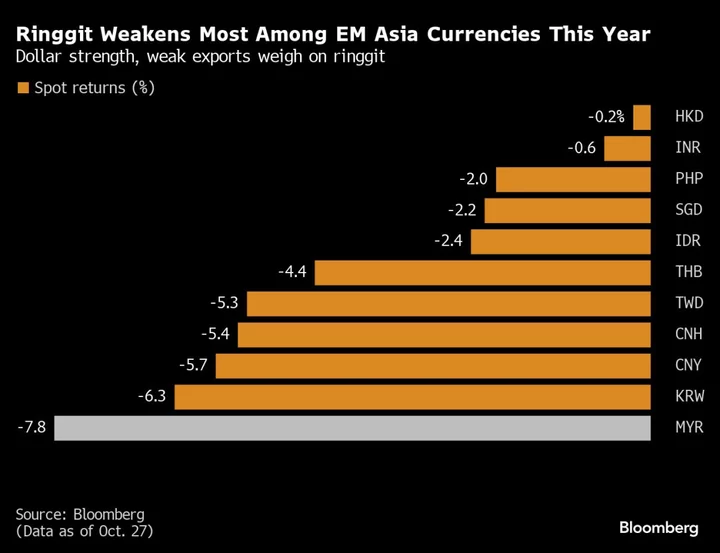

Dollar bulls have history on their side going into September as the currency has strengthened during that month for six years in a row.

Not only has the Bloomberg dollar index risen every September since 2017, but its average gain of 1.2% in that month also beats the performance of any other month over the same period. Strategists say reasons include quarter-end buying and a general increase in haven demand ahead of October, which is notorious for stock-market declines.

“The month of September tends to be good for the dollar and the usual explanation is that risk aversion tends to rear its ugly head and this is boosting demand for the high-yielding, safe-haven king of G-10 FX,” said Valentin Marinov, head of Group-of-10 foreign-exchange research and strategy at Credit Agricole CIB in London.

“A seasonality analysis of measures of risk aversion like the VIX Index seem to corroborate that conclusion,” he said.

Hawkish Fed

There are plenty of fundamental reasons specific to 2023 that may underpin the dollar next month too, such as a relatively hawkish Federal Reserve and elevated Treasury yields, other strategists say.

“The bias of course will be for the dollar to probably continue to perform near-term given the growth and economic performance advantage,” said Rodrigo Catril, a currency strategist at National Australia Bank Ltd. in Sydney. “It looks like all the ingredients, at least in the near-term, favor a higher dollar from here.”

Trading in options provides further evidence that the market is positioning for gains in the dollar during September.

Risk reversals based on the Bloomberg dollar index — contracts that provide a hedge against strength or weakness in the US currency — show that those protecting against gains in the greenback are trading a premium to those hedging versus losses.

--With assistance from David Finnerty and Masaki Kondo.