US inspectors have in recent months uncovered wide-ranging lapses at factories run by some of India’s biggest pharmaceutical firms, as the world’s top supplier of cheap medicine faces increased scrutiny after a spate of deadly manufacturing incidents.

Dozens of drugmakers were issued notices and warning letters by the US Food and Drug Administration, which is increasing visits to Indian factories after the lifting of Covid-19 restrictions last year. Inspectors detailed unsanitary conditions in manufacturing plants and poorly trained staff; shredded paperwork and under-investigated customer complaints; and evidence of exporting contaminated drugs to the US.

The expansive lapses — detailed in FDA records obtained by Bloomberg News under the Freedom of Information Act — suggest that a nearly two-year hiatus in factory audits during the pandemic meant faults were missed in some Indian plants that export to the US. The South Asian nation is the largest supplier of generic drugs to the US and dozens of other countries. The $50 billion sector is under the spotlight after a number of recent scandals linked to smaller, privately-held Indian companies, including the deaths of dozens of children in Gambia and Uzbekistan from adulterated cough syrup, and supplying contaminated chemotherapy drugs to Lebanon and Yemen.

Read: Cough Syrup Linked to 20 Kids’ Deaths Was Circulating for Months

Those tragedies have prompted renewed calls by public health campaigners for more rigorous oversight and a rethinking of supply chains across the world. The Biden administration has warned about the preponderance of drug supplies from countries like India, and pushed to produce more medicine domestically. The deaths and drug recalls also come at a critical time for Prime Minister Narendra Modi’s government, which is selling the South Asian nation to investors as an alternative to China for high-quality manufacturing.

“It’s like playing whack-a-mole,” said Alice Wang, a London-based fund manager at Quaero Capital LLP, which for now has avoided investing in Indian pharma firms. “India is still behind China in many significant ways and some investments in the high-value-precision manufacturing spaces may end up needing a reality check.”

The adverse audits, some details of which are being reported for the first time, have also hit company stocks and scared off some investors from the sector. The S&P BSE Healthcare Index, which tracks India’s top industry stocks, has fallen 9.6% since the start of 2022, under-performing the 7.3% gain of the benchmark S&P BSE 100 Index.

Many Indian pharma companies under scrutiny by the FDA said in statements to Bloomberg News that they are addressing the agency’s concerns about manufacturing practices. Indian authorities have suspended the licenses of more than a dozen unlisted drugmakers in the wake of the cough syrup deaths, and haven’t released public details on the process to have them reinstated. In addition, from June 1 it’s compulsory for cough-syrup makers to send samples to a government-approved laboratory and obtain a certificate of analysis before their products can be exported.

Multiple Warnings

For years, the FDA has raised flags about standards at Indian factories. In 2019, the body told Congress that India — at 83% — had the lowest percentage of acceptable inspection outcomes at drug manufacturing facilities across the countries it policed. China had the second lowest percentage at 90%, followed by the US at 93%, with the European Union coming in at 98%. The report didn’t provide a more comprehensive breakdown.

Since the start of 2022, Indian drugmakers were issued nine FDA warning letters, which may lead to a ban of new products into the US. India is tied with Mexico for the most such letters for any overseas nation in that period, according to analysis of the agency’s data. Dozens of Indian pharma firms were also served Form 483s, which list potential violations.

In recent months, the pace of disclosures about lapses has picked up. In February, unlisted Chennai-based Global Pharma Healthcare Pvt Ltd. recalled eye drops and ointment exported to the US. Last month, the Centers for Disease Control and Prevention linked the products to 81 drug-resistant bacterial infections, four deaths and 14 cases of vision loss. Four people also had to have their eyeballs surgically removed because of the drops, according to the CDC.

During an FDA review of the firm’s plant in southern India, inspectors found sterility problems and quality failures in areas where the ointment was being produced. Global Pharma Healthcare didn’t respond to a request for comment. In the recall notice, the company ordered retailers and customers to stop selling and using the drops and ointment, citing reports of eye infections, blindness and a death.

Read: Clusters of Eye Drop-Linked Infections Found in Four States

While many of the recent medicine scandals have been traced to small producers that don’t export to highly-regulated European and North American markets, FDA reports and recalls reviewed by Bloomberg News suggest problems also reach the top of India’s drug-making sector.

Dinesh Thakur, the co-author of The Truth Pill: The Myth of Drug Regulation in India and a former pharma executive, said it’s difficult to “name one large Indian generics manufacturer that hasn’t been cited” by the FDA in recent years.

“One only needs to look at the 483 and warning letters,” said Thakur, who helped expose issues at Ranbaxy Laboratories Ltd., which pleaded guilty to felony charges in 2013 for making and distributing adulterated drugs bound for the US.

At a factory run by Lupin Ltd., one of India’s top five listed drugmakers by market value, FDA inspectors in March said in a report obtained by Bloomberg News through a FOIA request that the site’s staff only investigated 48 breakdown notifications out of 1,759 between January 2019 and March 2023. The facility is in Pithampur, in central India.

“We have taken swift action to comprehensively address all observations and are taking comprehensive measures to ensure compliance with all regulations,” a Lupin spokesperson said. The company is “committed to maintaining the highest standards of quality and compliance in all our manufacturing processes.”

