Stock

- M&A Watch Europe: Gresham House, OMV, Casino, Nexi, Banco BPM

- US Stock Futures Little Changed

You want more news on this market? Click here for a curated First Word channel of actionable news from Bloomberg and select sources. It can be customized to your preferences by clicking into Actions on the toolbar or hitting the HELP key for assistance. To subscribe to a daily list of European analyst rating changes, click here.

--With assistance from Michael Msika.