Signs of trouble in the cybersecurity sector are making some investors nervous ahead of Palo Alto Networks Inc.’s earnings report due after Wednesday’s close.

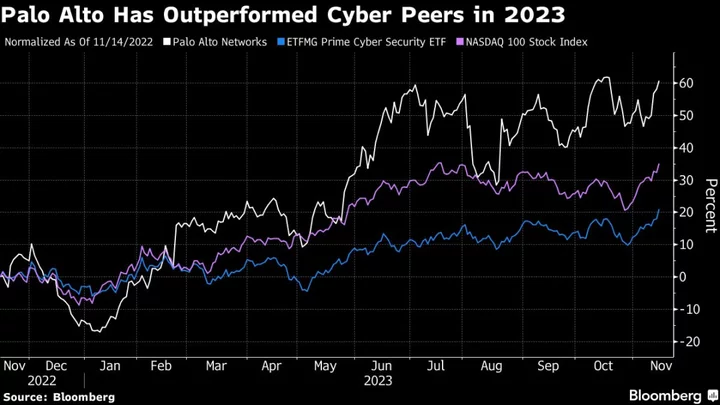

This month’s warning about a spending slowdown from peer Fortinet Inc. raised concerns that Palo Alto’s quarter may have faced similar headwinds. That’s put more scrutiny on the 87% rally in its shares this year, with the seller of firewall software and other security services having trounced peers to be the sixth-best performing stock in the S&P 500.

The risks were high enough for Ivana Delevska, chief investment officer at Speak Invest, to sell her Palo Alto shares recently. “The stock has really done well this year, and we’re concerned that its hardware business, while smaller than Fortinet, could become a headwind,” she said.

The uncertainty comes despite recent cyberattacks reinforcing the importance of security spending. The world’s largest lender Industrial & Commercial Bank of China Ltd. was last week hit by a cyberattack at its US unit that rendered it unable to clear US Treasury trades. MGM Resorts International in September suffered a breach that took down payment systems and slot machines. Clorox Co. sales were hit after an August attack forced it to shut down internal systems.

The sector has underperformed due to rising interest rates and slowing revenue growth. The Nasdaq CEA Cybersecurity Index is up 25% this year, lagging the Nasdaq 100 in the same period, and is also about 14% below the peak it hit in 2021.

Fortinet’s second revenue forecast cut this year has brought further caution. While Stifel analysts led by Adam Borg expect Palo Alto’s results to meet forecasts, there’s a likelihood that the issues Fortinet raised would affect Palo Alto to some degree, the analysts wrote in a research note on Monday.

Fortinet Sinks on 3Q Billings Miss, Forecast Cut: Street Wrap

While Palo Alto shares have had good momentum, “it’s not a stock I’d want to own,” Shana Sissel, chief executive officer of Banrion Capital Management LLC said, pointing to its lofty valuation and fundamentals that she sees as weaker than peer Cisco Systems Inc. “Long-term, I’d be a buyer of Cisco over Palo Alto Networks,” she said. Cisco also reports quarterly earnings Wednesday.

To be sure, most analysts on Wall Street believe that Palo Alto is better positioned than Fortinet and poised to meet expectations in the third quarter. Of the 49 analysts tracked by Bloomberg that cover Palo Alto, 42 have buy-equivalent ratings. Fewer than half of Fortinet analysts are bullish.

Palo Alto is priced at 46 times projected profits, nearly twice the valuation for the Nasdaq 100. Part of the reason the stock is more expensive than peers is that it’s seen as a sector leader with a comprehensive suite of services, according to Jamie Meyers, a senior equities analyst at Laffer Tengler Investments Inc.

“Most cybersecurity companies are a little bit fragmented in their offerings,” said Meyers. “Palo Alto is able to consolidate everything onto a single platform.”

Bulls expect Palo Alto will report earnings that solidify its industry leadership. Morgan Stanley has an overweight rating and $304 price target on shares, representing roughly 19% upside from where shares currently trade.

“Bottom line, we’d be buyers into the print, given lower expectations for the quarter and a more diversified business shifting towards software/next-gen security,” Morgan Stanley analysts led by Hamza Fodderwala wrote in a note.

Tech Chart of the Day

Nvidia shares edged higher in US premarket trading on Wednesday, set to extend gains for a record 11th consecutive session. The stock has climbed 22% during its latest rally as of the last close, adding about $219 billion in market value. Technology stocks have rebounded amid cooling inflation and hopes that Federal Reserve interest rates have peaked.

Top Tech Stories

- Tencent Holdings Ltd.’s earnings beat estimates in another sign that Chinese consumers remain willing to spend on games and entertainment during a nationwide downturn.

- JD.com Inc. posted a stronger-than-expected 1.7% rise in quarterly revenue, after heavy promotional spending propelled online transactions in the face of intense competition.

- ByteDance Ltd. is considering selling gaming studio Shanghai Moonton Technology Co., people familiar with the matter said, as the TikTok owner looks to streamline its operation and focus on core businesses.

- OpenAI will pause accepting new users for its paid ChatGPT Plus service due to overwhelming demand, Chief Executive Officer Sam Altman said in a post on Tuesday.

Earnings Due Wednesday

- Premarket

- Endava

- Riskified

- Postmarket

- Cisco

- Palo Alto Networks

- Kulicke & Soffa

- Vnet Group

- Core Scientific