The European Central Bank’s plan to maintain interest rates at their eventual peak for an extended period isn’t convincing economists, who see it starting to unravel after just six months.

A slim majority in a Bloomberg survey expects a final hike in the deposit rate in September, to 4%, before officials embark on rate cuts in March. Uncertainty about subsequent moves builds gradually, with projections for end-2024 borrowing costs ranging from 2% to 4%.

Respondents unanimously see a quarter-point step next week.

The divergence of views highlights how tricky it is to forecast when inflation will return to the 2% goal from 5.5% now and more than 10% last fall. Not only are stubborn price pressures and a struggling euro-zone economy clouding the path ahead, but officials still aren’t sure how the unprecedented 400 basis points of tightening implemented since last July will hit activity as their lagged effect becomes felt.

“The ECB will have to find a rationale to stop hiking rates in the near future while at the same time leaving a credible tightening bias in place,” said Kristian Toedtmann, an economist at Dekabank, who predicts rates will peak this month and stay there until next September. “The risk is that markets interpret such a pause as a sign that rate cuts are already in the offing.”

President Christine Lagarde will seek to snuff out talk of borrowing costs being reduced any time soon when she speaks following the July 27 policy announcement. The onus is on rates staying restrictive for longer — particularly after data this week saw underlying inflation for June revised higher.

What Bloomberg Economics Says

“While we don’t expect Lagarde to provide much guidance on when a pause will arrive, she does seem focused on clearly broadcasting the ECB is unlikely to cut anytime soon.”

—David Powell, senior euro-area economist. Click here for ECB preview

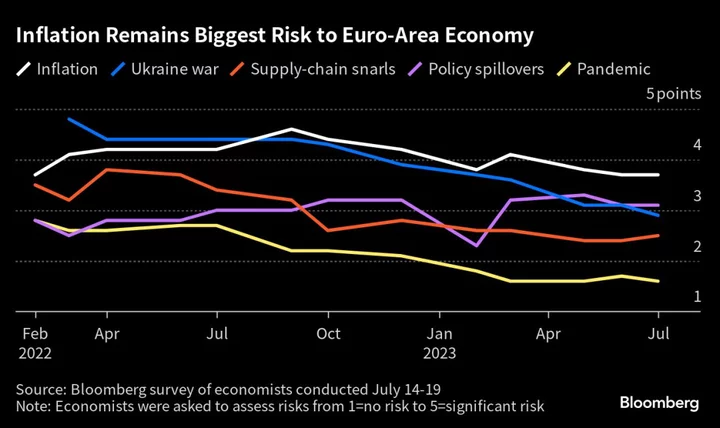

Economists still deem inflation to be the biggest risk to the economy, with policy spillovers from elsewhere overtaking fallout from Russia’s war in Ukraine in second place. The Federal Reserve will deliver what’s widely expected to be its final rate hike next week. Traders are betting on a first US rate cut as early as the spring.

Despite the challenges, survey respondents have confidence in the ECB’s ability to find the right dose of tightening to tame inflation without sending the economy off a cliff. More than two-thirds are convinced officials won’t push too far, and nine in 10 say they won’t stop raising rates too early, either.

With next week’s move looking sealed, Nomura’s Andrzej Szczepaniak reckons the big question is whether the ECB again pre-commits to hiking at its next meeting. “If it does, market pricing for October could well firm up as the data between the September and October meetings is expected to be broadly unchanged,” he said.

There are also grounds, though, for officials to keep their options open.

“I don’t think that President Lagarde will give any hints for the outcome of the September meeting,” said Ulrike Kastens, an economist at DWS. “They’ll stress their data-dependency and wait for the September projections.”

The ECB last month lifted its inflation forecasts through 2025 and said the outlook remains “highly uncertain.” Nearly all of the Governing Council’s 26 members have since offered their views — hinting at growing divergence between those wondering if the they’ve already done enough and those contemplating more.

That difference of opinion will make reaching a compromise harder. Already, officials see striking the correct tone in telegraphing their intentions to be their toughest hurdle, according to people familiar with their thinking.

“The July meeting is a ‘no brainer:’ Hike rates by 25 basis points and keep the door wide open for another rate hike in September, without giving any guidance to when and where the terminal rate will be reached,” said ING’s Carsten Brzeski. “So, maybe the only challenge is to stick to an evergreen song: Silence is golden.”