Pakistan’s iron-clad grip on its dollar holdings may be keeping its currency stable, but it’s also hurting local and foreign businesses that are caught between closing and reopening factories as they face difficulty accessing the greenback.

The assembler of Suzuki vehicles in the country is shutting its motorcycle plant for 16 days through mid-August due to a lack of inventory. Sitara Peroxide Ltd., a chemical producer, last month closed its factory for four weeks and then extended the shut down period for another three weeks. The manufacturer of Toyota cars also shut its plant for two weeks.

Factories have been forced to shutter for weeks at a time since the South Asian nation slid into a crisis last year as a dearth of dollars bars them from importing raw materials. That’s weighing on industries from steel to automobiles as production comes to a standstill.

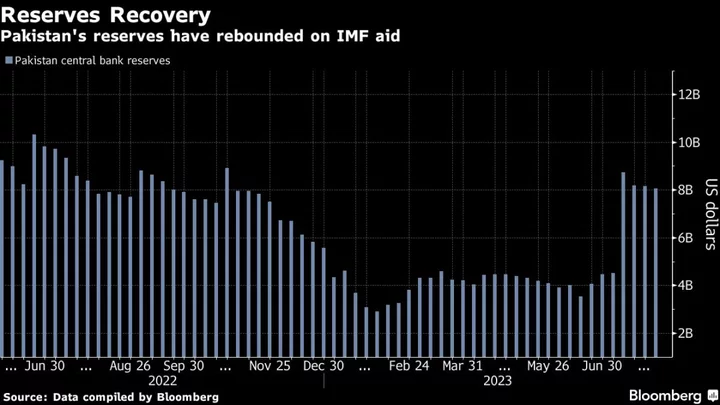

After securing billions of dollars from the International Monetary Fund and other creditors in July, Pakistan is prioritizing currency stability as it struggles to recover from the debt crisis. Thousands of companies are finding it difficult to obtain import permits for their manufacturing needs and cargoes remain stuck in ports as the government curbs demand for dollars to prevent a drain on the nation’s foreign-exchange stockpile.

“Absolutely there is a dollar shortage,” said Khurram Schehzad, chief executive officer of Alpha Beta Core Solutions Pvt. Ltd., a financial consultancy in Karachi. “Companies will continue to operate at bare minimum capacity. Imports will normalize eventually, but it can take six more months.”

Pakistan’s rupee has stabilized in recent months after a devaluation in January and a selloff in May that left it with a loss of about 20% for this year, while foreign reserves have doubled to $8 billion since the IMF bailout. But pressure remains as the nation’s financing requirements remain elevated with Standard Chartered Plc and Natixis SA predicting the rupee, which slid 1.4% to 294.75 per dollar at 3:57 p.m. local time on Wednesday, will weaken to a record-low of 300 by the end of the year.

“The authorities had been relying on import controls to curb dollar demand and keep reserves stable,” said Patrick Curran, a senior economist at Tellimer based in Portland, Maine. “Rupee depreciation will be required to restore balance in the FX market, or else dollar shortages will continue to weigh on growth.”

Letters of Credit

Suzuki’s Pakistan unit posted its biggest quarterly loss in at least a decade during the three months ended March, according to data compiled by Bloomberg. The Pakistan Association of Large Steel Producers said the industry is operating at 40% to 50% of its capacity.

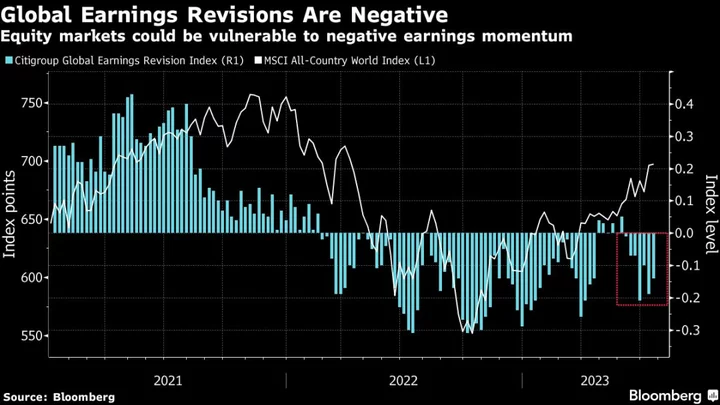

Growth in the $377 billion economy skidded to a halt in fiscal year 2023, ending June, with the IMF forecasting a 0.5% contraction.

Companies say they are struggling to obtain letters of credit, a trade finance tool that facilitates payment between a buyer and a seller given by a lender. While the central bank lifted all import restrictions in July, it also stopped providing dollars to banks for their clients’ import requirements. The removal of import restrictions is one of the conditions of the IMF loan.

“Things are certainly not back to normal,” said Abdul Waheed Khan, director general of the Pakistan Automotive Manufacturers Association. “Things will get better, but when it will happen or get better is still a question mark.”

While the IMF deal has put the economy on a more stable footing, political uncertainty has risen ahead of elections. Prime Minister Shehbaz Sharif last week handed over power to a caretaker government while his rival Imran Khan is seeking a court review on his jail sentence that bars him from contesting in the polls.

Some companies say banks are deciding which companies get dollars. Air Link Communication Ltd., which assembles mobile phones in Lahore for companies including Xiaomi Corp, said it is no longer facing difficulties securing dollars.

“Banks have the onus now,” said Muzzaffar Hayat Piracha, chief executive officer at the company. “If it is a bad customer that annoys them in credit, of course they will open less letters of credit for them.”

With the dollar crisis expected to last for a while, others are turning to creative solutions. Arif Habib Corp., a conglomerate that is invested in commodities and financial services, said it splits its dollar purchases across several banks to secure enough foreign currency.

“We learned that if you want to open a letter of credit for $20 million, you don’t ask one bank, you split it among five,” said Chief Executive Arif Habib. “Everybody has learned from the worst days.”

(Updates with Sitara plant closure in second paragraph, rupee performance in sixth.)

Author: Karl Lester M. Yap and Faseeh Mangi