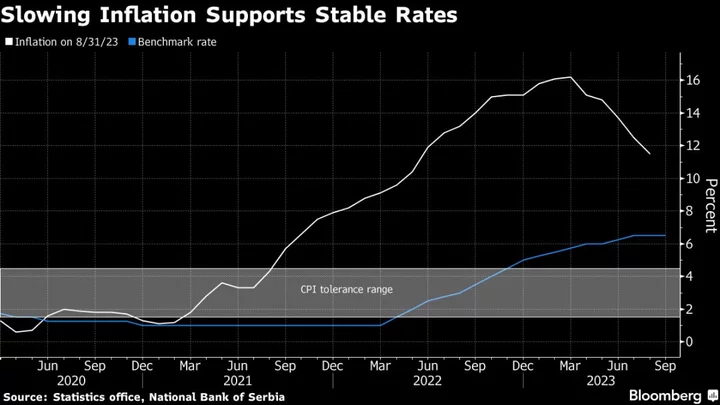

Colombia’s central bank has room to lower interest rates by over five percentage points from the current level to 8% in 2024 as inflation continues to slow, Finance Minister Ricardo Bonilla said in an interview.

Inflation has eased for six straight months, and if the trend continues, it could slow from 10.99% now to 9.2% in December and 5% in 2024, Bonilla said from the International Monetary Fund’s annual meeting in Morocco. The government is being careful that fuel cost rises don’t stoke consumer prices, he said.

“If the trend goes like this, the central bank could cut rates from 13.25%, which is the current level, to 12.5% at the end of the year,” said Bonilla, a voting member at the monetary policy committee. “It is expected that inflation will ease to 5% in 2024, and that the central bank will lower rates.”

Colombia targets inflation at 3%, with a tolerance range of between 2% and 4%.

The Andean nation is home to one of Latin America’s few remaining central banks that hasn’t cut interest rates in recent weeks. Colombia’s annual inflation has slowed from a peak, but it is still running almost four times above the official target. In September, policymakers kept borrowing costs unchanged at 13.25%, the highest level since 1999, in a rare split vote.

Read more: Colombia Central Bank Defies Pressure, Holds 13.25% Key Rate

Meanwhile, Brazil, Chile, and Peru, as well as smaller economies including Costa Rica, Uruguay, Paraguay, and the Dominican Republic have all started to ease monetary policy following post-pandemic rate hikes.

Colombia’s inflation will not ease as fast as in Chile or Brazil, as the Andean nation still has to increase fuel prices to close a gap caused by subsidies provided after the pandemic. Specifically, Bonilla said the government may have to increase gasoline costs for the next three or four months as oil jumps globally and will then begin gradual increases in diesel through 2025.

Bonilla estimates the fiscal cost of fuel subsidies in 2024 will rise to 20 trillion pesos ($4.7 billion), of which 85% corresponds to diesel.

Fiscal Stimulus

Colombia’s retail sales and manufacturing declined more than anticipated in July and August, indicating tight monetary policy has hurt activity.

The finance minister maintained his economic growth forecast of 1.8% for this year after a 7.3% expansion in 2022, as the government will implement fiscal stimulus in housing and public works, he said, adding that gross domestic product could expand above 2% in 2024.

The Colombian peso has advanced 14.5% year-to-date, the most among all emerging-market economies. However, over the past month, it has led global losses, showing how sensitive the currency is to global shocks.

Bonilla said the government is showing investors fiscal responsibility by lowering debt levels and increasing fuel prices to close the budget gap, which should support the currency.

“I hope that the peso stays around 3,900 per dollar,” he said. “In the last month, due to the instability of the United States and the growth of interest rates, the exchange rates in all Latin American countries changed.”