European regulators are telling banks that sailed through an early round of this year’s stress test that the final results will be less rosy.

The European Central Bank has signaled to lenders benefiting from the surge in interest rates to prepare for adjustments in the name of achieving more credible results, the people said, asking not to be identified. Many bankers disagree, saying regulators are seeking a worse outcome to pressure the industry, some of the people said.

The assessment is a key exam for lenders because it gives insight into their preparedness to weather shocks and feeds into capital requirements. A clean bill of health strengthens the case for distributing billions of euros in payouts to shareholders, even as economic uncertainty increases.

A spokesman for the ECB declined to comment, as did a spokeswoman for the European Banking Authority, which coordinates the stress test, due to be completed by the end of July.

The 23-member Euro Stoxx Banks Index gave up some gains on the news. The index was up 0.6% at 12:02 p.m. in Frankfurt on Monday, taking its rise this year to about 10%.

This year’s test was billed as using the toughest economic scenario to date, yet the banks’ results have been buoyed by a profit boost last year from rising rates and low provisions for bad loans. That’s led some officials to suggest that the exam doesn’t show a sufficient deterioration of that starting position.

Banks are tested under an adverse scenario and more benign baseline scenario for the three years through 2025.

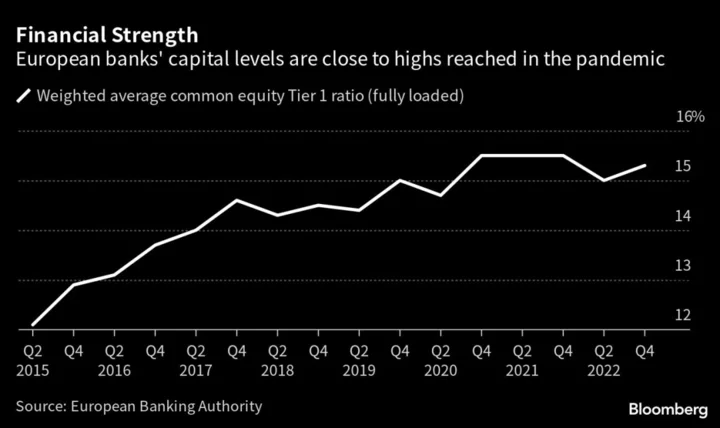

Banks argue that the stronger exam results reflect tangible steps they’ve taken to make their businesses more resilient, and they should reap the rewards of those efforts. Regulators are wary of a situation where a lenient test allows banks to excessively reduce their capital cushions with shareholder payouts, only for the environment to then turn more challenging.

Authorities cannot afford to be complacent, said Spanish Economy Minister Nadia Calvino, whose country takes over the rotating European Union presidency at the end of the month.

“The situation of the financial sector is of course solid,” Calvino told reporters on Monday when asked about the stress test. “But we have to pay great attention and be vigilant because with rising interest rates and falling liquidity, it is clear that the weakest elements that may exist in the sector could be affected.”

Regulators will probably force banks whose projections deviate widely from their own to factor in their calculations if lenders can’t justify the difference, said the people. This phase, known as quality assurance, will probably be tougher than previous exercises, the people said.

In private, regulators say the process of challenging the banks is about pushing for more realistic results and note that the methodology and central scenarios remain unchanged. Bankers and trade associations take a different view, saying they have the impression that the EBA and ECB are simply seeking worse results.

The stress tests featured prominently in a meeting between bank lobbyists and executives and ECB officials earlier this month, said the people.

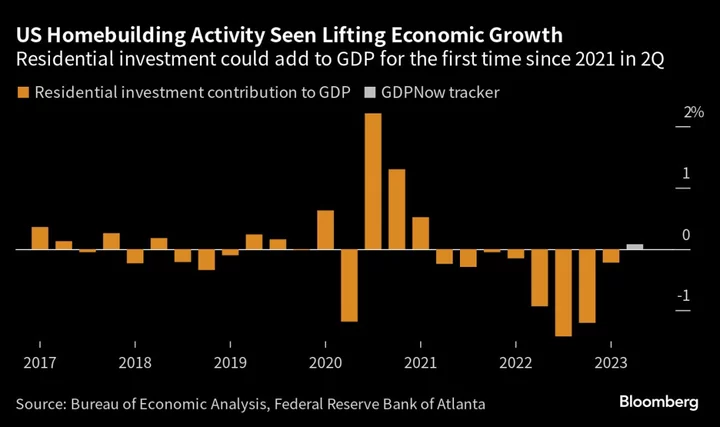

The angst over positive results is another sign of the tricky moment for banks and their overseers. Higher interest rates have been a boon for the banking industry overall, but the rapid speed of rate hikes caught some smaller US lenders unprepared, with disastrous consequences for those firms. European banks want to reward their shareholders after years of lean returns, while regulators are wary of letting lenders get too confident.

Andrea Enria, who leads the ECB’s bank oversight arm said on Tuesday that the regulator focuses on how lenders expect their capital levels to evolve when scrutinizing individual plans to distribute money to shareholders.

“We want a solid capital trajectory projected by the bank,” he said at an event hosted by Goldman Sachs Group Inc. in Paris, without naming any lenders. “If the bank is able to convince us that even under a decently conservative adverse scenario, they would be able to respect all the supervisory yardsticks, then there would be no constraints from our side in terms of their distribution.”

--With assistance from Alonso Soto and Macarena Muñoz.

(Updates with Spanish Economy Minister comment in ninth paragraph)

Author: Sonia Sirletti, Nicholas Comfort and Steven Arons