Asian equity futures were mixed and the dollar held losses Thursday after Treasury yields fell on signs of easing inflationary pressure in the US.

Contracts for the S&P 500 were little changed after the benchmark rose 0.4% Wednesday. Nasdaq 100 futures were also steady following a 1.1% rise in the tech-heavy benchmark, which closed at the highest level since August.

Currency markets were largely flat in early Asian trading after an index of the dollar dropped 0.3%. The yen held a Wednesday gain that pushed it toward the strongest level in a week.

The move in the Japanese currency weighed on the nation’s equity futures, which inched lower alongside Australian contracts. Futures for Hong Kong were marginally higher.

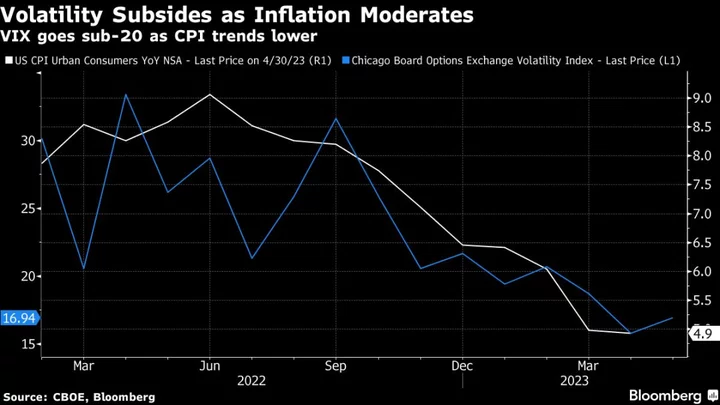

Headline US inflation eased to 4.9% in April, the first reading below 5% in two years and below consensus expectations. Core inflation remained at 5.5%. The policy-sensitive two-year Treasury yield fell 11 basis points and the 10-year benchmark eased eight basis points lower to 3.44%.

“We need more CPI prints to clarify that inflation is definitely declining,” said Priya Misra, global head of rates strategy at TD Securities. “Markets may be too optimistic and put too much weight on the weakness in some series that are inherently volatile, such as hotels.”

Investors in Asia will turn their attention to China’s consumer and producer price growth data due this morning. Monthly year-over-year inflation is expected to drop to the lowest level since February 2021.

Elsewhere in the region, Adani Enterprises, billionaire Gautam Adani’s flagship, will hold a board meeting to consider selling stock, the company said in a statement. The company’s shares have halved this year in a decline driven by accusations of fraud from short seller Hindenburg Research.

In after-hours trading in the US, Walt Disney Inc. shares slid 3.1% on faster-than-expected streaming losses. Shares in Alphabet Inc. extended an advance in post-market trading after the company unveiled AI tools to boost its search engine.

President Joe Biden and congressional Republicans have made little tangible progress toward averting a first-ever US default. The cost of insuring America’s debt against default now eclipses that of some emerging markets and even junk-rated nations. The president and House Speaker Kevin McCarthy plan to hold another meeting on Friday.

Key events this week:

- China PPI, CPI, Thursday

- UK BOE rate decision, industrial production, GDP, Thursday

- US PPI, initial jobless claims, Thursday

- Group of Seven finance minister and central bank governors meet in Japan, Thursday

- US University of Michigan consumer sentiment, Friday

- Fed Governor Philip Jefferson and St. Louis Fed President James Bullard participate in panel discussion on monetary policy at Stanford University, Friday.

Some of the main moves in markets:

Stocks

- S&P 500 futures were little changed as of 7:20 a.m. Tokyo time. The S&P 500 rose 0.4%

- Nasdaq 100 futures were little changed. The Nasdaq 100 rose 1.1%

- Nikkei 225 futures fell 0.4%

- Hang Seng futures rose 0.1%

- S&P/ASX 200 futures fell 0.2%

Currencies

- The Bloomberg Dollar Spot Index fell 0.3%

- The euro was little changed at $1.0983

- The Japanese yen was little changed at 134.28 per dollar

- The offshore yuan was little changed at 6.9378 per dollar

Cryptocurrencies

- Bitcoin fell 1.2% to $27,528.73

- Ether fell 1.2% to $1,836.63

Bonds

- The yield on 10-year Treasuries declined eight basis points to 3.44%

Commodities

- West Texas Intermediate crude rose 0.3% to $72.81 a barrel

This story was produced with the assistance of Bloomberg Automation.

--With assistance from Emily Graffeo and Vildana Hajric.