Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

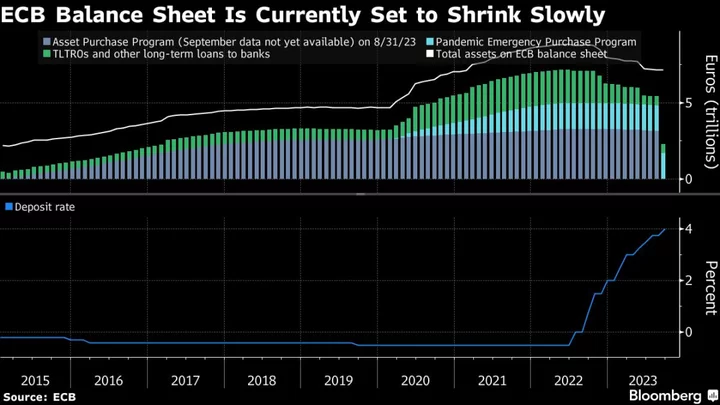

The European Central Bank should consider speeding up the wind-down of its bond portfolio now that interest rates have reached a level that’s probably high enough to get inflation under control, Governing Council member Madis Muller said.

One option would be to start rolling off the €1.7 trillion ($1.8 trillion) of securities amassed during the pandemic under the so-called PEPP program, where proceeds are currently scheduled to be fully reinvested through the end of 2024, the Estonian central-bank governor said in an interview in Santiago de Compostela, Spain.

“We should have a discussion soon about how to proceed with PEPP reinvestments and for how long,” Muller said on the sidelines of a meeting of euro-area finance chiefs. “There’s a strong argument in favor of stopping PEPP reinvestments sooner than the end of next year. That would be consistent with our interest-rate policy.”

The ECB raised borrowing costs for a 10th straight time on Thursday, bringing its deposit rate to a record level in a decision that some of the 26 Governing Council members opposed. Officials also signaled that rates may now have reached their peak, though some have warned that more tightening could be necessary.

Muller’s comments add to a growing chorus of policymakers that are pushing for a quicker reduction of the ECB’s bond portfolio. Reinvestments under the central bank’s €3.1 trillion Asset Purchase Program, launched when inflation was too low, have already stopped, so the wind-down could only be accelerated with sales.

Slovenia’s Bostjan Vasle signaled he’d prefer targeting the APP for a more aggressive quantitative tightening. In an interview on Friday, he argued that officials should retain — at least for now — the flexibility PEPP reinvestments offer in keeping bond yields in check.

Earlier this week, ECB President Christine Lagarde said that officials haven’t discussed any changes to their current policies on QT.

Muller, usually one of the Governing Council’s more hawkish officials, also reiterated that he thinks borrowing costs are unlikely to rise further.

“There’s a good chance that we don’t have to lift rates any higher, but of course that can change if inflation doesn’t come down as quickly as expected,” he said.

He added that officials may be able to get consumer-price growth under control without causing a downturn in the 20-nation euro zone, even as concerns about the economic outlook are growing.

“Of course we don’t want to cause a recession, but that’s not what we have in the cards now,” he said. “It’s a difficult period for the euro-area economy but we should still expect a gradual recovery toward the end of the year.”