Document Shredding

Cipla Ltd., a storied Mumbai-based drugmaker that pioneered the sale of cheap HIV drugs across Africa, received more than 3,000 US patient complaints since 2020 for an unidentified product made at its factory in central India, the FDA found. But the agency’s inspectors only discovered the complaints in February when they visited the facility, according to an audit released under FOIA and reviewed by Bloomberg News.

Nine out of 10 of those were related to the product’s performance, the inspectors wrote, adding that staff failed to implement “effective corrective actions” to reduce complaints.

The same Cipla plant was also cited for failing to retain original records. Inspectors observed a truck loaded with bags of scrap and documents marked for shredding. In February, the company’s shares fell the most in nearly two years after Cipla notified Indian stock exchanges about eight potential violations flagged by the FDA.

“We have examined all data pertaining to our drug performance and have determined that the products in the market are safe and efficacious for use,” a Cipla spokesperson said. “In addition, following the audit we have further strengthened our processes and controls to better handle complaints and are working closely with the regulatory authorities on our recommended corrective and preventive actions.”

The spokesperson added that none of the “scrap documents” were so-called “good manufacturing practice” records or contained sensitive information — and that an independent party is reviewing Cipla’s “documentation practices.” The FDA inspection record doesn’t clarify whether agency personnel halted shredding or simply observed the documents.

Read: Just How Dangerous Are India’s Generic Drugs? Very: Ruth Pollard

‘Significant’ Violations

One of the most impacted firms has been Sun Pharmaceuticals Industries Ltd. — the country’s largest drugmaker by revenue. In December, the FDA wrote to billionaire owner Dilip Shanghvi to summarize “significant” violations at Sun’s plant in Halol, in western India, where capsule samples failed to meet dissolution specifications. The agency placed the factory under an import alert, meaning US-destined products may be detained without inspection and are subject to heightened scrutiny.

That came after auditors discovered water leaks and equipment used to manufacture drugs that weren’t adequately cleaned and maintained, according to the letter. One staff member running visual quality checks since 2014 had repeatedly failed to identify defects, according to an earlier audit report reviewed by Bloomberg News. After the inspection, Sun Pharma later recalled batches of injectable medroxyprogesterone acetate, a hormonal birth control, as well as testosterone cypionate injections.

Sun Pharma said US supplies from the Halol site accounted for about 3% of consolidated revenue in the year through March 2022 and 14 of their products were excluded from the import alert, subject to certain conditions. Last year, the company said it’s “committed” to compliance. On a call with industry analysts at the end of January, Shanghvi said the Halol plant continues to export to other countries.

But in April, Sun Pharma notified India’s stock exchanges that the FDA had asked for “corrective actions” in another one of its plants before exporting products to the US — this one in Mohali, in northern India. The firm’s shares fell the most in four months after the disclosure.

In a letter from the FDA to Sun Pharma, which Bloomberg News obtained through a FOIA request, the US agency listed three “significant” violations at the Mohali factory. The issues highlighted were “inadequate” investigations into unexplained drug discrepancies; a failure to document or justify deviations from laboratory control mechanisms; and the manufacturing of a drug for chronic angina through 2021 to 2022 “despite failing dissolution results.”

Sun Pharma notified the stock exchanges that it would hire independent manufacturing auditors and temporarily halt shipments to the US. The FDA letter also gives additional information about the timeline: Sun Pharma must seek the agency’s sign-off on drug batches the company plans to export for at least 12 months.

“We are taking all necessary steps to resolve the outstanding issues as fast as possible,” said a Sun Pharma spokesperson.

Beyond safety, the problems could also come with a cost to India’s drug manufacturers and disrupt supplies in the US. Analysts from Nomura Holdings Inc. estimate the affected Mohali factory alone contributes $100 million to $150 million in annual sales to Sun Pharma’s US business.

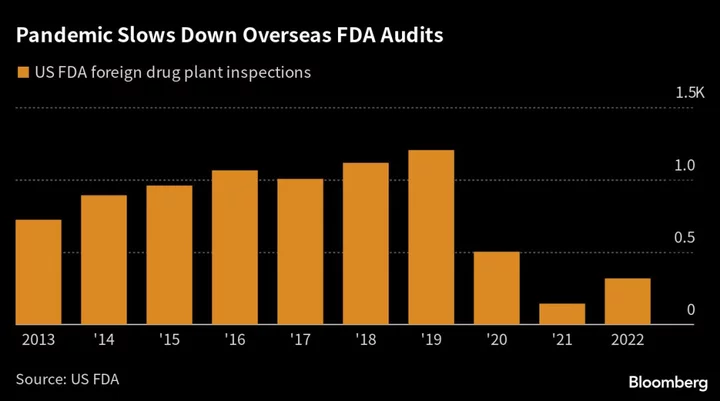

As US inspectors work through a pandemic-era backlog of more than 1,000 foreign drug-plant audits across the world, the latest problems are unlikely to mark India’s last. Overseas inspections were down 74% last year from 1,204 reviews in 2019. Only 245 such visits have taken place so far this year.

Tushar Manudhane, a pharma analyst at Mumbai-brokerage Motilal Oswal Financial Services Ltd., said the “pace of inspections is still much lower than it was pre-Covid.” As they ramp up, he said, the risk of more adverse FDA findings “will continue to rise.”

(Corrects story published June 1 to show chemotherapy drugs exported to Lebanon, Yemen in third paragraph.)