To reach new customers across Asia, Estée Lauder Cos. has spent the past two years beefing up its global supply chain. Executives have heralded these investments as positioning the company for accelerated growth in a crucial region. While analysts applaud the buildout — a manufacturing plant in Japan, an innovation center in China and a distribution facility in Switzerland for its duty-free business — they bemoan that it’s years overdue.

The too-little, too-late approach helps explain why Estée Lauder executives have cut their annual outlook in each of the last three quarters. The company is grappling with sluggish sales in Asia, supply-chain missteps and product miscues that have left it trailing behind French beauty giant L’Oréal SA. When it reports quarterly results Friday morning, investors will be looking for details on how Estée Lauder executives plan to right the ship.

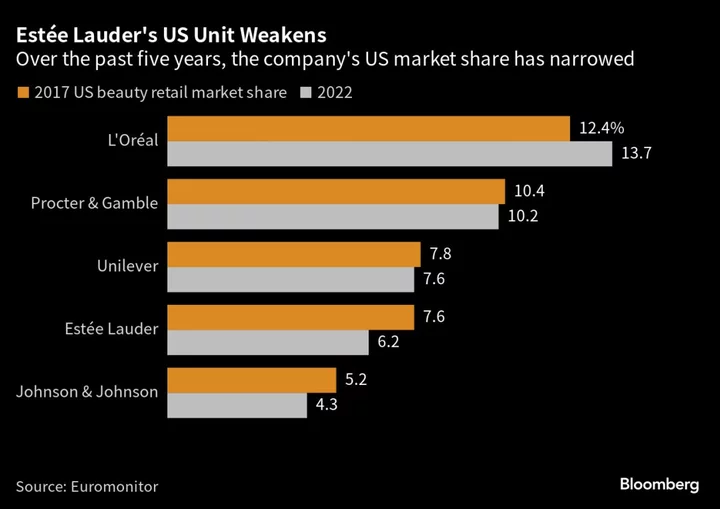

Estée Lauder has lost market share in the US to competitors like L’Oréal, which has been quicker to seize on the now-booming market for dermatological beauty products, with brands such as CeraVe and SkinCeuticals. Estée Lauder has also underinvested in advertising, forfeiting a chance to bolster sales, some analysts say.

Estée Lauder’s pivot away from struggling department stores to popular retailers like Ulta Beauty Inc. and LVMH’s Sephora hasn’t been enough to stave off its declining market share. Adding to the tumult, hackers last month shut down the company’s email for several days, delaying some online orders and potentially leading to millions of dollars in lost sales.

The slow supply-chain revamp, meanwhile, left Estée Lauder ill-prepared for China’s tumultuous reopening earlier this year. Sales tanked in its Asia-focused travel retail business, which represented nearly one-third of revenue in the most recent fiscal year.

An Estée Lauder spokeswoman declined to comment before earnings. At an analyst event in June, Estée Lauder Chief Executive Officer Fabrizio Freda said, “We are completely focused on solving these issues.”

Succession

Estée Lauder’s challenges have raised the question inside and outside of the company about a successor for the 65-year-old Freda, who has been in the post since 2009.

Freda has an incentive to stay through at least June 30, 2024, when he will be awarded stock payouts. At a December conference he affirmed that he’s “completely committed to continue leading this company for the foreseeable future.”

While it’s too early for a frontrunner to have emerged in the succession talks, some of the internal candidates who have been discussed in recent months include Jane Lauder, chief data officer and a granddaughter of the founder; Stéphane de la Faverie, one of two executive group presidents; and Tracey Travis, chief financial officer since 2012, according to people close to the company who asked not to be named.

The three executives didn’t respond to requests for comment. In May, Executive Chairman William Lauder sent a memo to employees lauding Freda: “Under Fabrizio’s leadership, the company is executing a successful long-term strategy.”

Whether the company’s board would prefer an external candidate remains unclear. Jane Lauder’s inclusion on the short list adds a dose of intrigue. The Lauder family controls about 86% of the voting power at one of America’s largest family-run companies, but investors and analysts credit Freda, as an outsider from Procter & Gamble Co., with instilling financial and professional discipline and more than doubling its revenue from $7.8 billion in 2010 to $17.7 billion in 2022.

