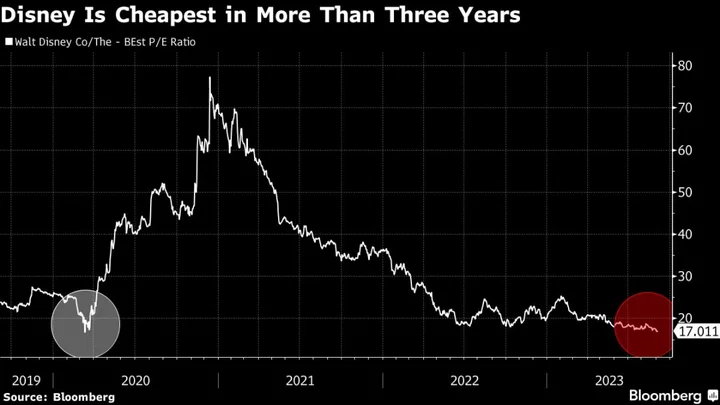

Not even the cheapest valuation since the Covid-19 pandemic is tempting investors to buy Walt Disney Co. shares.

Losses in its online video businesses and a drop in subscribers to its Disney+ streaming service are just some of the issues it faces. Then there’s the impact of the Hollywood actors and writers strike and a fee dispute with the second-largest US cable company, which has seen Disney yank its channels including ESPN from the service, cutting access for millions of viewers.

“I don’t want to own it for the near term and I don’t know that I want to own it for the long term,” Nancy Tengler, chief investment officer at Laffer Tengler, said of Disney stock. She counts the fee standoff with Charter Communications Inc. among her main concerns, while calling for a dividend reinstatement. Her firm sold most of its Disney holdings in 2021.

The world’s largest entertainment company is in the throes of a major upheaval, having launched an extensive cost cutting drive after the return of Chief Executive Officer Bob Iger in November. That included 7,000 job cuts and other reductions in spending.

Read More: Disney Pins Hopes for Stock Recovery on More Iger: Tech Watch

Disney’s stock has lost about $219 billion in market value since peaking at $367 billion in 2021. It’s priced at a below-average 17 times profits projected over the next 12 months. That’s down from a peak of 77 times in late 2020, when rock-bottom interest rates and exuberance over streaming businesses sent the stock soaring.

By comparison, Netflix Inc. has rallied 49% this year — it now trades at about 32 times forward earnings — amid improving profitability and resurgent streaming subscriber growth that the company has attributed in part to a crackdown on password sharing. Disney, whose shares are down 7.3% in the same period, is planning a similar move.

The impact of Hollywood strikes on media companies’ content pipelines are becoming a bigger problem the longer they go on. Warner Bros. Discovery Inc. trimmed its full-year adjusted Ebitda forecast, reflecting the assumption that the strikes will have a negative impact of as much as $500 million. Netflix, with the largest library of content, likely has the largest cushion in the industry.

“I would traditionally be one of the people that would be buying Disney here,” said Ross Gerber, co-founder and chief executive officer of wealth management firm Gerber Kawasaki Inc. However, the strike is making him “increasingly nervous” about his entertainment investments.

Disney is also in the process of buying Comcast’s stake in Hulu, and is selling its TV networks including ABC and FX.

Gerber said he’d like to see an end to the labor dispute, as well as profitability achieved for Disney+ and a sale of ESPN. The sports network could be worth as much as $30 billion, according to Keybanc. Wedbush put the potential price tag at more than $50 billion.

“It would be a great move for them to monetize the asset,” said Gerber. “Because clearly, Disney broken up is worth more than Disney together right now.”

Tech Chart of the Day

The Nasdaq 100 Index is up 38% this year, compared with a gain of 5.7% for the Russell 2000 Index. This outperformance results in a ratio of 8.19, matching the level hit in the dot-com era.

Top Tech Stories

- China plans to expand a ban on the use of iPhones in sensitive departments to government-backed agencies and state companies, a sign of growing challenges for Apple Inc. in its biggest foreign market and global production base.

- SK Hynix Inc. has opened an investigation into the use of its chips in the latest phone from Huawei Technologies Co., after a teardown of the device revealed its memory and flash storage inside.

- Online grocery delivery startup Instacart Inc. is preparing to set a price range for its initial public offering and start its investor roadshow as early as Monday, according to people familiar with the matter.

- China-linked hackers breached the corporate account of a Microsoft Corp. engineer and are suspected of using that access to steal a valuable key that enabled the hack of senior US officials’ email accounts, the company said in a blog post.

Earnings Due Thursday

- Premarket

- Methode Electronics

- John Wiley

- Postmarket

- DocuSign

- Guidewire

- Smartsheet

- Braze

- Semtech

--With assistance from Ryan Vlastelica and Subrat Patnaik.

(Updates stock moves after market open.)