Investors are looking anew at Egypt’s bonds after signs of progress in its plans to sell state assets.

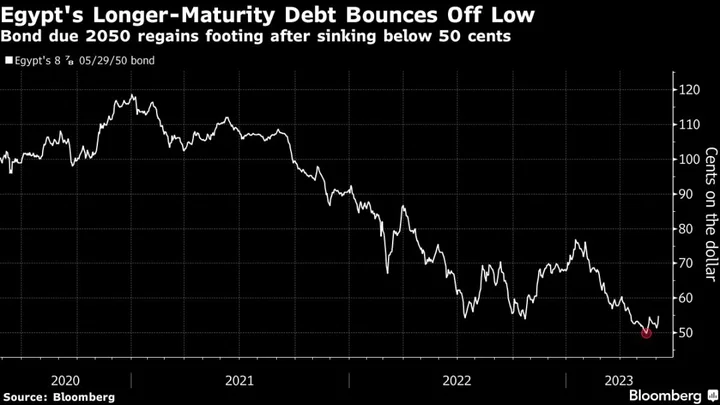

Egyptian dollar-denominated debt securities have been the biggest gainers across emerging markets in the last two trading days, with longer-maturity securities that were recently battered to around 50 cents on the dollar leading gains. The cost of protecting the nation’s debt against default dropped 103 basis points on Monday to around 1,650.

The government has been stepping up efforts to either sell or partially list at least 32 state-held firms to bringing in fresh hard currency and boost private-sector participation in an economy reeling from the aftershocks of Russia’s invasion of Ukraine. That’s fueled expectations of “positive privatization catalysts materializing soon,” said Gordon Bowers, a London-based analyst at Columbia Threadneedle Investments.

Bowers said he has turned “slightly more constructive” on Egypt after meeting officials and bankers in Cairo last month and doesn’t expect the nation to default on its debt in the next two years. Moody’s Investors Service’s move in May to place the North African nation’s B3 rating on review for downgrade “seems to have lit a fire under key decision makers to push some of these privatizations across the finish line,” he said.

“It really seems like the privatization agenda has been elevated to a national priority,” Bowers said. “The willingness to pay remains very high.”

With the government struggling to regain access to external financing, the nation sold a stake in state-run Telecom Egypt Co. and named advisers in the planned sale of United Bank, owned by the central bank, in May.

Rescue Program

The International Monetary Fund has delayed its review of a $3 billion rescue program and billions of dollars in promised funding from Gulf Arab nations have yet to materialize as the potential lenders seek greater evidence that authorities are moving ahead with reforms — including genuine flexibility in Egypt’s currency.

Egyptian officials have said the country won’t default on any obligations and it expects more state assets to be sold in the coming weeks. Authorities have also been revamping the investment climate, including making it easier for foreigners to set up shop, while working to boost private-sector participation that’s key to sustainable growth in the long term.

Egypt’s bonds with maturities from 2047 offer coupons of as high as 8.88%, making them attractive, according to Yury Zusman, author of a monthly series on emerging markets by Hedder, which provides research reports to investors. The nation’s note due 2050 has risen to 54.3 cents on the dollar to yield 16.5% on Tuesday, from an all-time low of 49.9 cents reached in mid-May.

In comparison, the security maturing in May 2024 was at 91.5 cents and yielded 15.5% in early London trade.

While investors can make money from collecting the coupon on the longer-maturity securities, the beaten-down bonds will need sustained progress on reforms for prices to appreciate from their current levels of around 50 cents.

“We’re expecting some positive news in the near term, so we think that in the 50’s, valuations do look attractive,” said Carmen Altenkirch, a London-based analyst at Aviva Investors. Egypt needs to ensure the flow of financing is much more forthcoming to avoid the prospect of any default by the middle of next year, she said.

The market sees about a 20% probability of default by December next year and a higher chance of 55% by the end of 2026, after the IMF program ends, Zusman said. The calculations assume investors would recover 35% of the Egyptian bonds’ value if the government failed to adhere to its debt commitments, he said.

“The market thinks that Egypt will likely be able to make all the payments in the next one to two years, but is pessimistic about the long-term,” said Zusman, a former emerging-markets strategist at hedge fund Pharo Management. “This is why the short-end has outperformed.”