‘Ultimate authority’

Estée Lauder founded the company in 1946, becoming an iconic American entrepreneur who transformed the way cosmetics and skin-care products were sold. Despite its storied history in the US, the company has been flailing in its home market.

Its share of the beauty and personal-care market in the US fell by nearly one-fifth to 6.2% in 2022 from five years earlier, according to Euromonitor, a data research company. L’Oréal saw its market share increase by a tenth to 13.7% over that period, cementing its position as the leading beauty and personal-care company in the US.

L’Oréal also enjoys a narrow edge over Estée Lauder in the so-called prestige category of US beauty and personal care, Euromonitor says — a tough setback for Estée Lauder, which specializes in more high-end products than L’Oréal. The French company has more mass-market brands like Maybelline and Garnier.

In June, Freda said the company’s relationships with its “winning retailers” — Ulta and Sephora — will help rebuild market share.

L’Oréal dominates, in part, because of its sheer size: It generated around $42 billion at the current exchange rate last year and employs around 88,000 people. Estée Lauder, by contrast, reported nearly $18 billion in revenue in 2022 and employs more than 60,000 workers.

But it’s not just about size. L’Oréal’s skin-care products appear to resonate more with US consumers than those of Estée Lauder, according to an analysis for Bloomberg News prepared by Yogi, a consumer-data analysis firm. Among the 50 highest-rated skin-care products from the two companies, Yogi found that L’Oréal sold 40 of them. La Roche-Posay’s Toleriane Purifying Foaming Facial Wash topped the list.

L’Oréal also seized on growing consumer interest in products recommended by dermatologists — not just by social media influencers — acquiring CeraVe in 2017 and La Roche-Posay in 2018.

“L’Oréal has placed its bets that the ultimate authority is coming from the professional,” said Matthew Wiseman, head of the UK consumer sector at European investment bank Alantra Partners SA. That’s “proved to be the better bet,” he added.

While Estée Lauder has acquired ingredient-focused brands like The Ordinary and launched Clinique decades ago, it hasn’t “necessarily exploited that in the same way that L’Oréal have been able to,” Wiseman said. CeraVe remains more popular.

At the June conference, Freda said Estée Lauder is focusing on increasing consumers’ engagement with Clinique.

Estée Lauder also hasn’t kept pace on advertising. In June, Freda said the company had slashed its ad budget in recent years in part because social media often provides free marketing. He also said that mask wearing during the pandemic convinced executives to temporarily lower spending on marketing on makeup. Overall spending will soon return to more historical levels, he added.

But L’Oréal and most other beauty companies have increased their ad investments as a percentage of revenue in the past several years, Stifel analyst Mark Astrachan noted.

Asian supply chains

Now, Estée Lauder’s hopes for a recovery lie largely in Asia.

One reason revenue has suffered is that the company didn’t invest enough in local manufacturing to support regional sales, Barclays analyst Lauren Lieberman noted in a recent research report.

In the 12 months ended in June 2012, for example, Estée Lauder had 21% of its operational facilities in Asia Pacific, in line with its portion of sales in the region. Ten years later, the region accounted for around one-third of sales but only 14% of operational facilities, she said.

While the new Asian facilities will help address that imbalance, the factories didn’t open fast enough for Estée Lauder to navigate China’s reopening earlier this year.

Instead, the company’s long supply chains forced it to send merchandise to Chinese duty-free shops and other retailers at least six months in advance. When they shipped the products, Estée Lauder executives bet China’s reopening would be shaped like a hockey stick: a sharp uptick in demand that rapidly accelerated. So they shipped a lot of merchandise.

But the recovery for Estée Lauder has been more gradual. That’s left travel retail shops with too much merchandise and not enough demand.

“The length of our supply chain is one of the reasons why we had this inventory issue in travel retail,” Freda said in June, “and we are addressing it.”