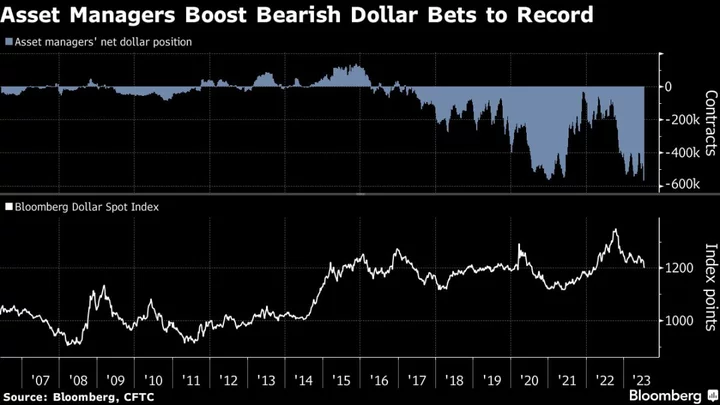

Asset managers boosted bearish dollar bets to a record amid speculation slowing US inflation will hasten the end of the Federal Reserve’s 16-month run of policy tightening.

Institutional investors — including pension funds, insurers and mutual funds — increased net short position on the greenback by 18% to 568,721 contracts in the week through July 18, according to data on eight currency pairs from the Commodity Futures Trading Commission and aggregated by Bloomberg.

The Bloomberg Dollar Spot Index slid the most in six months on July 12 when US government data showed inflation slowed more in June than economists forecast. The Fed will raise its key rate by 25 basis points this week but may start cutting its benchmark early next year, overnight-indexed swaps indicate.

“We have been gaining this confidence that inflation will come down quite significantly over the coming quarters in the US,” Rodrigo Catril, a senior foreign-exchange strategist at National Australia Bank Ltd., said on Bloomberg Television. “That in itself will encourage the market to believe the Fed not only is done but it will be contemplating rate cuts toward the turn of the year, and that will be a significant downturn for the US dollar.”

Asset managers boosted dollar net shorts by the most against the euro and pound among the eight currencies, the data compiled by Bloomberg show. At the same time, they cut yen shorts by the most since March 2020.

The market is positioning for a number of key central bank policy decisions this week, including the Fed on Wednesday, the European Central Bank Thursday, and Bank of Japan Friday.

--With assistance from Haidi Lun and Matthew Burgess.