Most oil majors are stepping up investment in green energy amid rising activist pressure but without abandoning fossil fuels, putting at risk reaching carbon neutrality in 2050.

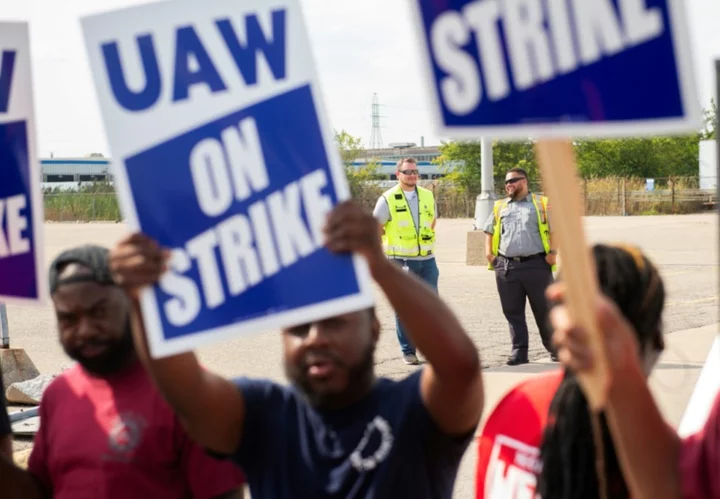

During the annual shareholders' meeting of British group Shell on Tuesday, activists shouted out "Go to hell Shell!"

BP got similar treatment, as did banking giant Barclays, which is accused of financing oil extraction.

French oil and gas company TotalEnergies will likely be targeted by activists at its shareholders' meeting on Friday.

Since 2021 the International Energy Agency (IEA) has called for a stop to new oil projects, to ensure the world meets the goal of keeping global temperatures to 1.5 degrees Celsius above pre-industrial levels.

But new oil fields continue to open.

- Not enough renewables investment -

The oil and gas industry, particularly in Europe, has set objectives to reduce its emissions of greenhouse gases that cause global warming.

While investments by oil and gas firms in renewable energies and carbon capture have increased, they remain a marginal amount of overall spending.

According to the IEA, such spending rose from one percent in 2020 to five percent of total expenditures by last year, still only representing a quarter of what energy firms paid out to shareholders.

European firms such as TotalEnergies and Equinor are doing better than their peers, but "their investment in clean energy is tiny compared to their capital expenditure on oil and gas expansion", said David Tong, global industry campaign manager at Oil Change International.

Other than renewables and carbon capture, energy firms also have expertise that could be put to use in the production of hydrogen, biogas, ethanol and low-carbon fuels, said Christophe McGlade, head of the IEA's energy supply unit.

"If they can direct more of their spending towards those technologies, that could really move the needle in terms of getting them to scale up, and getting the deployment levels we need to get on track with net zero," he said.

- Shift from oil to gas -

The emissions reduction efforts made by energy majors have concerned mostly their own operations, which represent only about 15 percent of their overall carbon footprint.

They have in particular been battling against methane leaks and reduced the burning of unwanted natural gas at oil fields.

Such measures have helped BP reduce its emissions by 41 percent from 2019 to 2022, and it has upped its 2030 target to a 50 percent reduction.

Even US oil majors, which have long resisted recognising the need to reduce emissions, have begun to do so. ExxonMobil plans to cut its proper emissions by a fifth by 2030, from 2016 levels.

But the bulk of the work is elsewhere: reducing the emissions from its products as they are burned in cars or furnaces, the so-called scope three indirect emissions that account for 85 percent of the sector's overall carbon footprint.

Reducing these implies lowering the use of oil, and eventually gas.

Yet oil and gas firms are not cutting investment in fossil fuel exploration and production. The IEA forecasts that it will rise this year to hit the 2019 pre-pandemic level.

BP announced earlier this year it is stepping up investment in oil and gas projects, knocking back its emissions reduction plans. Instead of a 35-40 percent drop in indirect emissions linked to its production by 2030, BP now targets a 20-30 percent reduction.

TotalEnergies plans to keep its indirect emissions steady this decade.

It also plans a shift from oil to gas. If oil accounted for 55 percent of sales in 2019, Total aims to reduce that to 30 percent this decade, with gas rising to half.

"The sector will be dominated by gas rather than oil by 2030," said Moez Ajmi, an energy expert at EY consulting firm.

For the IEA's McGlade, these forecasts by energy firms are revealing.

"If companies are banking on continued increases in oil and gas demand, they are implicitly assuming that we will not reach our net zero targets and not limit climate change," he said.

nal/rl/lth/leg